Paisley Brothers Limted, a company producing loud paisley shirts, has a net operating income of ¢20,000 and is faced with following three options of how to structure its debt and equity:

a) To take no debt and pay shareholders a return of 9%;

b) Borrow ¢50,000 at 3% and pay shareholders an increased return of 10%;

c) Borrow ¢90,000 at 6% and pay a 13% return to shareholders.

Assuming no taxation and a 100% payout ratio,

Required:

Calculate the Weighted Average Cost of Capital for each of the options and determine which method is optimal. (5 marks)

View Solution

Option (a). Income of GH¢20,000 is distributed to shareholders who require a return of nine per cent. The market value of equity is therefore 20,000/0.09 = GH¢222,222.

Option (b). Interest on debt of 50,000 x 3 per cent = GH¢1,500 is paid, so dividends to shareholders are 20,000 – 1,500 = GH¢18,500. Since the required return of shareholders is 10 per cent, the market value of equity is 18,500/0.10 = GH¢185,000. Since the market value of debt is ¢50,000, the total value of the company is 185,000 + 50,000 = GH¢235,000.

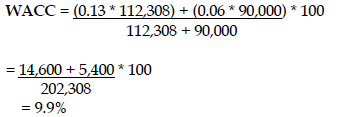

Option (c). interest on debt of 90,000 x 6 per cent = ¢5,400 is paid, so dividends to shareholders are 20,000 – 540 = ¢14,600. Since the required return of shareholders is 13 per cent, the market value of equity is 14,600/0.13 = ¢112,308. As the market value debt is ¢90,000, the total value of the company is 112,308 + 90,000 = GH¢202,308.

Conclusion:

The optimal capital structure is the capital structure with the lowest WACC and highest market value. This is option 2.