Lolonyo Foam Ltd (Lolonyo), an Accra-based unlisted company, has been manufacturing mattresses and other form products since 1990. The company is considering a new project which requires a GHS75 million investment in capital expenditure and net working capital. The directors of Lolonyo have decided to raise the needed funds through a new issue of 10-year subordinated bonds to investors in Ghana. Lolonyo uses a discount rate of 20% to appraise new projects. However, the directors feel that this rate will not be appropriate for this project as its financing method is different from what has been used in the past.

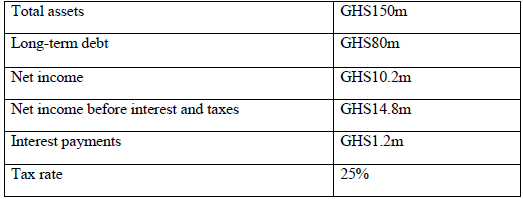

The following information is available for the company:

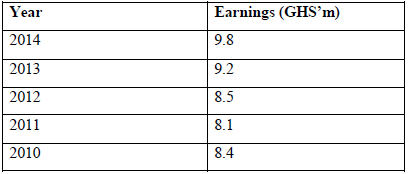

Earnings of the company for the past five years are as follows:

Directors intend to use the Kaplan Urwitz model for unlisted companies to assess the cost of debt. The Kaplan Urwitz model for unlisted companies is given by: 𝑌=4.41+0.001𝑆𝑖𝑧𝑒+6.40𝑃𝑟𝑜𝑓𝑖𝑡𝑎𝑏𝑖𝑙𝑖𝑡𝑦−2.56𝐷𝑒𝑏𝑡−2.72𝐿𝑒𝑣𝑒𝑟𝑎𝑔𝑒+0.006𝐼𝑛𝑡𝑒𝑟𝑒𝑠𝑡−0.53𝐶𝑂𝑉

where :

Y is the credit score

Size is measured by total assets

Profitability is measured by the ratio of net income to total assets

Debt refers to the status of the debt stock; subordinated debt is assigned score 1, and unsubordinated debt is assigned score 0

Leverage is measured by the ratio of long-term debt to total assets

Interest refers to interest cover, which is measured by net operating income (i.e. net income before interest and tax)

COV is the coefficient of variation in earnings, which measures volatility in earnings

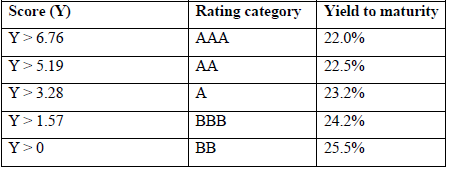

The table below presents credit score ranges and corresponding rating category and yield to maturity for 10-year corporate bonds:

Required:

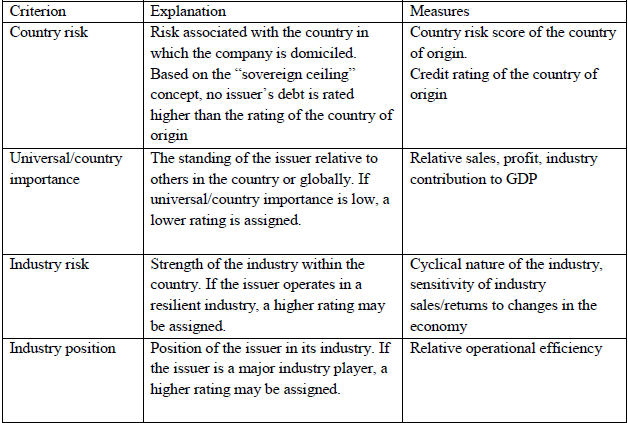

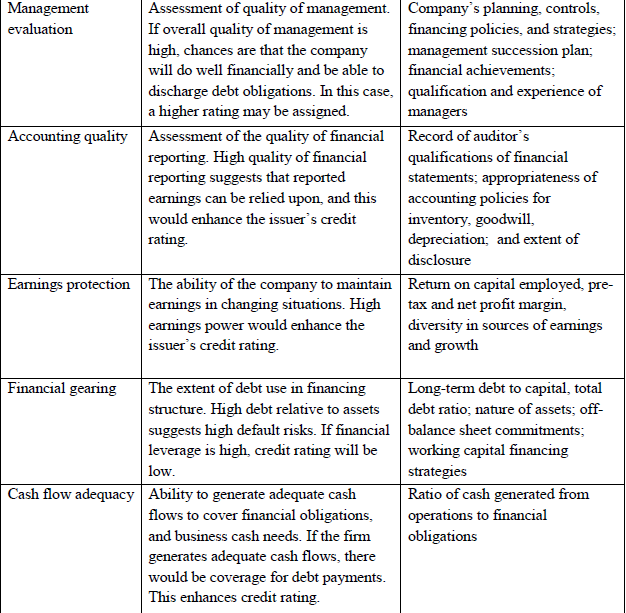

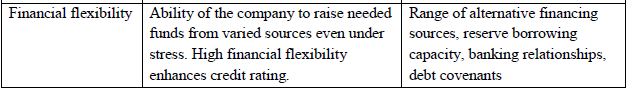

(b) Suppose Lolonyo applies to a credit rating agency for rating of its debt. Explain any THREE (3) of the criteria the credit rating agency would use in establishing the company’s credit rating. For each criterion, suggest one factor that can be used to assess it. (6 marks)

View Solution

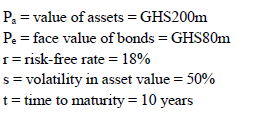

(c) Suppose the fair market value of assets is GHS200 million and the face value of the 10-year bonds is GHS80 million. The risk-free rate is 18% and the volatility of asset value is 50%.

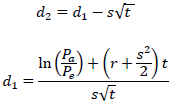

i) Find the value of the default probability using the Black-Scholes option pricing model. (3 marks)

View Solution

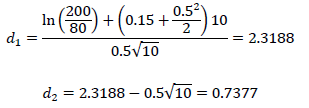

Default probability is estimated using the Black-Scholes OPM as under.

Default probability = 1 – N(d2)

From the standard normal probability table, N(d2 = 0.74) = 0.7704.

Default probability = 1 – 0.7704 = 0.2296

The chance that Lolonyo will default on bond payments is 22.96%.

ii) Estimate the expected loss on the bonds if the recovery rate is 60%. (3 marks)

View Solution

Expected loss = Loss given default x default probability

Loss given default = Face value x (1 – recovery rate)

Loss given default = GHS80m x (1 – 0.6) = GHS32m

Therefore,

Expected loss = GHS32m x 0.2296 = GHS7.3472m