The Board of Peartek Ltd is considering the company’s capital investment options for the coming year, and also evaluating the following potential investments:

Investment A

This investment is similar to its current investments and requires an investment of GH¢60,000 now, GH¢40,000 for new capital equipment and GH¢20,000 for increases in working capital. This will be financed from Shareholders Funds. Sales next year would be 10,000 units, variable costs would be GH¢6 and the product would be sold for GH¢10. But due to entry of new competitors and technological improvements, the sales price would decline by 20% per annum thereafter, sales volume would fall by 10% and variable costs would fall by 20% per annum. Overheads attributed to the project would be GH¢15,000 per annum.

In year three the project would be wound up, working capital investment would be recovered and capital equipment sold off for 25% of its purchase costs the following year. Fixed costs include an annual charge of GH¢4,000 for depreciation.

Investment B

This is a long–term project in a totally new area, involving an immediate outlay of GH¢90,000, which they intend to borrow from their lenders at 6%. They expect net profits of GH¢12,000 next year, rising thereafter by 3% per annum in perpetuity.

Investment C

This is another long-term investment in a totally new area, involving an immediate outlay of GH¢25,000 which they intend financing by retained profits.

Expected annual net cash profits are as follows:

Years 1 to 4 : GH¢3,000

Years 5 to 7 : GH¢5,000

Year 8 onwards forever : GH¢7,000

The company discounts all projects lasting ten years duration or less at a cost of capital of 10% and all other projects at a cost of 13%. You may ignore taxation.

Required:

As a financial management analyst, you have been asked to advise the board of Peartek Ltd (in the form of a briefing report) which investment should be undertaken. In your report you are to make use of the NPV method, as the members of the board believe this is the best to use and have asked you to use it. (15 marks)

View Solution

Report to Peartek Ltd.

Your answer should be in a report, properly addresses, dated and structured. Irrespective of how the projects are financed they should be discounted as per the company policy, i.e. all projects lasting ten years duration or less at a cost of 10% and all other projects at a cost of 13%.

The following NPV calculations should be included in the body or the main findings in the body with the following in the appendices:

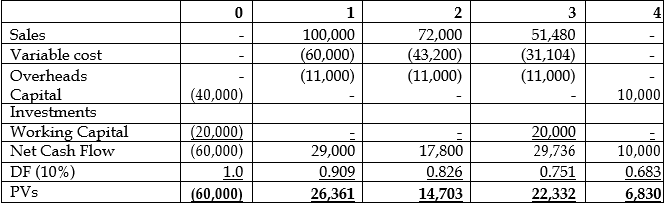

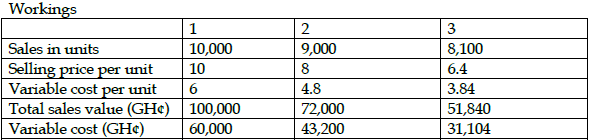

INVESTMENT A

NPV = GH¢10,226

INVESTMENT B

r = 13%

g = 3%

Costs = 90,000

Yr1 = 12,000

NPV = PV Benefits – PV of Costs

PV Benefits = CFI / (r – g)

. = 12,000 /(0.13 – 0.03)

. = GH¢120,000

NPV = ¢120,000 – ¢90,000 = ¢30,000

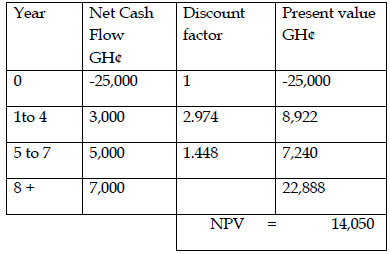

INVESTMENT C

NPV = PV Benefits – PV of Costs

PV of ¢7,000 per annum in perpetuity = CFt / r = 7,000/0.13 = ¢53,846.15

Less PV of ¢7,000 for years 1 to 7 x Discount Factor = ¢7,000 x 4.423 = ¢30,958.27

Thus PV of ¢7,000 a year from year 8 in perpetuity = ¢53,846.15 – ¢30,958.27 = ¢22,887.88

The discount factor for years 1 to 7 when r = 13% is 4.423

Less the discount factor for years 1 to 4 when r = 13% is 2.974

Thus the discount factor for years 5 to 7 when r = 13% is 4.423 – 2.974 = 1.448

As all projects have positive NPV’s they should all be undertaken. On the basis of the NPV criteria project B has the greatest positive net present value, followed by A then C and all should be undertaken.

Since the NPV values depend crucially on the discount rate used, students should outline to the board of Peartek Ltd. the appropriateness of their choice of discount rates.

Students should also outline limitations associated with using the NPV method and ways to deal with these limitations. Limitations include how risky are the predicated cash flows and hence what is the appropriate cost capital. Appropriate methods to deal with these include probability analysis and sensitivity analysis.