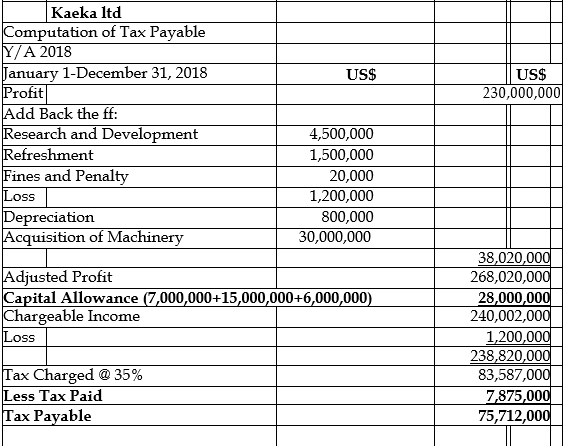

Kaeka Ltd operates in the Upstream Petroleum Sector. The following relates to its 2018 year of assessment:

. US$

Profit 230,000,000

Tax paid 7,875,000

The following was adjusted in arriving at the profit above:

Research and development cost incurred 4,500,000

Refreshment 1,500,000

Fines and penalty 20,000

Loss-2017 (unrelieved) 1,200,000

Depreciation 800,000

Acquisition of Drilling Machine 30,000,000

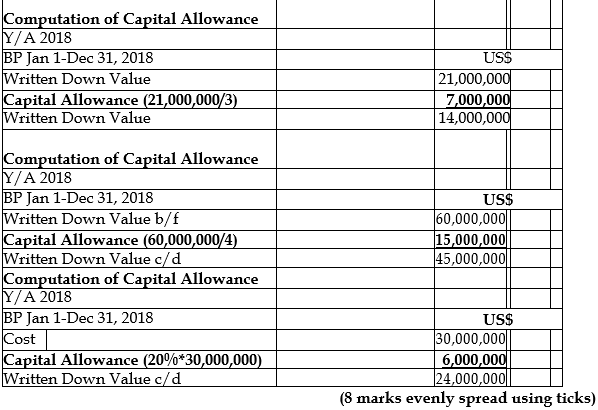

Note: Written Down Value of depreciable assets are as follows:

Balance c/d-2017:

US$21,000,000 with capital allowance granted twice as of 2017.

US$60,000,000 with capital allowance granted once as of 2017.

Required:

i) Compute the tax payable. (8 marks)

View Solution

ii) Comment on the treatment of research and development expenditure. (2 marks)

View Solution

Research and development has been added back to income as it is not an allowable deduction for tax purposes in petroleum upstream operations.

In the solution above, the research and development has been added back to income.