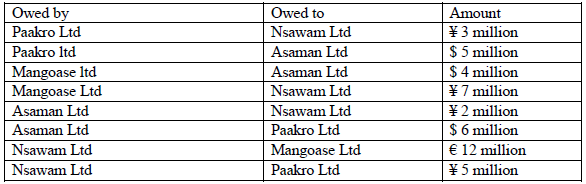

Paakro Limited, based in Ghana, is the parent company of a group that contains 3 subsidiaries: Mangoase Limited based in Munich, Germany; Asaman Limited based in the Atlanta, USA; and Nsawam Limited based in Tokyo, Japan. The following cash flows are due in 3 months’ time between Paakro Limited and its subsidiaries:

Mid-rate exchange rates in three months’ time are expected to be:

GH¢4.0 = $1

GH¢3.0 = €1

GH¢3.5 = ¥1

Required:

Calculate, using a tabular format (transaction matrix), the impact of undertaking multilateral netting by Paakro Limited and its three subsidiary companies for the cash flows due in three months. (8 marks)

View Solution

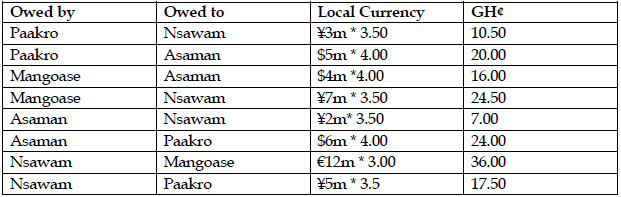

Convert all the cash flows into Ghana Cedis (GH¢)

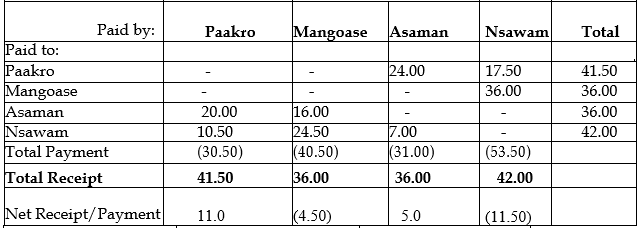

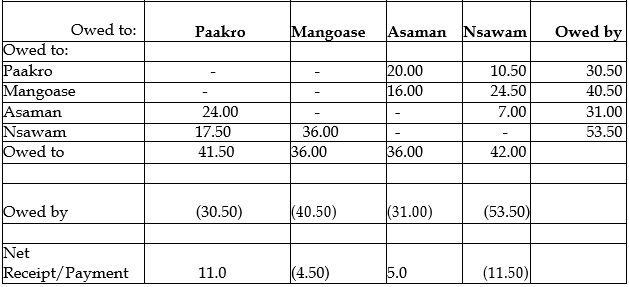

So overall, Nsawam Limited needs to pay amounts equivalent to GH¢11m to Paakro, Receive GH¢4.5m from Mangoase and pay GH¢5m to Asaman Limited.

OR

So overall, Nsawam Limited needs to pay amounts equivalent to GH¢11m to Paakro, Receive GH¢4.5m from Mangoase and pay GH¢5m to Asaman Limited.