Asana Ltd (Asana) is a manufacturing company based in Ghana. It is listed on Ghana’s stock exchange with a total market capitalization of GH¢400 million and 50 million shares outstanding. Its debt stock is made up of 10,000 18% bonds with face value of GH¢100 each. Per the bond indenture, Asana is required to maintain a maximum debt-to-equity ratio of 80% and is prohibited from paying a dividend in any year unless its dividend capacity for that year is at least 45% of net income for that year. For the past three years, the company has not been able to pay dividends to its shareholders because it has not been able to meet the minimum dividend capacity requirement.

Presently, the company is planning an expansion project that could enhance its dividend capacity for the coming years. The expansion project is expected to increase profit before interest and tax by 15% above the recent figure of GH¢35 million. The directors are considering whether to use equity or debt finance to raise the GH¢50 million required by the expansion project. The amount required by the business expansion will be invested in additional property and equipment. Details of the two financing methods under considering follow:

Method 1: Equity finance

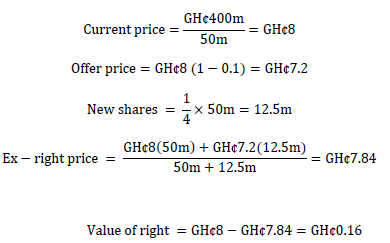

If equity finance is used, Asana will offer 1 new share for every 4 existing shares in rights offer at a discount of 10% off the current market price.

Method 2: Debt finance

If debt finance is used, Asana will raise the required GH¢50 million through a syndicated loan arrangement. The interest rate on this syndicated loan is expected to be 20%. It is assumed that the entire principal will be drawn immediately and be paid back in a lump sum in 5 years’ time.

The directors of Asana are concerned about how the finance method could affect the firm’s ability to enhance its dividend capacity while maintaining the required debt-to-equity ratio.

Additional information:

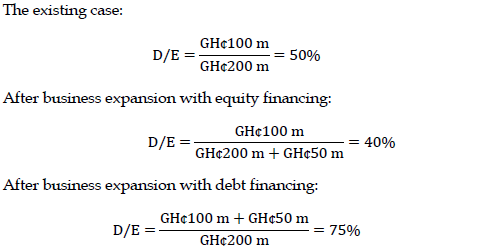

1. Presently, the book value of equity is GH¢200 million while the debt level is GH¢100 million.

2. The recent profit before interest and tax is reported after charging depreciation of GH¢10 million and profit on disposal of non-current assets of GH¢2 million. The aggregate cost of the non-current assets sold is GH¢10 million, and their aggregate accumulated depreciation is GH¢8 million.

3. In addition to the business expansion expenditure, GH¢2 million will be invested to maintain existing productive capacity in the coming year. This will be financed from retained earnings.

4. Additional investment in net working capital will be 20% of the current net working capital balance of GH¢100 million.

5. Asana pays corporate income tax at 22%.

Required:

i) Supposing equity finance is used, compute the value of a right. (2 marks)

View Solution

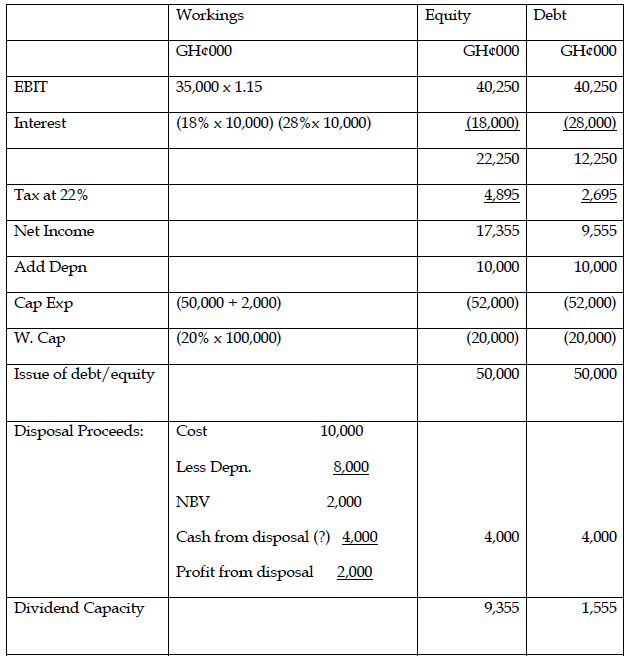

ii) Forecast the dividend capacity of Asana under both financing methods after the business expansion. Conclude whether Asana would be able to pay dividends to its shareholders in the coming year. (5 marks)

View Solution

Dividend capacity for the coming year

The company can meet its dividend capacity requirement if the business expansion is financed with equity.

iii) Compute the revised debt-to-equity ratio of Asana under both financing methods after the business expansion. (3 marks)

View Solution

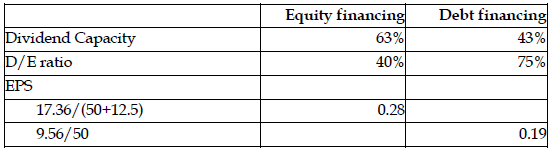

iv) Use the results of the calculations above to evaluate whether equity or debt finance should be used for the planned business expansion. (2 marks)

View Solution

- If equity financing is used, the company will improve on its debt-to-equity ratio while it meets the requirements to pay some dividend to its shareholders. Interestingly EPS would be better if equity finance is used.

- If debt financing is used, the company’s debt-to-equity ratio will be just below the required minimum of 80%. This will leave little room for future borrowing in the future to finance investment opportunities that become available. What is more, the company will not be able to meet the required dividend capacity.

- Therefore, the equity financing method is a better option for raising the money required by the business expansion.