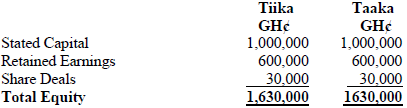

The following is the extract of financial statements-

Financial position as at 31 December 2018 of the following companies:

Tiika is a Free Zone company, resident in Ghana .Taaka is also a company resident in Ghana and both companies are engaged in the sale of tiles.

A Ghanaian who was living in the United States for a very long time has relocated to Ghana and has sought your opinion as a student of taxation to advise on the company to buy shares in. Your background checks indicate that the two companies have huge prospects.

Required:

Which of the companies will you advise this Ghanaian to invest in and why? (6 marks)

View Solution

- A free zone enterprises are enterprises which operate in non-custom controlled territory and pay tax when they export at the rate of 15% on their income while local sales are taxed at the rate of 25%.

- While a company that deals in tiles in Ghana is subject to tax at the rate of 25%. An investor in a company is part of the ownership structure. (2 points for 2 marks)

The following are other tax benefits to a shareholders:

- Dividend paid to shareholders are exempt from tax.

- Shareholders are going to benefit from huge profits when they export to grow their capital. (2 points for 2 marks)

Conclusion:

- I will advise the investment in Tiika as the investors stand to benefit from the above arrangement. In the case of investors in Taaka, dividend declared shall be subject to a high taxes at 8% final. The growth of equity is much more with Tiika than with Taaka. In future investors in Tiika shall have huge capital gain from the investment in Tiika as against equal investment in Taaka.

- On the strength of the above, the investor should not look any further but to invest in Tiika for maximum benefit in dividend and capital gains when there is a disposal in shares. (2 points for 2 marks)