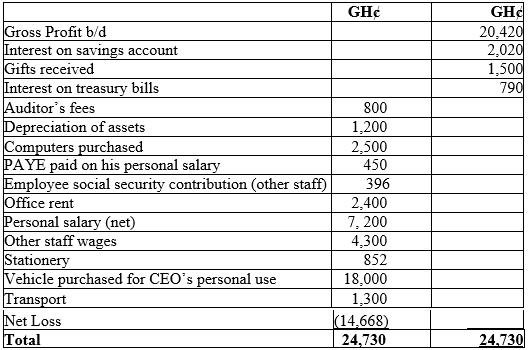

Mr. George Amoako, a self-employed single parent with two children attending a private University in Ghana trades as George Amoako Enterprise. He commenced business on 1st January 2016 and submitted the following extracts of his financial statements for the year ended 2016.

Required:

a) Determine the Chargeable Income of Mr. George Amoako for 2016 year of Assessment. (10 marks)

View Solution

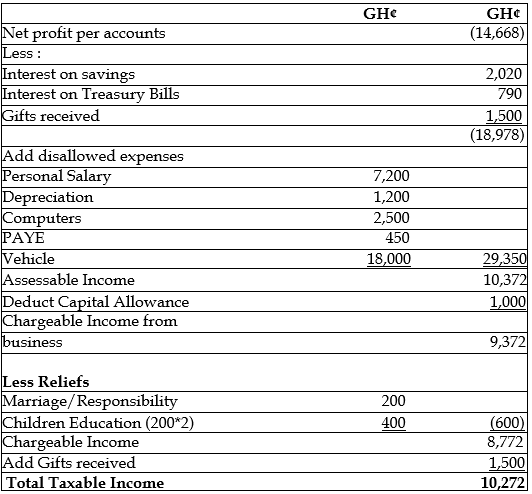

GEORGE AMOAKO

DETERMINATION OF CHARGEABLE INCOME FOR 2016 YEAR OF ASSESSMENT

BASIS PERIOD: 1ST JANUARY, 2016 – 31ST DECEMBER 2016

(10 marks evenly spread using ticks)

b) Support your computations with relevant explanations. (5 marks)

View Solution

Reasons for add back and or deduction:

- Interest on savings accounts and interest on treasury bills: Interest paid to an individual is exempted from tax under Act 2015 Act 896 .

- Gift received: Gifts received that are business related are added to business income in accordance with Act 2015 Act 896 and Act 2016 Act 924 .

- Personal Salary of Mr. Amoako and his tax paid: This is not allowable deduction because the proprietor and the enterprise are one and should not be treated differently.

- Depreciation: Depreciation is not allowable for tax purpose instead capital allowance computed in line with the 3rd Schedule of the Income Tax Act, 2015 Act 896 section 130.

- Computer Purchased: This is Capital in nature and not allowed as an expense in computing the chargeable income under section 9 of Act 2015 Act 896. However, capital allowance is granted in accordance with Third Schedule of Act 2015 Act 896.

- Vehicle Purchased for CEO: this expenditure is for the personal use of Mr. Amoako and should not be allowed as a deduction in accordance with section 9 of the Income Tax Act, 2015 (Act 896). It is not wholly, exclusively and necessarily incurred for the purpose of the business.

- Reliefs: George Amoako will be granted responsibility relief instead of marriage relief in accordance with s.51 of Act 896 in view of the fact that he is not married but has two children.

- Child Education Relief: This will be granted in view of the fact that George has two children attending Universities in Ghana in accordance with section 51 of Act 896. (Any 5 points)

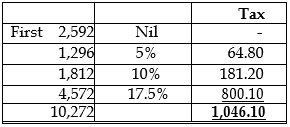

c) Compute all Taxes payable. (5 marks)

View Solution