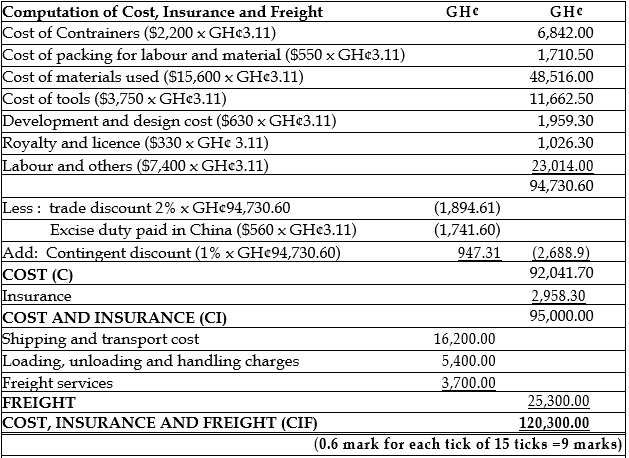

Obiba JK Enterprise imports component parts from China and assemble them into various forms of office equipment. On 1 January 2016, components parts were imported with the following details:

Cost of containers containing the goods $2,200.00

Cost of packing for labour and materials in China $550.00

Cost of materials used in China in the production incurred by Obiba JK $15,600.00

Cost of Tools inserted in the components incurred by Obiba JK $3,750.00

Cost of Engineering development and Design paid by Obiba JK $630.00

Royalties and licences paid by the Obiba JK $330.00

Cost of labour and others in China (not included above) $7,400.00

Shipping and transport cost to the Tema Habour GH¢16,200.00

Loading, unloading and handling charges up to Tema habour GH¢5,400.00

Cost of marine insurance GH¢2,958.30

Assembling overhead cost incurred at Obiba JK’s factory GH¢23,400.00

Fees for freight services by a shipping company up to Tema Harbour GH¢3,700.00

Additional information:

- The Chinese exporter allows trade discount of 2% on the cost of the goods. (yet to be accounted for)

- Excise duty paid in China is $560.00 on the goods. (this is included in the cost of labour and others)

- Contingent discounts and rebates allowed by the Chinese company is 1% of the cost of the goods, before trade discount and excise duty. (this has been accounted for in the above figures)

- Technical assistance from the Chinese company for the assembly of the goods amounted to GH¢3,000.00 after the goods have arrived at Obiba JK’s factory.

- Average exchange rate during the entry for the import was $1= GH¢3.11

- Import duty is 20%

Required:

i) Compute the Cost, Insurance and Freight, clearly showing workings of each component. (9 marks)

View Solution

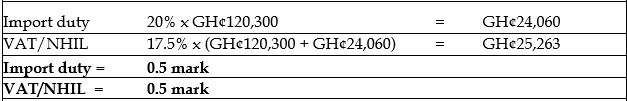

ii) Compute the VAT/NHIL (1 mark)

View Solution