AB Ltd is a mining company and has the following set of data relating to 2016 year of assessment.

From the above, the following came to light:

- Capital allowance of GH¢500,000 was added to cost.

- Penalty of GH¢100,000 was imposed by the Minerals Commission for failure to follow standard operating guidelines.

- Loss from operation amounting to GH¢50,000 recorded in 2010 was added to the cost above.

- According to the accountant, the company is entitled to carryover its losses.

Required:

i) Calculate the Royalty payable if any. (2.5 marks)

View Solution

Royalty Rate = 5%

Computation of Royalty is 5% of Revenue

5% x 5,000,000= 250,000

Royalty payable by AB Ltd is GH¢250,000.00

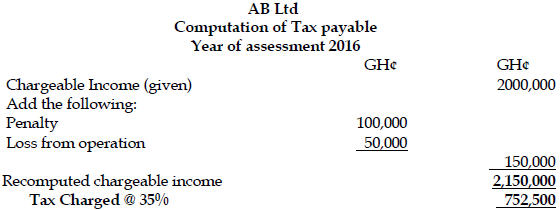

ii) Compute the corporate tax payable by AB Ltd. (2.5 marks)

View Solution

Explanations:

- The capital allowance was added to cost which eventually decreased the chargeable income is appropriate per the law.

- Penalty is an infraction which should be not be an allowable deduction. From the question, it came to light that it was part of the cost of operation.

- Loss is carried over for five years both under the old law and the new Act. Loss recorded in 2010 would have expired in 2015 if it was not entirely deducted.