CASE STUDY: GRACE TELECOM LIMITED

Introduction

Grace Telecom Ltd. is a well-established company which is providing telecommunications services both nationally and internationally. Its business has been concerned with telephone calls, the provision of telephone lines and equipment, and private telecommunication networks. Grace Telecom Ltd. has supplemented these services recently by offering mobile phone, which is an expanding market worldwide

The company maintains a diverse customer base, including residential users, multi-national companies, government agencies and public sector organisations. The company handles approximately 100,000 million calls each working day, and employs nearly 140 personnel.

Strategic development

The Chairman of Grace Telecom Ltd stated within its latest Annual Report that there were three main areas in which the company aimed to develop in order to remain a world leader in the telecommunications market. He believes that the three main growth areas reflect the evolving nature of the telecommunications market and will provide the scope for development.

The areas in which development is planned are:

- expansion of the telecommunications business in the national and overseas markets, both by the company acting on its own and through partnership arrangements with other suppliers

- diversification into television and multi-media services, providing the hardware to permit telephone shopping from home and broadcasting services

- extension of the joint ventures and strategic alliances which have already been established with companies in West Africa.

The Chairman explained that the company is intent on becoming a world leader in communications. This will be achieved through maintaining its focus on long-term development by improving its services to customers, developing high quality up-to-date products and being innovative, flexible and market-driven. His aim is to deliver a world-class service at competitive cost.

Financial information

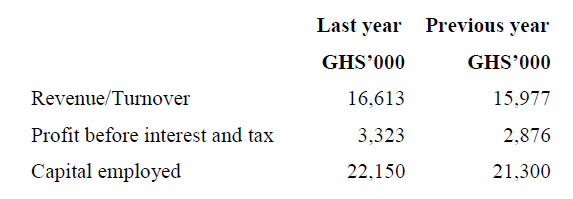

The following comparative statistics show extracts from the company’s financial performance in its national telecommunications market over the last two years:

The company estimates its cost of capital to be approximately 18%.

The Chairman expressed satisfaction with the increase in turnover and stated that cost efficiencies were now being generated following the completion of a staff reduction programme. This would assist the company in achieving a target return on capital employed (ROCE) of 20% in this market over the next three years.

Business opportunities

The Chief Executive of Grace Telecom Ltd. has stated that the major opportunities for the company lie in the following areas:

- encouraging greater use of the telephone

- provision of advanced services, and research and development into new technology, including the internet and systems integration.

the increasing freedom from government control of worldwide telecommunication services.

An extensive television and poster advertising campaign has been used by the company. This was in order to penetrate further the residential market segment by encouraging greater use of the telephone with various charging incentives being offered to residential customers.

To further the objective of increasing long-term shareholder value, the company is actively considering an investment of GHS200 million in each of the next three years in new technology and quality improvements in its national market. Because of its specialist technical nature, the investment is not expected to have any residual value at the end of the three-year period.

Following the investment, the directors of Grace Telecom Ltd. believe that its rate of profit before interest and tax to turnover in its national telecommunications market will remain constant. This rate will be at the same level as last year for each of the three years of the investment.

Markets and competition

The company is currently experiencing an erosion of its market share and faces increasingly strong competition in the mobile phone market. While Grace Telecom Ltd. is the leader in its national market, with an 85% share of the telecommunications business, it has experienced a reduced demand for the supply of residential lines in the last five years as competition has increased.

The market for the supply of equipment in the national telecommunications market is perceived to be static. The investment of GHS200 million in each of the next three years is estimated to increase Grace Telecom Ltd.’s share of this market to a level of 95%. The full improvement of 10% is expected to be received by Grace Telecom Ltd. next year, and its market share will then remain at this level for the full three-year period. It is anticipated that unless further investment is made after the three-year period, Grace Telecom Ltd.’s market share will revert to its current level as a consequence of the expected competitive response.

Industry regulation

The government has established an industry regulatory organisation to promote competition and deter anti-competitive behaviour.

As a result of the activities of the regulator and aggressive pricing strategies, it is anticipated that charges to customers will remain constant for the full three-year period of the new investment.

All cash flows can be assumed to occur at the end of the year to which they relate. The cash flows and discount rate are in real terms.

Future outlook

The business still remains under family control, but the board is considering an expansion programme for which and that the family would need to raise GH¢200 million in equity or debt finance. One of the possible risks of expansion lies in the fact that the market for fixed telephone lines is falling. New income is being generated by expanding the product range to include mobile money transfer. The key to profit growth for Grace Telecom is the ability to generate sales growth, but the company recognizes that it faces stiff competition from large telecom companies in respect of the prices charged.

In planning its future, Grace Telecom is advised to look carefully at a number of external factors which may affect the business including government economic policy. In recent months the following information has been published in respect of key economic data.

i) Bank base rate has been reduced from 22% to 20%, and the forecast is for a further 0.5% reduction within six months.

ii) The annual rate of inflation is now 12%, down from 14% in the previous quarter, and 16% 12 months ago. No further falls in the rate are expected over the medium term.

iii) Personal and corporate tax rates are expected to remain unchanged for at least twelve months.

Required:

Explain whether Grace Telecom should continue with its expansion plans. Clearly justify your argument for or against the expansion. [10 marks]

View Solution

i) Need to increase sales

Due to the low level of gross margins, Grace Telecom Ltd needs to increase the level of sales in order to trade profitably. In view of the low level of recent seals growth, in spite of the addition of new products, it seems that the only way to increase sales significantly is by the opening of new outlets.

ii) Bulk order discounts

Expansion of the business will increase the level of purchase and could lead to an improvement in the level of buying power with suppliers, and the ability to take advantage of bulk order discounts. This would in turn have a positive impact on gross margins and profitability.

iii) Wider geographical spread

A wider geographical spread will make the business less vulnerable to local even, such as an increase in the level of unemployment or the opening of a new superstore.

iv) Economic of scale

Expansion could lead to some economies of scale, for instance in the wider deployment of regional management.

Arguments against expansion

i) Nature of products

Expansion will not change the fundamental weakness of the business, which is that most of the business is in low value products with strong price competition. There is limited potential to grow, and other factors, the greater convenience of being able to buy practically all products required at a single large store, are working against the business.

ii) Risk of political pressure

Grace Telecom Ltd. risk coming under greater political pressure if it tries to expand further to obtain large share of the marker (already 85% is very significant and could lead to monopolistic behaviours by the company). Such political pressures could lead to greater political regulation and costs that may hinder the operations of the company.

iii) Competitive pressures

Strong price competition due to low inflation and the position of the supermarket sector is likely to continue for the foreseeable future.

Conclusion

In conclusion, Grace Telecom Ltd should think very carefully before committing to the expansion, since this is unlikely to do much to increase margins and profitability. The company could perhaps consider an alternative strategy of selling different higher added value products, and changing the whole style of the operation. For example, it could consider expanding into areas which present greater opportunities for competing based on cost/price.