Rock Minerals Ltd (Rock) is a minerals mining company based in Ghana. Rock is considering an investment opportunity in South Africa, which involves developing and operating a gold mine and later transferring the mine to the South African government.

Last year, the directors commissioned a special committee to assess investments and regulatory requirements relating to the project. Based on the committee’s report, the directors estimate that it will take two years to develop the mine. Development of the mine entails an immediate outlay of ZAR1.2 million in regulatory requirement expenditures, an investment of ZAR20

million in plants and equipment in the first year and ZAR15 million for development expenditure in the second year. The directors also estimate that Rock will invest ZAR2 million in net working capital at the beginning of the third year. The investment in net working capital is expected to be increased to ZAR3 million at the beginning of the fifth year.

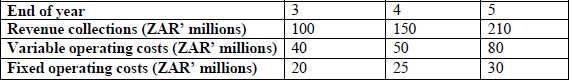

Commercial production and sales are expected to begin in the third year. Below are estimated operating cash flows before tax in the first three years of commercial production:

At the end of the fifth year, Rock will transfer ownership and control of the mine to the South African government for an after-tax consideration of ZAR100 million. The special committee also reports that income tax rate for mining operations is 30% and capital expenditure in relation to acquisition of property, plant and equipment and development expenditure qualify for capital allowance at the rate of 20% per annum on straight line basis. Capital allowance is granted at the end of each year of commercial production. On repatriation of profit, the committee reports that the South African government does not restrict repatriation of profit and there are no profit repatriation taxes. Rock would repatriate cash returns as they become available.

Rock plans to finance this project using existing capital. Rock’s after-tax cost of capital is 25% in Ghana. Annual rate of inflation is expected to be 11% in Ghana and 5% in South Africa in the coming years. Currently, the rate of exchange between the Ghanaian cedi (GH¢) and the South African rand (ZAR) is GH¢0.3822 = ZAR1.

Required:

a) Evaluate the project on financial grounds using the net present value (NPV) approach, and recommend whether the investment proposal should be accepted for implementation or not. (12 marks)

View Solution

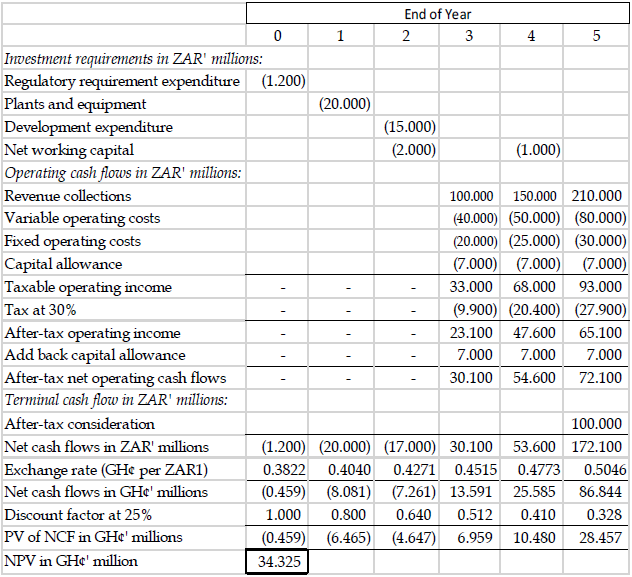

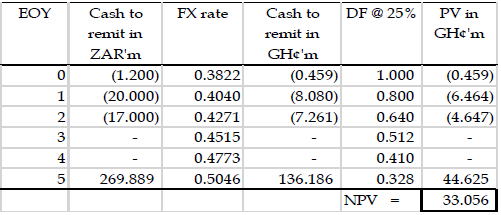

Evaluation of mining project using NPV with no restriction on repatriation.

The project’s NPV

The NPV of the operation is GH¢34.325 million. The positive NPV suggests that implementation of the proposed mining operation in South Africa will enhance the value of the company. Rock should accept the investment opportunity for implementation.

Workings:

1. Computation of tax allowable depreciation

Capital allowance is granted at 20% per annum on straight line basis at the end of each year of commercial production. Since commercial production begins in the third year, the first capital allowance claim will be at the end of year 3.

A total investment of ZAR35 million will qualify for capital allowance as of the end of

the third year and subsequent years.

Thus, each year’s capital allowance is ZAR 7 million (20% x ZAR35 million)

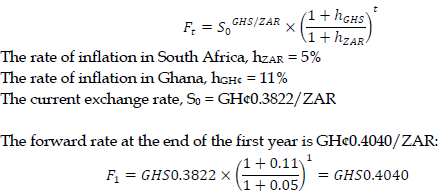

2. Forecasted exchange rates

On the assumption that purchasing power parity holds, forward exchange rates are forecasted as under:

b) Suppose the South African government changes its policy on profit repatriation and legislates that profit cannot be repatriated until termination or exit.

i) If Rock can invest blocked funds in South Africa for 12% annual rate of return, by how much would the project’s NPV differ from your results in sub-question (a) above? (5 marks)

View Solution

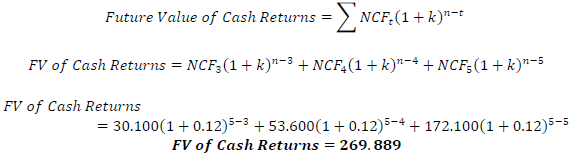

Evaluation of impact of restriction on profit repatriation restriction on the NPV With a restriction on repatriation until exit, all cash returns from the third year to end of year 5 will be available to Rock only at the end of year 5 when it exits. As blocked funds can be invested at 15% in South Africa up to the end of year 5, the amount that will be repatriated at the end of year 5 is the aggregate future value of the cash returns from year 3 to 5.

The NPV will reduce by 3.7% ((33.056 – 34.325) / 34.325)

ii) Suggest THREE (3) ways through which Rock can deal with the risk of blocked funds. (3 marks)

View Solution

- Rock can deal with blocked funds by doing any of the following:

- Negotiating with the South African government for a stable profit repatriation policy.

- Selling goods or services to the subsidiary and obtain payment.

- Licensing the subsidiary to use its production processes protected by patent for royalties.

- Offering management services to the subsidiary for a fee.

- Giving more loan (rather than equity) finance to the subsidiary for interest payment. (Any 3 points)