a) The management of Smith Plc, a UK based Company, is considering the possibility of launching its presence in Ghana and it is not too sure of the tax implication of the following in the light of the tax laws of Ghana:

i) It is considering making its presence through incorporation in Ghana or create an external company that is a Permanent Establishment (Branch) instead.

ii) It intends to acquire all its non-current assets through finance lease as against buying the assets outright when it makes its presence in Ghana.

iii) It intends to bring some staff from the United Kingdom to work in Ghana who will be paid half salary in Ghana and the other half paid directly to their accounts in the United Kingdom as against paying their full salary in Ghana.

iv) Management intends to acquire shares in many companies in Ghana as part of efforts to create value for shareholders through dividend receipts as against granting loans to interested companies in Ghana if it is unable to make its presence in Ghana.

Required:

Evaluate the above policy interventions and advise on the tax implication on each one of them to enable management of Smith Plc take a decision on them. (10 marks)

View Solution

i) Incorporation:

- A company that is incorporated in Ghana through the Registrar General shall be required to pay a stamp duty on the shares introduced as stated capital at the rate of 0.5% on the value of the equity, and pay corporate taxes when profits are made.

- Additionally, anytime dividend is declared, the shareholders, in this case the Smith Company Ltd shall be subject to dividend withholding taxes at the rate of 8% in line with section 115 of Act 896 and the first schedule of the same Act.

- Again, it shall be responsible for the deduction of Pay As You Earn (PAYE) from the employment income of its employees on their behalf and other withholding taxes to the Ghana Revenue Authority (GRA) in respect of payment for goods, services and works at the rates of 3%, 7.5% and 5% respectively, for payment to resident persons and 20% in respect of non-resident person on only goods, services and management and technical services if any subject to double taxation agreement.

(2 points for 2 marks)

Permanent Establishment (Branch) - It will register as an external company and pay corporate taxes on its profits. It will be subject to a branch profit tax at the rate of 8% in line with section 60 of Act 896 and Regulation 21 of LI 2244 of 2016. The branch shall pay tax on the gross amount of earned repatriated profits.

- Additionally, it shall pay PAYE to GRA on behalf of its employees and pay other withholding taxes in respect of goods, services and works at the rates of 3%, 7.5% and 5% respectively. Non-resident at the rate of 20% including payment of management and technical services if any.

- In conclusion, if both of them engage in the same business, they shall have the same tax exposure except that with branch profit tax, it is paid whether profits have been repatriated or not but with the dividend, it becomes payable when it is declared by the company.

- Stamp duty is not payable by a branch. (2 points for 2 marks)

ii) Non-current assets acquired through finance lease

- Non-current assets acquired through finance lease shall be granted capital allowance to the lessee in respect of the capital portion of the lease rental payment.

- Interest portion on the lease rental payment shall be granted as an allowable deduction when it meets the deductibility principles

- Outright acquisition of capital assets shall be granted capital allowance on the amount of the acquisition paid or payable. Both shall be entitled to capital allowance. Under both cases, the base rule for granting capital allowance shall apply.

(2 points for 2 marks)

iii) Bringing staff from UK to work in Ghana

- Income is subject to tax based on the residence status of the person. A resident persons shall pay tax on their global income (world-wide income) with non-resident persons paying taxes on incurred derived from or accrued in Ghana only.

- The salaries of the expatriate employees shall be subject to tax in Ghana. The tax implication of paying the salary in Ghana and paying half in Ghana has the same effect. They are free to use their salaries after the taxes are paid.

- Following from the above, the employment income of the expatriate employees derived from Ghana shall be subject to tax fully in Ghana. Any part of the salary that is remitted through their foreign accounts should be done after the taxes have been paid. There is no tax benefits in either case. (2 points for 2 marks)

iv) Acquisition of shares by management

- Any person that acquires shares in an entity becomes a shareholder of that entity. In this case, Smith Company ltd shall become a shareholder. Any dividend that is declared shall be subject to tax at the rate of 8% being a final withholding tax, meaning the shareholder shall not be allowed to pay further tax in respect of the same income.

- On the grant of loans to interested persons, this shall undoubtedly provide additional funding to persons that access them in Ghana. The interest on the loan that shall be paid to the provider of the loan in this case Smith Company ltd shall be subject to withholding tax at the rate of 8% final as it is being paid to a non-resident person. (2 points for 2 marks)

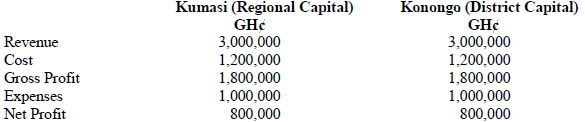

b) The following information is an extract of projected financial performance of YZ Ltd a manufacturing company that intends to go into operation with a basis period from January to December. Management is contemplating operating in either Kumasi or Konongo but the results are expected to be the same irrespective of the location. The following projected results from January to December Year 1 are worth analysing.

The following additional information is relevant:

A building to be bought on 1 March Year 1 for GH¢400,000 has been granted full year’s depreciation at the rate of 20% and same has been added to projected cost above.

Required:

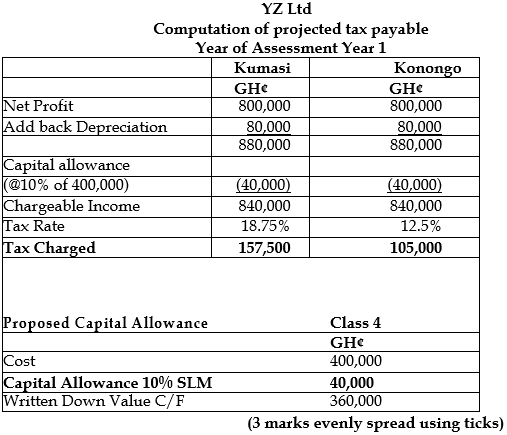

i) Compute the projected tax payable on the above and state where management is likely to site the entity and why? (4 marks)

View Solution

Comments:

Management is likely to invest in Konongo as it has a lower tax rate of 12.5%. The tax saving is (157,500-105,000) GH¢52,500.00 by siting the manufacturing company in Konongo as against Kumasi.

Management is likely to invest in Konongo instead of Kumasi as it offers a lower tax rate and consequently a better value for shareholders.

ii) What other TWO (2) factors apart from what has been identified in (i) above may dictate siting a manufacturing business in a regional capital? (1 mark)

View Solution

- Proximity to labour

- Proximity to power supply

- Proximity to Market

- Proximity to Raw Materials (Any 2 points)