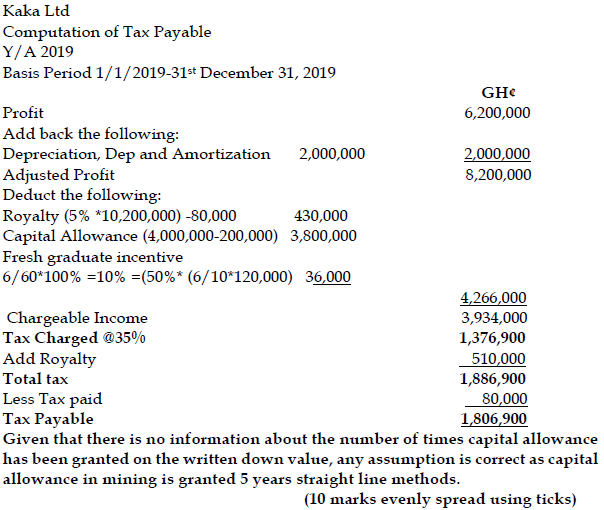

Kaka Ltd is a mining company that has been operating in Ghana for some time now. The following relates to Kaka Ltd’s 2019 year of assessment:

GH¢

Revenue 10,200,000

Cost 4,000,000

Profit 6,200,000

The following additional information is relevant and has been adjusted in arriving at the profit stated above:

GH¢

i) Depreciation, Depletion and Amortization 2,000,000

ii) Cost incurred in overburden stripping and shaft sinking during production to improve access amounted to GH¢800,000.

iii) Contribution towards worthwhile cause is GH¢10,000. This was in support of a hole-in heart child. This was duly acknowledged by Ghana Health Service.

iv) Royalty of GH¢80,000 was paid without recourse to the revenue from production.

Additional information:

- An asset (Capital Asset) acquired in 2016 for GH¢1,000,000 was sold for GH¢200,000 in 2019.

- Capital allowance (written down value brought forward) on the assets as at 31 December 2018 was GH¢4,000,000

- 10 fresh graduates were recruited in 2019 year of assessment, 4 of the fresh graduates completed universities in the United States of America while the others completed University for Development Studies in Ghana. They were paid GH¢120,000 as salaries. Total workforce for 2019 year of assessment was 60.

Required:

i) Compute the tax payable by Kaka Ltd. (10 marks)

View Solution

ii) The mining company indicated that it had an idle cash of GH¢100,000. If it adds it to its working capital, an additional income of GH¢10,000 would accrue but with an option to purchase Treasury Bills, the interest would remain at GH¢10,000.

Required:

Advise Management on the tax implication of the proposed investment. (2 marks)

View Solution

With the option to add the idle cash of GH¢100,000 to working capital, a tax of 35% shall be imposed on the income of GH¢10,000 as the outcome as opposed to a tax of 25% to be imposed as tax on an investment income of GH¢10,000.

Following from the above, management is advised to rather buy Treasury bills and pay a lower tax at the rate of 25% instead of additional mining income at the rate of 35%.