SHOCKS IN THE GHANAIAN BANKING INDUSTRY

Introduction

The news on August 14, 2017 to the effect that the licenses of two indigenous banks – UT Bank and Capital Bank have been revoked came as a surprise to the Ghanaian business community, since the two banks had won numerous awards for performing well in the industry. The two banks were taken over by GCB Bank Ltd. In the 2011 Ghana Banking Awards, UT Bank was adjudged the Bank of the year. Capital Bank was also adjudged the Best Growing Bank, and Best Bank in Deposits & Savings in 2016. A press statement issued by Bank of Ghana (BoG) read in part as follows: “The Bank of Ghana has revoked the Licences of UT Bank Ltd and Capital Bank Ltd. This action has become necessary due to severe impairment of their capital. The two banks have high non-performing loans. UT Bank and Capital Bank were deeply insolvent, meaning that their liabilities exceeded their assets, putting them in a position not to be able to meet their obligations as and when they fell due”. This revocation was in line with Section 123 of the Banks and Specialised Deposit Taking Institutions (SDIs) Act 2016 (Act 930). The Act states that “when a bank is in distress, the Bank of Ghana revokes its license, possesses the bank, appoints a receiver and then put it up for sale”. In this case, GCB Bank Ltd acquired the banks, while Bank of Ghana appointed PricewaterhouseCoopers (PWC) as the receiver.

To avoid a run on other banks and to minimise instability in the financial sector, all deposits and selected assets of the two Banks were transferred to GCB Bank Ltd, thereby assuring the depositors of their funds. The combined deposits of the two banks were estimated to be over GH¢2 billion, which far exceeds available liquid assets

As at the close of February 28, 2018, GCB Bank Ltd had successfully completed the full integration of the systems of the erstwhile UT Bank and Capital Bank by retaining 22 out of the 53 branches based on their location and accessibility to customers as well as absorption of more than half of permanent staff of those Banks. The acquisition of the two failed Banks by GCB Bank has increased its branch network across the country to 183.

The Ghanaian Banking Industry

The number of banks operating in Ghana had increased from 25 in 2010 to 34 as at the close of 2017. To outwit increasing competition in the industry, a wide array of products and services are being offered by the banks in order to attract customers. The accounts opening process has been simplified across the industry and makes it easier to open account with any bank. The non-banking financial institutions are offering higher returns/yields on deposits compared to that of the banks making deposit mobilization in the industry more difficult and expensive. However, the rates offered by the commercial banks on loans are, generally much lower than that available in the non-banking financial services segment. The major risk facing the industry is the quality of assets (loans), as reflected in high Non-Performing Loans (NPL) ratio, which edged up from 17.3% to 22.7% in December 2016 and 2017 respectively. In response to worsening NPL ratio, banks are tightening credit risk stance by cutting back on loans and advances portfolio and redirecting the funds to the money market and government securities even though the rates on those securities have been trending downward from 2017.

Another significant change in the industry is the switch from IAS 39 to IFRS 9 Financial Instrument – recognition and measurement effective January 1, 2018. The new standard changes measurement of impairment from historical credit loss to expected credit loss model, which recognises life-time expected credit loss based on forward looking information. This is anticipated to result in higher provision for loan losses and further impairment of the capital of banks.

Extract of selected Financial Soundness Indicators of the Ghanaian Banking Industry for the year end 2014 was as follows:

%

Net interest income growth 12.7

Cost to income ratio 56

Asset utilization ratio 8.8

Return on Equity 30.8

Profit after tax growth 66.5

The rise and fall of UT Bank and Capital Bank

The two defunct banks started as non-banking financial institutions and, subsequently, acquired banking license. They entered the banking landscape with legacies of expensive funds and huge NPL, making them less competitive. Since the collapse of the two banks, the media space has been agog with discussions by financial experts on the reasons for the failure of the two banks. Questions have been asked of the regulatory and supervisory role of the Bank of Ghana, since the failure was not an event, but a failure of processes over time. The integrity of the clean audit opinions issued by the external auditors on the two banks over the years have been questioned. At the time of the collapse in 2017, the two defunct banks had for the previous year not published their financial statements.

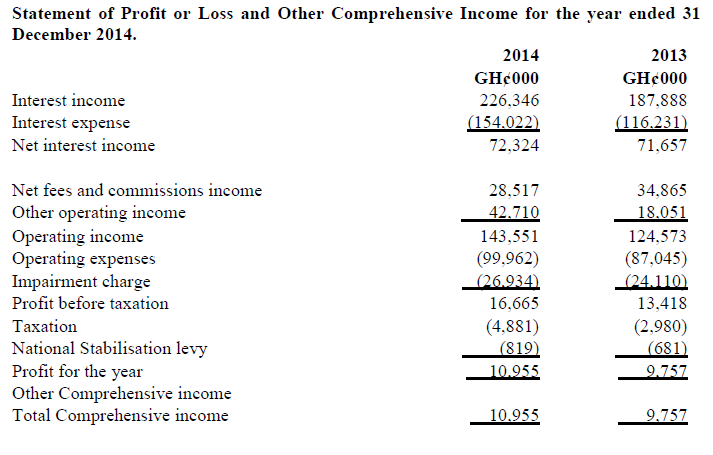

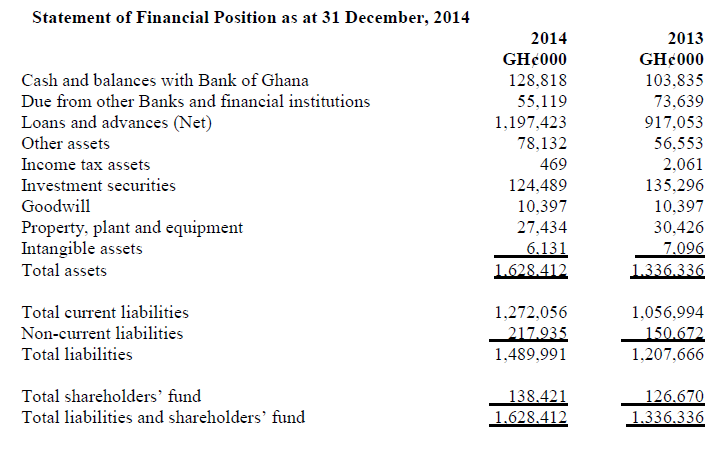

Below is extracts of the financial statements of one of the defunct banks.

Regulator’s action

Some recent measures by the Bank of Ghana to address vulnerabilities in the financial sector include: increase of minimum capital from GH¢120 million to GH¢400 million effective December 31, 2018 and a temporary freeze on issuance of new licenses in 2018. In July 2016, the Banks and Specialised Deposit-Taking Institutions Act, 2016 (Act 930) was passed by Parliament to tighten regulation of the banks. The Act limits the powers of Bank of Ghana in granting waivers to the banks, especially single obligor, which limits the risk of exposure to a single customer. Again, the Act imposes heavier sanctions for regulatory breaches.

To improve the quality of risk management, corporate governance and internal control practices in the banks, Bank of Ghana has issued directive to the banks to implement Basel II/III Capital Framework effective June 30, 2018. This imposes stringent requirements for capital measurement.

Addressing the annual dinner of the Chartered Institute of Bankers (Ghana) on December 2, 2017, the Governor of the Bank of Ghana made some remarks about the failure of the two defunct banks. Exhibit 1 below contains portions of the said speech.

Exhibit 1

“Despite the improved regulatory environment and supervisory frameworks, we have witnessed the dissolution of two banks this year. While no systemic challenges to the financial sector arose from the dissolution, it is useful to understand the underlying factors and reposition the sector to avoid the same mistakes in the years ahead.

Let me be upfront and say that though the failure of the two banks was due to significant capital deficiencies, the underlying reason was poor corporate governance practices within these institutions. In this instance, we saw the dominant role of shareholders who exerted undue influence on management of the banks, leading to poor lending practices. This was also reinforced by weak risk management systems and poor oversight responsibility by the boards of directors. Some of the examples of recklessness that led to the failure of the two banks include:

Co-mingling of the banks’ activities with their related holding companies. For instance, one bank was paying royalties for the brand name, even at a time that the bank’s financial performance was abysmal and could not pay dividends. Interestingly, the royalties were approved by four (4) out of seven (7) members of the Board without the consent of the other significant minority shareholders including an International Financial Institution. As a result, the international institution placed a notice on its website abrogating all relationships with the Bank and this led to most of the foreign lenders cutting off their credit lines to the Bank and recalling their credits thereby creating serious liquidity squeeze to the bank.

Also, very high executive compensation schemes were being operated by the affected banks which were not commensurate with their operations. The risk and earnings profile of the banks could not support the compensation schemes.

Non-Executive Directors of the banks compromised their independence and fiduciary duties to serve as checks on Executive Directors. This was because rewards such as business class air tickets were being granted to them annually.

Interference by Non-Executive Directors in the day-to-day administration of the banks weakened the management oversight function of executive directors. Some non-Executive Directors were also acting as consultants to the same banks with no clear mandate, which gave rise to conflict of interest situations.

Non-adherence to credit management principles and procedures as the banks were heavily exposed to insiders and related parties. There was also no evidence of interest payments on these investments. The investments were therefore impaired, but some members of the Board at the time accepted the responsibility to pay off the said amount through a board resolution.

Diversion of funds to holding companies and their related parties was widespread. In the case of one Bank, placements could not be traced to the bank’s records though some customers showed proof of their investments with the Bank. Irregular board meeting also accounted for the weaknesses in the board oversight.

In all of these cases, one thing was clear, and that is, the banks could not delineate themselves from their past practices as finance houses. They followed the same practice of borrowing from high net worth persons at a very high costs without any plans to bring themselves in line with the industry norm”

Required:

Discuss FOUR corporate governance practices that the Directors of the two defunct banks failed to adhere to. (10 marks)

View Solution

- Adequate Supervision

Employees who are not properly supervised by the board can create large losses for the organisation through their own incompetence, negligence or fraudulent activity. Interference by Non-Executive Directors in the day-to-day administration of the banks weakened the management oversight function of executive directors. Some non-Executive Directors were also acting as consultants to the same banks with no clear mandate, which gave rise to conflict of interest situations. Non-Executive Directors of the banks compromised their independence and fiduciary duties to serve as checks on Executive Directors. This was because rewards such as business class air tickets were being granted to them annually. - Non-Dominant role of shareholders

A feature of many corporate governance scandals has been boards dominated by a single senior executive with other board members merely acting as a rubber stamp. In the case of these two defunct banks, there was the dominant role of majority shareholders who exerted undue influence on management of the banks, leading to poor lending practices. - High Involvement of board

Boards that do not meet regularly or that fail to systematically consider the activities and risks of an organisation are clearly weak. For instance, one bank was paying royalties for the brand name, even at a time that the bank’s financial performance was abysmal and could not pay dividends. Interestingly, the royalties were approved by four (4) out of seven (7) members of the Board without the consent of the other significant minority shareholders including an International Financial Institution. As a result, the international institution placed a notice on its website abrogating all relationships with the Bank and this led to most of the foreign lenders cutting off their credit lines to the Bank and recalling their credits thereby creating serious liquidity squeeze to the bank. - Good oversight of accounts and audit

A lot of governance guidance has been concerned with defining effective internal control. At the time of the collapse in 2017, the two defunct banks had for the previous year not published their financial statements. Also, very high executive compensation schemes were being operated by the affected banks which were not commensurate with their operations. - Adequate control function

An obvious weakness is a lack of internal audit. Non-adherence to credit management principles and procedures as the banks were heavily exposed to insiders and related parties. There was also no evidence of interest payments on these investments. The investments were therefore impaired, but some members of the Board at the time accepted the responsibility to pay off the said amount through a board resolution. Diversion of funds to holding companies and their related parties was widespread. In the case of one Bank, placements could not be traced to the bank’s records though some customers showed proof of their investments with the Bank