XYZ Ltd runs a business with a basis period from January to December each year. The following information is relevant to its business operations for 2016 year of assessment.

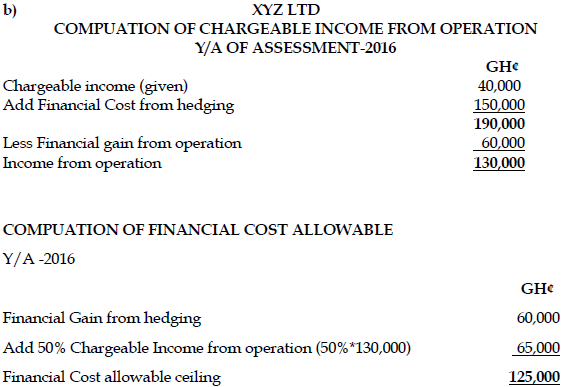

Chargeable Income from business operations GH¢40,000. The chargeable income was arrived at after the following adjustments were made:

Financial cost incurred on hedged transactions GH¢150,000.

Financial gain from hedged transactions GH¢ 60,000.

Required:

i) Compute the financial cost to be allowed in 2016 year of assessment. (6 marks)

View Solution

ii) Advise management on the above results. (4 marks)

View Solution

Cost incurred from hedging was GH¢150,000. The allowable ceiling on the cost incurred is GH¢125,000. The excess of (GH¢150,000-125,000) GH¢25,000 will be carried over for five years. The financial cost carried forward shall be allowed in five years following. It is granted in the order in which they occur.

Management should in future be mindful of the implication of cost on derivatives as they are not allowed wholesale but are restricted in accordance with section 16 of Act 896 Act 2015 and its amendment.