Animal Farm Product Ltd, (AFP), a manufacturer of veterinary medicines for farm animals, wishes to estimate its current cost of capital.

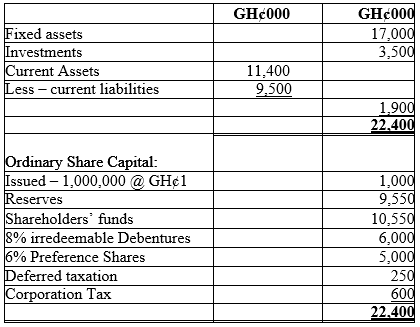

The following figures have been extracted from their most recent accounts:

The current market value of AFP’s ordinary shares is GH¢12.50 per share cum-dividend. AFP’s beta is 1.4, the risk-free rate is 3%, and the return on the SEC index (the market proxy) is 8%. An annual dividend of GH¢800,000 is due for payment shortly. The 8% debentures are irredeemable and are trading at a current market value of GH¢106.00, a GH¢6.00 above their issue price of GH¢100.00. Semi-annual interest of GH¢4 million has just been paid on the debentures.

The 6% preference shares are trading at a current market value of GH¢6.00, a GH¢1 above their issue price of GH¢5.00. Interest has just been paid on these preference shares. There have been no issues or redemptions of ordinary shares or debentures during the past five years and corporation tax rate remains at 12.5%. Assume that tax relief on the debenture interest arises at the same time as the interest payment.

Required:

a) Calculate the cost of capital that AFP should use as a discount rate when appraising new marginal investment opportunities. (11 marks)

View Solution

Cost of Capital:

Cost of Equity (using CAPM) = Rf + [Ba x (Rm – Rf)]

Rf = 3%

Rm = 8%

Ba = 1.4%

Cost of Equity (using CAPM) = 3% + [1.4 x (8% – 3%)]

. = 3% + [1.4 x (5%)]

. = 3% + [0.070]

. = 10. 00%

OR

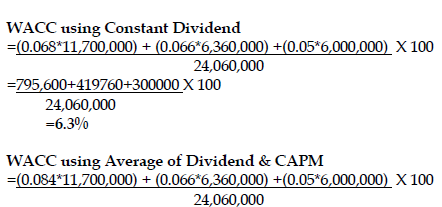

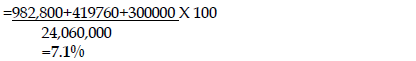

![]()

. =0.8/11.7 = 0.068 ; g= 0

. =6.8%

We can find the average of the two methods or use any of the answers.

Average= (6.8+10)/2 = 8.4%

The 8% irredeemable debentures:

The yield on this can be estimated solving for Kd in the following perpetuity formula: Po = 1

Kd = the after tax cost of debt

Note: tax of 12.5% must be deducted from the interest payments

I.e. interest is GH¢4.00 per nominal GH¢100, every six months

Hence after tax payment = GH¢4.00 = (1-0.125) = GH¢3.5 per nominal GH¢100,

Po = 1/ Kd where: Po = GH¢106.00 and I = GH¢3.50

=> Kd = I / Po

. = 3.5 / 106

. = 3.30% semiannual (ie. 6.60% annually)

Cost of preference shares

Its preference shares has a GH¢5.00 nominal value

Dividend on the preference shares is 6%

Current market price of the preference shares is GH¢6.00

Cost of preference shares is = Actual Dividend / current market price

. = (6% x GH¢5.00) / GH¢6.00

. = (GH¢0.30) / GH¢6.00

. = 0.05 = 5.00%

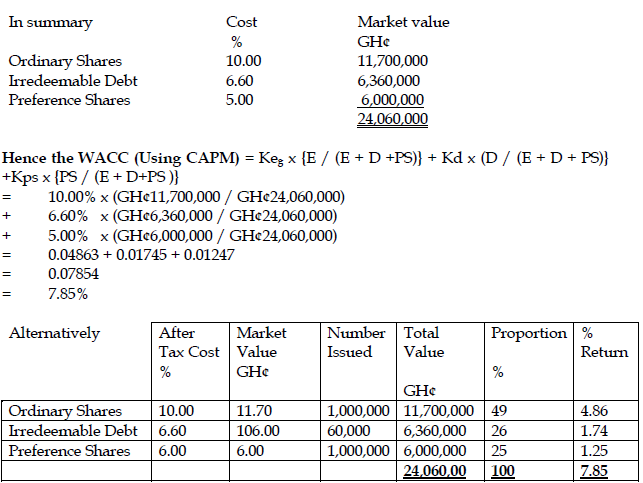

Market Value of the capital Structure

The market value of Equity:

Current cum div share price GH¢12.50

Current numbers of shares 1,000,000

Expected dividend GH¢800,000

Expected dividend per share GH¢0.80

Current Ex div share price GH¢11.70

Current equity market value GH¢11,700,000

The market value of the irredeemable Debt

= the current market price, (ex interest) per bond X # of bonds issued

The 8% irredeemable debentures

= GH¢106.00 x (6,000,000 / 100)

= GH¢106.00 x (60,000)

= GH¢6,360,000

The market value of the Preference shares

= the current market price, (ex div) per share x # of shares issued

= GH¢6.00 x (5,000,000 / GH¢5.00)

= GH¢6.00 x (1,000,000)

= GH¢6,000,000