a) Mrs. Olivia Quartey is a resident in Ghana and works as the Finance Director of Ghana Trustees Limited. She earned a gross salary of GH¢30,000.00 for 2014 year of assessment. She contributed 5.5% of her salary to the social security fund. In 2014 the gross royalties that accrued to her was £4,000 from the United Kingdom from which tax of £800 had been deducted with the remainder of £3,200 being remitted to her in Ghana.

Granted that Ghana has a double taxation agreement with the United Kingdom, you are required to calculate the tax credit relief (if any) available to Mrs. Olivia Quartey for the year 2014. [Exchange rate, GH4.50=£1.] (16 marks)

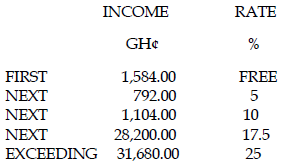

TAX RATES:

View Solution

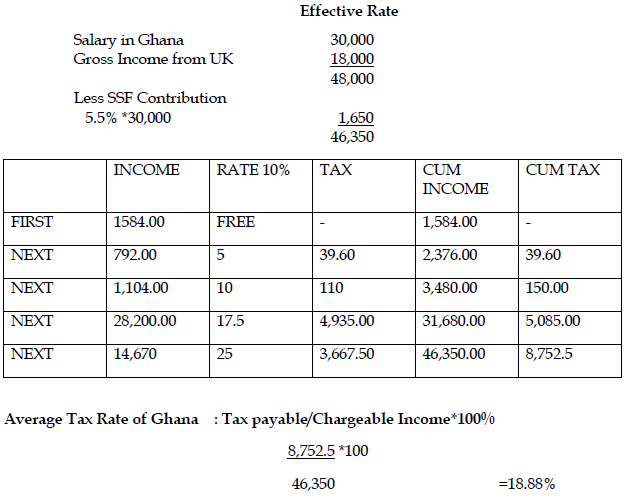

Effective Rate of Tax of the UK income:

![]()

Exchange Rate =£1 =4.50

800*4.50 = 3,600

4000*4.50 =18,000

A comparison of the UK effective rate with the Ghana effective rate shows that the Ghana rate is lower.

With the Ghana rate being lower than that of UK, the UK income has to be taxed at the average rate of Ghana tax as follows;

Tax on Total Income = 8,752.50

Less Foreign tax credit granted (18.88% of 18,000) = 3,398.40

. = 5,354.10

b) Mention the countries with which Ghana has double taxation agreements. (4 marks)

View Solution

1. France

2. Belgium

3. Italy

4. South Africa

5. Germany

6. Switzerland

7. Netherlands

8. Denmark

9. United Kingdom (Any 8 for 4 marks)