You are the newly employed Finance Director of Gala Gold Mining Ltd (GGML), a fast growing Ghanaian mining company. The ordinary shares of GGML are listed on the Ghana Stock Exchange. The company issued two million fresh shares in an Initial Public Offer (IPO) to meet the minimum public shareholding requirement of the Exchange. In the prospectus accompanying the IPO, the company proposed a stable earnings pay-out ratio of 20%.

It has been one year since the listing of GGML’s ordinary shares. At the first post-listing annual general meeting, which was held last week, the directors recommended that the company retains the entire profit earned in its first year as a public company to help finance profitable mining opportunities in the Western part of Ghana. This 100% earnings retention proposal was rejected by the shareholders, and the directors have promised to reconsider the issue and recommend some dividends.

The directors would be meeting in the coming month to discuss the matter with the hope of developing a sustainable dividend policy for the next three years. You are expected to make a presentation on the company’s dividend capacity at the meeting.

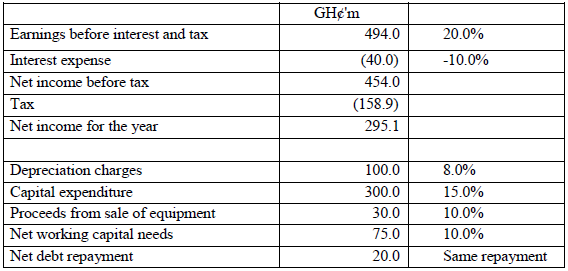

You have gathered relevant extracts from the financial results of the past financial year (i.e. financial year ending June 2015) and expected annual changes in the values over the next three years (i.e. financial years ending June 2016, 2017 and 2018) presented in the Table below:

The company’s tax rate is expected to remain at 35%.

Required:

i) Advise the directors on THREE factors they should consider in developing an appropriate dividend policy for GGML. (6 marks)

View Solution

Dividend policy refers to decisions concerning paying out earnings to shareholders and retaining earnings for reinvestment. In theory, optimal dividend policy is one that strikes a balance between current dividend and futures growth to minimize WACC while maximizing stock value. To craft an appropriate dividend policy for GGML, the directors would have to consider several factors, including the following:

- Legal requirements – There are certain provisions in the Companies Code that restrict dividend payment with a view to protecting the interest of lenders. For instant, a company cannot pay out more dividends than distributable earnings in its reserves.

- Investment opportunities/requirements – When a firm is presented with a lot of investment opportunities that are in line with its growth strategy, it would require more financing. As earnings retention is the first choice on the pecking order, higher investment requirements would restrict dividend payment. As a fast growing company, GGML’s investment requirements would be high; and so may have to maintain a dividend policy that retains more earnings to fund investments. If GGML revises its growth strategy and rather pursues a lower growth rate, it can maintain a dividend policy that pays out relatively more dividends.

- Alternative sources of finance – The amount of dividends the company can afford to payout is influenced by the variety of financing sources available to the company. If the company has access to a variety of financing sources (including debt financing), then it can afford to maintain a dividend policy that pays out more dividends. However, considering the fact that GGML is rather repaying debt and not getting more, it cannot afford to maintain a dividend policy that pays out more cash to

shareholders. - Tax implications for shareholders – Earnings payout or retention has tax implications for shareholders. For instance if tax on dividend is lower than tax on capital gains, majority of shareholders may prefer current dividends to future capital gains.

ii) Calculate the maximum dividends GGML can pay for the past financial year, and estimate its dividend capacity for the next three years. Recommend an appropriate dividend pay-out ratio for the coming three financial years. (8 marks)

View Solution

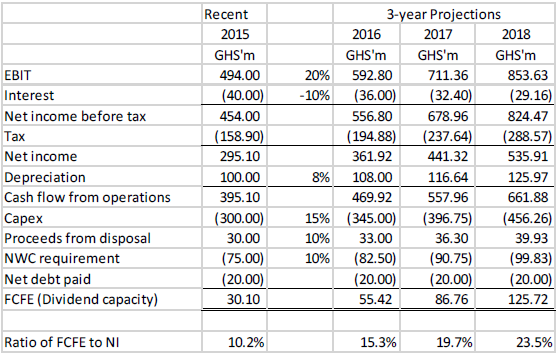

Dividend capacity which is the amount of dividend a firm can afford to pay to its shareholders is measured by free cash flow to equity (FCFE). GGML’s free cash to equity for the recent year and the coming three years are computed below:

MAXIMUM DIVIDEND FOR RECENT YEAR:

For the past financial year, GGML can afford to pay maximum dividends of GHS30.1m, which is 10.2% of earnings. This implies that company cannot meet its IPO promise of 20% payout ratio.

Recommendation for next 3 years:

The FCFE projections for the coming three years suggests that the company can pay a maximum dividend of GHS55.42m in 2016, GHS86.76m in 2017, and GHS125.72m in 2018.

The ratio of dividend capacity to net income (i.e. maximum payout ratio) ranges from 15.3% to 23.5% over the coming three years. However, to maintain a smooth dividend payout policy, the directors may consider the minimum payout ratio in the range (which is about 15%) or the average (which is about 20%).