Retail Specialist Co. Ltd (RSCL) is a large company, operating in the retail industry, with a year ended 31 December, 2018. You are a manager in Jen & Co, responsible for the audit of Retail Specialist Co. Ltd (RSCL), and you have recently attended a planning meeting with Olivia Danso, the finance director of the company. As this is the first year that your firm will be acting as auditor for Retail Specialist Co. Ltd (RSCL), you need to gain an understanding of the business risks facing the new client. Notes from your meeting are as follows:

Retail Specialist Co. Ltd (RSCL) sells clothing, with a strategy of selling high fashion items under the RSCL brand name. New ranges of clothes are introduced to stores every eight weeks. The company relies on a team of highly skilled designers to develop new fashion ranges. The designers must be able to anticipate and quickly respond to changes in consumer preferences. There is a high staff turnover in the design team.

Most sales are made in-store, but there is also a very popular catalogue, from which customers can place an order on-line, or over the phone. The company has recently upgraded the computer system and improved the website, at significant cost, in order to integrate the website sales directly into the general ledger, and to provide an easier interface for customers to use when ordering and entering their credit card details. The new on-line sales system has allowed overseas sales for the first time.

The system for phone ordering has recently been outsourced. The contract for outsourcing went out to tender and Retail Specialist Co. Ltd (RSCL) awarded the contract to the company offering the least cost. The company providing the service uses an overseas phone call centre where staff costs are very low.

Retail Specialist Co. Ltd (RSCL) has recently joined the Ethical Trading Initiative. This is a ‘fair-trade’ initiative, which means that any products bearing the RSCL brand name must have been produced in a manner which is clean and safe for employees, and minimises the environmental impact of the manufacturing process. A significant advertising campaign promoting Retail Specialist Co. Ltd (RSCL)’s involvement with this initiative has recently taken place. The RSCL brand name was purchased a number of years ago and is recognised at cost as an intangible asset, which is not amortised. The brand represents 12% of the total assets recognised on the statement of financial position.

The company owns numerous distribution centres, some of which operate close to residential areas. A licence to operate the distribution centres is issued by each local government authority in which a centre is located. One of the conditions of the licence is that deliveries must only take place between 8 am and 6 pm. The authority also monitors the noise level of each centre, and can revoke the operating licence if a certain noise limit is breached. Two licences were revoked for a period of three months during the year.

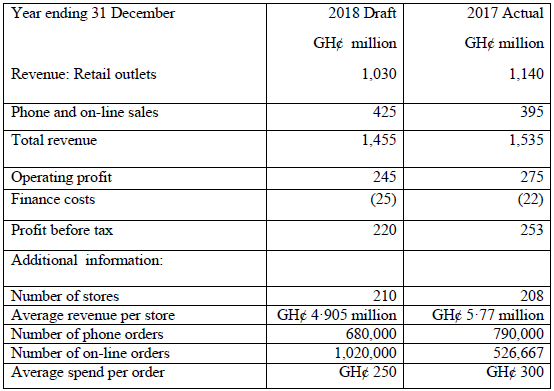

To help your business understanding, Olivia Danso has e-mailed to you extracts from the draft statement of comprehensive income, and the relevant comparative figures, which are shown below.

Extract from draft Statement of Comprehensive Income

Required:

Prepare briefing notes to be used at a planning meeting with your audit team, in which you evaluate FIVE (5) business risks facing Retail Specialist Co. Ltd (RSCL) to be considered when planning the final audit for the year ended 31 December 2018. (10 marks)

View Solution

Briefing notes

Subject: Business risks facing Retail Specialist Co. Ltd (RSCL)

Introduction

These briefing notes evaluate the business risks facing our firm’s new audit client, Retail Specialist Co. Ltd (RSCL), which operates in the retail industry, and its year under review ended 31 December 2018.

Ability to produce fashion items

The company is reliant on staff with the skill to produce high fashion clothes ranges, and also with the ability to respond quickly to changes in fashion. If Retail Specialist Co. Ltd (RSCL) fails to attract and retain skilled designers then the clothing ranges may not be desirable enough to attract customers in the competitive retail market. The high staff turnover in the design team indicates that Retail Specialist Co. Ltd (RSCL) struggles to maintain consistency in the design team. This could result in deterioration of the brand name and, ultimately, reduced sales.

There would be a high cost associated with frequently recruiting – this would have an impact on operating margins.

Inventory obsolescence and margins

There is a high operational risk that product lines will go out of fashion quickly, because new ranges are introduced so quickly to the stores (every eight weeks), leading to potentially large volumes of obsolete inventory. These product lines may be marked down to sell at a reduced margin. The draft results show that operating margins have already reduced from 17·9% in 2017 to 16·8% in 2018. Any significant mark down of product lines will cause further reductions in margins.

Wide geographical spread of business operations

Retail Specialist Co. Ltd (RSCL) operates a large number of stores, many distribution centres, and has an outsourced function which is located overseas. This type of business model could be hard to control, increasing the likelihood of inefficiencies, systems deficiencies, and theft of inventories or cash.

E-commerce – volume of sales

On-line sales now account for GH¢ 255 million (GH¢ 250 per order x 1,020,000 orders). In the previous year, on-line sales accounted for GH¢ 158 million (GH¢ 300 per order x 526,667 orders). This represents an increase of 61·4% (255 – 158/158 x 100%). One of the risks associated with the on-line sales is the scale of the increase in the volume of transactions, especially when combined with a new system introduced recently. There is a risk that the system will be unable to cope with the volume of transactions, leading possibly to unfilled orders and dissatisfied customers. This would harm the reputation of the company and the RSCL brand.

The company has recently upgraded its computer system to integrate sales into the general ledger. A disaster plan should have been put into place, for use in the event of a system shutdown or failure. The risk is that no plan is in place and the business could lose a substantial amount of revenue in the event of the system failure.

E-commerce – security of systems

It is crucial that the on-line sales system is secure as customers are providing their credit card details to the site. Any breach of security could result in credit card details being stolen, and Retail Specialist Co. Ltd (RSCL) may be liable for losses suffered by customers if their credit card details were used fraudulently. There would clearly be severe reputational issues in this case. Additionally, the system must be secure from virus infiltration, which could cause system failure, interrupted sales, and loss of customer goodwill.

E-commerce – tax and regulatory issues

There are several compliance risks, which arise due to on-line sales. Overseas sales expose Retail Specialist Co. Ltd (RSCL) to potential sales tax complications, such as extra tax to be paid on the export of goods to abroad, and additional documentation on overseas sales that may be needed to comply with regulations. Another important regulatory issue is that of data protection. Retail Specialist Co. Ltd (RSCL) faces the risk of non-compliance with any data protection regulation relevant to customers providing personal details to the on-line sales system.

Retail Specialist Co. Ltd (RSCL) is now making sales overseas. If these sales are made in a different currency to Retail Specialist Co. Ltd (RSCL)’s currency, the business will be exposed to exchange rate fluctuations which will have an impact on the company’s profit margin.

Outsourcing of phone ordering system

The fact that Retail Specialist Co. Ltd (RSCL) engaged the outsource provider offering the least cost could lead to business risks. Staff at the call centre may not be properly motivated, due to low wages being paid, and may fail to provide a quality service to Retail Specialist Co. Ltd (RSCL)’s customers, leading to loss of customer goodwill. As the call centre is overseas, the staff may have a different first language to Retail Specialist Co. Ltd (RSCL)’s customers, leading to customer frustration if they are not understood, and incorrect orders possibly being made. In addition, there may be staff shortages due to the low wage offered, leading to delay in answering calls and lost sales.

Overseas call centres are not always popular with customers, so Retail Specialist Co. Ltd (RSCL) may find that fewer customers use this method of purchase. However, the on-line system is there as an alternative for customers, and is proving popular, so this may not be a significant risk for the company.

The fact that Retail Specialist Co. Ltd (RSCL) opted for the lowest cost provider for the phone ordering system could pose a potential problem in that the provider may not be sustainable in the long term. If the provider fails to generate sufficient profit or cash, it may shut down, leaving Retail Specialist Co. Ltd (RSCL) without a crucial part of the sales generating system.

Ethical Trading Initiative

Retail Specialist Co. Ltd (RSCL) has aligned itself to an initiative supporting social and environmental well-being, presumably to promote its corporate social responsibility. The risk associated with this is that the claims that products have been produced in a responsible way can easily be undermined if the supply chain is not closely managed and monitored. Such claims are often closely scrutinised by the public and pressure groups, and any indication that Retail Specialist Co. Ltd (RSCL)’s products have not been sourced responsibly will lead to loss of customer goodwill and waste of expenditure on the advertising campaign.

Distribution centres

There is a risk of non-compliance with the operating licence issued by the local government authority. The authority will monitor the operating hours of the distribution centres, and also the noise levels created by them. Breaches of the terms of the licence could lead to further revocations of licences, causing huge operational problems for Retail Specialist Co. Ltd (RSCL) if the centres are forced to close for any period of time. Fines and penalties may also be imposed due to the breach of the licence.

Financial performance

Total revenue has decreased by GH¢ 80 million, or 5·2% (80/1,535 x 100). Operating profit has also fallen, by GH¢ 30 million, or 10·9% (30/275 x 100). The information also shows that the average spend per order has fallen from GH¢ 300 to GH¢ 250. These facts may signify cause for concern, but operating expenses for 2010 are likely to include one-off items, such as the costs of the new on-line sales system, and the advertising of the ‘fair-trade’ initiative. The fall in spend per customer could be a symptom of general economic difficulties. The company has increased the volume of on-line transactions significantly; so on balance the overall reduction in profit and margins is unlikely to be a significant risk at this year-end, though if the trend were to continue it may become a more pressing issue.

Retail Specialist Co. Ltd (RSCL)’s finance costs have increased by GH¢ 3 million, contributing to a fall in profit before tax of 13%. The company has sufficient interest cover to mean that this is not an immediate concern, but the company should ensure that finance costs do not escalate.

Conclusion

Retail Specialist Co. Ltd (RSCL) faces a number of operational and compliance risks, the most significant of which relate to the need for constant updating of the product lines and the potential for obsolete inventory. The new on-line sales system also raises risks in terms of security, systems reliability and the sheer volume of transactions. Retail Specialist Co. Ltd (RSCL) must also carefully manage the risk of non-compliance with local government authority regulations. The trend in financial performance should be carefully monitored, as further reductions in revenue and margins could indicate that a change in business strategy is needed.