Percy-Perry Engineering Company (USA) Ltd is incorporated in USA and has Percy-Perry Construction (Ghana) Ltd as it subsidiary in Ghana. The foreign company was awarded a road construction contract by the Government of Ghana at a total sum of GH¢9 million on 1 January, 2019. The company sub-contracted the job to Percy-Perry Construction Ghana Ltd at GH¢7 million. Both companies entered into a technical service agreement under which the parent company would provide equipment and technical personnel for the execution of the contract.

The contract was successfully executed by Percy-Perry Construction Ghana Ltd during the year ended 31 December, 2019 and the statement of comprehensive income of the company showed the following:

GH¢

Contract Fees 7,000,000

Less:

Cost of Materials (910,000)

Hiring of Equipment (795,000)

Technical Personnel Cost (555,000)

Other Administration Expenses (223,000)

Depreciation (110,000)

Net Profit 4,407,000

The following additional information is provided:

- The equipment hired from the parent company at GH¢795,000 could have been hired from another company at GH¢600,000.

- If the parent company did not provide the technical personnel, Percy-Perry Construction Ghana Ltd could have employed the same personnel at GH¢450,000.

- Capital allowances for the year have been agreed at GH¢65,000

- The contract fees were subject to withholding tax.

Required:

i) Compute the Companies Income Tax payable by Percy-Perry Construction Ghana Ltd for the relevant year of assessment and comment on the treatment of any two of the transaction. (5 marks)

View Solution

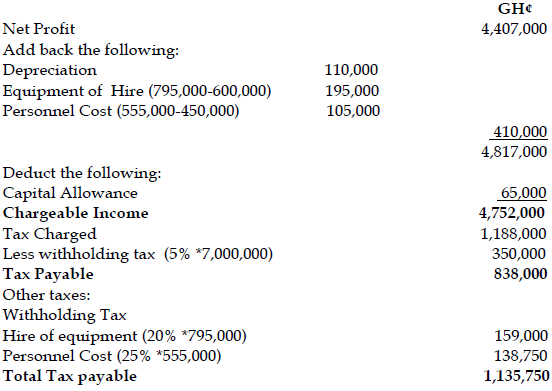

Percy-Perry Construction

Computation of Tax Payable

Y/A 1st January-31st December 2019

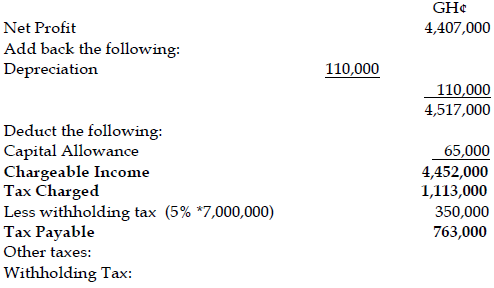

Alternative solution

Alternative solution with the assumption that the hire of equipment and staff costs between the USA and Ghana are incomparable in view of the geography and the economic climate of both jurisdiction.

Percy-Perry Construction

Computation of Tax Payable

Y/A 1st January-31st December 2019

ii) Compute the Companies Income Tax payable by Percy-Perry Engineering Company (USA) Ltd to the Ghana Revenue Authority for the relevant year of assessment. (2 marks)

View Solution

Percy- Perry USA

Computation of tax Payable

Y/A 2019

GH¢

Profit (9,000,000-7,000,000) 2,000,000

Tax Charged @25% 500,000

Less withholding Tax (9,000,000*5%) 450,000

Net Tax Payable 50,000

Issues:

The Parent Company based in the USA is using its subsidiary in Ghana to perform the task. Assuming it had no subsidiary, technically, it would have been considered a Permanent Establishment (PE) since construction for 90 days or more makes a non-resident person a PE in Ghana.

Hire of equipment

There is no indication that the subsidiary in Ghana tried finding out if any entity in the USA could hire the equipment for a lower amount or at best the GH¢600,00 being quoted by the Subsidiary

Staff Cost

There is no indication that other person that is uncontrolled in the USA could collect an amount lower than what the Parent Company is asking.

In any case, Citizens of other States that come to Ghana are paid slightly higher than their counterparts in Ghana.

Contract award

By winning the contract for GH¢9m and subletting it for GH¢7m, making a profit of GH¢2m, the profit will be subject to tax in Ghana as profit attributable to operations in Ghana.