GUSSIE PERRY LTD

Introduction

Gussie Perry Ltd (GPL) is a long-established divisionalised company with its origins in shipping. The company has been in existence for nearly 120 years and has developed a reputation for reliability and quality service.

The shipping activities in which Gussie Perry Ltd (GPL) is engaged in comprise four divisions – cruise, ferry, container and bulk shipping. The cruise division is engaged entirely in the carriage of passengers and the ferry division carries passengers and vehicles. The vehicles carried by the ferries range from motor cars to articulated trucks and buses. The container and bulk shipping divisions are engaged in the carriage of freight only.

Organisational goals

The company has stated over recent years that it aims to:

1. Increase its international business to achieve long-term profitability.

2. Provide the necessary capital investment to support its international operations.

3. Train and develop the company’s employees.

Environmental and Safety policy

Environmental protection is now a key aspect of corporate social responsibility. Pressure on Gussie Perry Ltd (GPL) for better environmental performance is coming from many quarters. The company recently implemented an environmental and safety policy, which is monitored through an audit system, in an effort to ensure that its policies are being executed. It is the aim of the company to have operational standards which match with the best industry’s standard. Training of management, staff and specialist auditors is seen as a priority within the organisation’s environmental and safety policy. This has become a major concern for the company, because of customer anxiety about the safety of the ferries.

Financial results

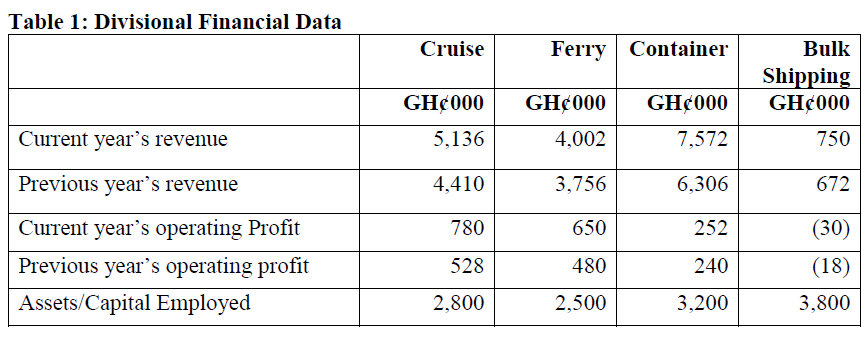

In the last financial year, earnings per share was GH¢2.12 producing a dividend cover of 1.15 times. The dividend per share paid by Gussie Perry Ltd (GPL) has remained at the same level for five years. Comparative values for divisional revenue and operating profit are shown in table 1.

During the year, general inflationary levels in the shipping industry was 14% per annum. The company’s cost of capital is 25%.

Extract from the Chairman’s statement for the financial year

In his statement, Mr. Aaron Yeboah, the Chairman of Gussie Perry Ltd (GPL), commenting on revenue and profit before the inflation adjustment, said the company achieved encouraging results, particularly in the cruise division. The company had taken delivery of a new cruise liner, at a cost of GH¢1,200,000 and has two more on order. Aaron believed that this was an expanding market and considered the company to be in a good position to take advantage of the opportunity. With regard to the ferry division, Aaron expected continued growth, although there was an expectation of potential new entrants due to increased cargo volumes. This contrasted with his view of the declining performance of the container and bulk shipping divisions as shown in table 1.

Market information

Gussie Perry Ltd (GPL) commissioned a marketing research into its cruise and ferry operations. The results of this research indicated that, in recent years, within the cruise liner industry, there has been a change in customer appeal. Traditionally, the main customer base had comprised of traders. In the last five years, the cruise division has experienced an increase in its clientele especially holiday makers. This stemmed from the promotion of domestic tourism.

Furthermore, the research showed a 15% increase in marine transport but Gussie Perry Ltd’s market share actually reduced by 4%. The report indicates that the probability of the cruise market continuing to grow was bright. However, there were uncertainties about the future potential of the container and bulk shipping divisions.

Required:

With reference to Porter’s five competitive forces model, assess the nature of the cruise and ferry shipping market in which Gussie Perry Ltd (GPL) is engaged. (16 marks)

View Solution

Porter’s model identifies five competitive forces that affect performance and these are considered below with particular reference to the cruise and ferries divisions.

(i) The threat of new entrants

In both cruises and ferries, the threat of new entrants is restricted by the cost of entry, namely the acquisition of the shipping and facilities required to operate these very substantial vessels. If one considers outright purchase then this will be a significant deterrent. However, one must also consider that such vessels might be rented which makes access to the capital required more available. One might also consider that such vessels do exist all over the world and there is a possibility that competing companies might divert vessels that are not currently competing on GUSSIE PERRY Ltd routes to directly compete on GUSSIE PERRY Ltd routes. However, this threat should be related to the likely response that might come from incumbent firms within the industry.

One must also consider in this heading the extent to which a new entrant would gain access to the market. Unless such a new entrant has an existing name and reputation that is associated with this sort of marketplace then it is more difficult for them to attract customers to their services.

(ii) Competitive rivalry

Cruise liners and ferries are a high fixed cost operation. As such, one can only make profits if a company exceeds the breakeven volumes. All competitors in this marketplace will therefore be seeking to maximise their capacity, obviously without reducing prices to an extent that makes break-even capacity more and more difficult to achieve.

We have no details in the question as to how the marketplace operates, but one would expect a certain amount of price competition and, more importantly, significant non-price competition as well. Such non-price competition would include newer and higher quality vessels; improved port facilities to speed passenger and car throughput; customer loyalty schemes which may include links with other types of supplier (of which air miles would be a good example) but any such similar scheme.

(iii) The bargaining power of buyers

The buyers in this case are the passengers that use the ferries or cruise liners. Given that this is a very competitive market, then buyers do have significant power given that they can transfer to other suppliers if they do not like the price or the quality of the facilities offered by a particular company. Such power is effectively limited by the differences that exist between the companies and to the extent that companies cannot differentiate themselves by price or non-price competition then buyers are put in a weaker position. This market is probably better described as an oligopoly rather than a perfectly competitive market as for any particular route there will be a limit on the number of suppliers. To the extent that these companies do have unofficial albeit illegal agreements regarding price and facilities offered then the power of the buyers will be diminished.

(iv) The bargaining power of suppliers

Many suppliers will have little bargaining strength as they are themselves subject to very competitive markets. Thus suppliers of food, fuel, various fixtures or fittings on the vessels themselves, will be in highly competitive markets and GUSSIE PERRY Ltd will be able to take advantage of its own fairly strong position.

However, its labour force must also be considered a supplier in this context and it depends on the industrial relations within this particular industry as to whether the company is in a strong or weak position in this respect.Port facilities and landing fees may also be an area where the company is in a weak position vis-a-vis a fairly small number of suppliers. However, as with all suppliers there will be limitations implied by legislation which limits, albeit not very effectively, the ability of the near monopoly suppliers to abuse their position.

(v) Threats of substitute products or services

Substitute products for the cruise division will be alternative types of leisure holidays. Thus a fortnight’s holiday visiting several cities by coach or air may be a perfectly reasonable substitute to a fortnight’s holiday cruising on a liner. Similarly, the numerous fly/drive holidays that are available would also be substitutes. The company would have to do market research to establish what sort of customers chose their cruises, whether it was customers who just liked cruising and would not really consider the alternatives available or whether it was customers who considered all the possible alternatives and then made a decision in favour of one or the other. Such market research would be vital for the company to produce the correct marketing strategy.

In the case of ferries, there are possibly more obvious alternatives such as the Channel Tunnel for the West African and also the airlines. Different considerations will apply to passengers and freight. As regards freight, the decision will be based almost exclusively on cost and time. Thus to compete, ferries would have to demonstrate that they can offer a cheaper service which does not significantly increase the time of the journey. As regards passengers, non-price factors such as the facilities and general amenity of the ferry service may also be important.