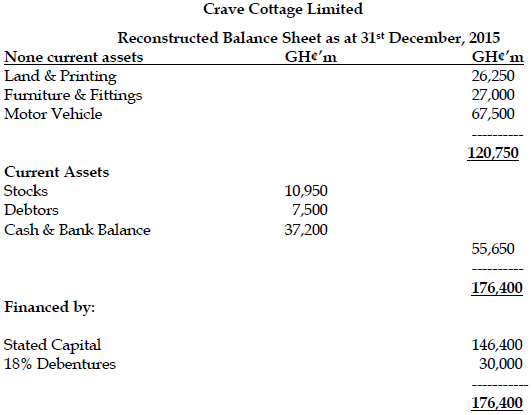

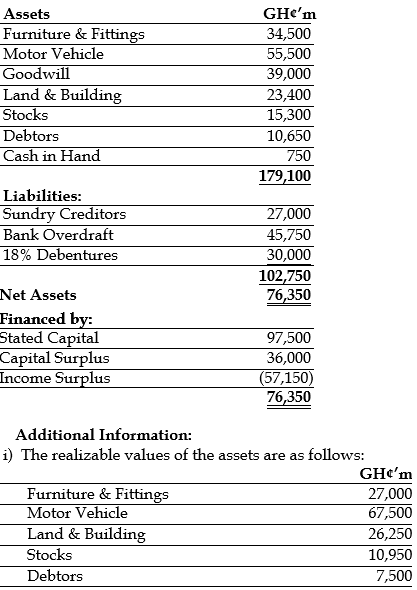

Crave Cottage Industry Limited has been in successful business for the past ten years. Following the retirement of its first Managing Director who also doubled as the majority shareholder, poor management has plunged the company into losses which is potentially eroding the capital of the company. The Statement of Financial Position of the company as at 31st December, 2015 is given below;

ii) The stated capital of the company is made up as follows:-

. GH¢’m

2,000,000 ordinary shares of no par value – 67,500

500,000 15% cumulative Preference shares of no par value- 30,000

iii) The cost of winding up is estimated at GH¢21,300 million.

iv) The bank overdraft and 18% debentures are secured by a floating charge on assets of the company.

v) The preference dividends and interest on debentures are two years in arrears. However, no provision has been made for those in the financial statement.

vi) The ordinary shareholder have decided to inject GH¢60,000 million in consideration for a new issue of equity shares if the capital reconstruction scheme is accepted.

vii) Although, it is the company’s policy to amortize intangible assets over five years, the Board of Directors nonetheless have decided to maintain the Goodwill indefinitely in the books due to the persistent losses in contravention of the company’s policy. Goodwill has been outstanding since 2009. The current financial state of the company negates the value and the existence of the goodwill.

viii) The preference shareholders have indicated their willingness to bear any deficit resulting from the reconstruction in proportion to their interest in the stated capital. In return, their stake would be converted into equity and would be permitted to make nomination to key management positions including chairing the board for the first five years. If these proposals are accepted, the preference shareholders will contribute further equity of GH¢60,000 million. They have also agreed to waive 50% of the arrears of dividend and convert the rest into equity.

ix) Any arrears of preference dividends are to form a first charge upon any surplus on winding up.

x) The original ordinary shareholders had decided to waive any dividend due to them during the first two years in order to put the company on sound financial ground.

xi) The company is expected to improve its cash flow positon and commence dividend payment if the additional capital of GH¢120,000 million is introduced.

Required:

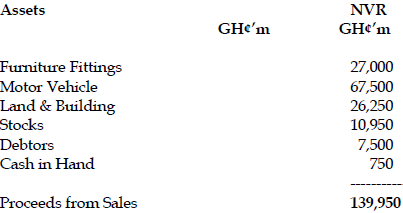

a) Calculate the amount available if Crave Cottage Industry Limited is liquidated and its distribution. (7 marks)

View Solution

Calculation of Amount Available if the Company is liquidated and its allocations.

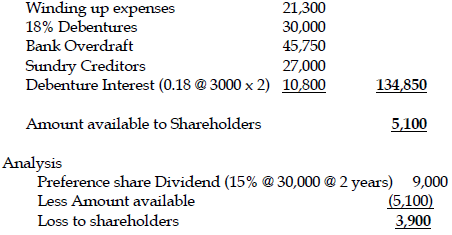

Distributed as follows:

This means that:

(1) If the company had been liquidated, the preference shareholders will lose GH¢3,900 million of the arrears of preference dividends in addition to the total amount of stated capital.

(2) Ordinary shareholder would receive nothing

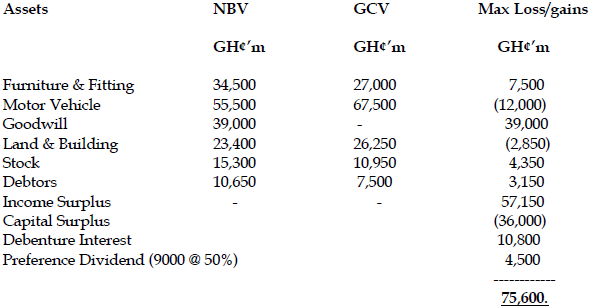

b) Calculate the maximum possible loss of Crave Cottage Industry Limited and its allocation to Preference Share Capital and Ordinary Share Capital. (6 marks)

View Solution

Analysis:

Allocation of losses 30:67.5

Preference Shareholders 30/97.5 @ 75,600 = 23,262

Ordinary shareholders 67.5/97.5 @ 75,600 = 52,338

If the reconstruction takes place, the total maximum loss would be GH¢75,600 million. Out of this, preference shareholder will suffer a loss of GH¢23,262 million whilst the ordinary shareholder would have to bear GH¢52,338 million.

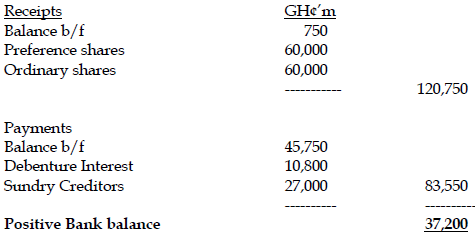

c) Calculate the Bank/Cash balance of Crave Cottage Industry Limited after the re-organization. (2 marks)

View Solution

Analysis of Bank/Cash Balance

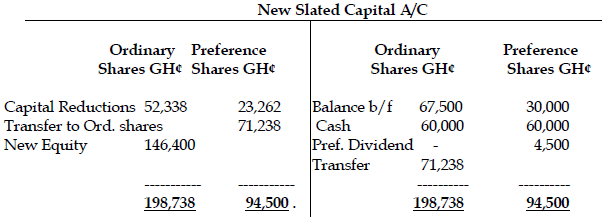

d) Calculate the new stated capital for the company after the reorganization. (2 marks)

View Solution

e) Prepare a Statement of Financial Position of Crave Cottage Industry Limited showing the position immediately after the scheme has been put in place. (3 marks)

View Solution