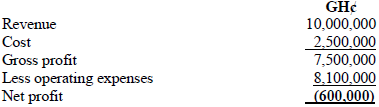

Kofas Ltd is a mining company incorporated in Ghana. In 2016 year of assessment, the company furnished the Ghana Revenue Authority with the following.

The following additional information is relevant

- Foopo Ltd paid a dividend of GH¢50,000 to Kofas Ltd which was added to revenue. Upon scrutiny, it was revealed that Kofas Ltd has 25% shares in Foopo Ltd.

- The operating expenses of GH¢8,100,000 include the following:

Filing penalties GH¢1,000

Capital work in progress GH¢200,000

Depreciation GH¢100,000 - It was agreed with Ghana Revenue Authority to grant capital allowance of GH¢300,000 for 2016 year of assessment. The capital allowance is yet to be factored into the computation of returns.

Required:

i) Compute the loss to be carried forward. (5 marks)

View Solution

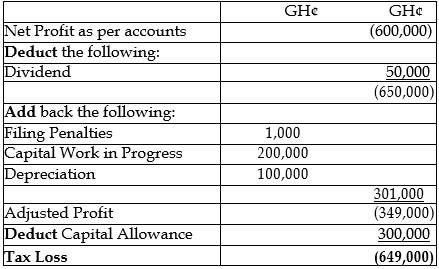

COMPUTATION OF LOSS TO BE CARRIED FORWARD

YEAR OF ASSESSMENT : 2016

BASIS PERIOD:

ii) Comment on the tax treatment of the dividend paid by Foopo Ltd. (2 marks)

View Solution

Dividend paid to a resident company by another resident company is exempt from tax where the company receiving the dividend controls directly or indirectly, at least 25% of the voting power of the company which paid the dividend. In this case, the dividend paid by Foopo ltd is exempt from tax in the hands of Foopo Ltd and Kofas ltd.

iii) How is unrelieved loss in the mining sector treated? (1 mark)

View Solution

Unrelieved loss is loss that has occurred which is carried forward for 5 years in the case of mining against income in subsequent five (5) years. The loss shall be used against income in future years for only 5 years.