The Board of Peartek Ltd is considering the company’s capital investment options for the coming year, and also evaluating the following potential investments:

Investment A

This investment is similar to its current investments and requires an investment of GH¢60,000 now, GH¢40,000 for new capital equipment and GH¢20,000 for increases in working capital. This will be financed from Shareholders Funds. Sales next year would be 10,000 units, variable costs would be GH¢6 and the product would be sold for GH¢10. But due to entry of new competitors and technological improvements, the sales price would decline by 20% per annum thereafter, sales volume would fall by 10% and variable costs would fall by 20% per annum. Overheads attributed to the project would be GH¢15,000 per annum.

In year three the project would be wound up, working capital investment would be recovered and capital equipment sold off for 25% of its purchase costs the following year. Fixed costs include an annual charge of GH¢4,000 for depreciation.

Investment B

This is a long–term project in a totally new area, involving an immediate outlay of GH¢90,000, which they intend to borrow from their lenders at 6%. They expect net profits of GH¢12,000 next year, rising thereafter by 3% per annum in perpetuity.

Investment C

This is another long-term investment in a totally new area, involving an immediate outlay of GH¢25,000 which they intend financing by retained profits.

Expected annual net cash profits are as follows:

Years 1 to 4 : GH¢3,000

Years 5 to 7 : GH¢5,000

Year 8 onwards forever : GH¢7,000

The company discounts all projects lasting ten years duration or less at a cost of capital of 10% and all other projects at a cost of 13%. You may ignore taxation.

Required:

Minority of board members feel that the Internal Rate of Return (IRR) should also be used as either an alternative or a complementary method of investment appraisal. Calculate the IRR of investments A and B (you may use 25% as the upper limit if you wish) and comment accordingly. (5 marks)

View Solution

From the calculations below, the IRR of Investment A is approximately 23% while the IRR of Investment B is approximately 18.5%. Thus both meet the required return of projects as given by the board of Peartek Ltd. i.e. 10% for all projects lasting ten years duration or less and 13% for all other projects.

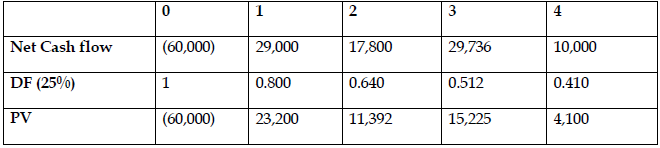

INVESTMENT A

NPV= -6,083

IRR = A +{(a/ (a-b) ) * B – A)}

i.e. at r = 10%, NPV = ¢10,226

i.e. at r = 25%. NPV = ¢-2,426.72

IRR = 10% +{(10,226 / ( 10,226 – -6,083)* (25% – 10%)}

. = 10% +{(10,226 / 16,309) * (15%)}

. = 10% +{(0.627) *(15%)}

. = 10% +{0.094}

. = 10% + 9.4%

. = 19.4% approximately

INVESTMENT B

r = 13%

g = 3%

Costs = 90,000

Yr1 = 12,000

NPV = PV Benefits – PV of Costs

PV Benefits = CFI / (r – g)

. = 12,000 /(0.13 – 0.03)

. = GH¢120,000

NPV = ¢120,000 – ¢90,000 = ¢30,000

r = 25%

g = 3%

Costs = 90,000

Yr1 = 12,000

NPV = PV Benefits – PV of Costs

PV Benefits = CFI / (r – g)

. = 12,000 /(0.25 – 0.03)

. = GH¢ 54,545.45

NPV = ¢54,545.45 – ¢90,000 = – ¢35,454.55

i.e. at r = 13%, NPV = GH¢30,000

i.e. at r = 25%, NPV = ¢-35,454.55

IRR = 13% + {(30,000 / (30,000 – – 35,454.55) * (25% – 13%)}

. = 13% + {(30,000 / (65,454.55) * (12%)

. = 13% + {(0.458) * (12%)

. = 13% + {5.50%}

. = 18.50% approximately