View Introduction to Question

Adofo Boateng (Adofo) and Coffie Oduro (Coffie) met in 2010 when they were both students at a university in the United States. They both had ambitions to succeed in business back in their home country, Ghana. They shared common interest in Ghanaian history and culture, and saw commercial opportunities in setting up a business in the tourism industry. At that time, tourism was a growing but under-developed industry. Adofo and Coffie agreed that if they could establish a small and successful tourism business, there would be opportunities for rapid growth within just a few years.

On returning to Ghana in late 2011, they established a private company, Ghanalux Ltd, with money from family backers and some private means. The company’s business was to organise small tour groups of tourists from the United States, mainly the north-eastern states of the US. They had dedicated tour guides taking the groups on planned itineraries lasting about four weeks. Initially, Adofo and Coffie acted as tour guides themselves, although they gradually did less of this work as the company expanded.

The tours are priced at a high rate, but the aim is to deliver high-quality ‘luxury’ holidays for all customers. Ghanalux uses the services of a travel booking company in the US to advertise its tours and attract customers. The booking company charges a commission for its services, as a percentage of the tour prices paid by customers.

Early growth

The tourism industry in Ghana suffered from a skills shortage, and Ghanalux proved a success initially because Adofo and Coffie were both talented individuals, with a strong motivation to succeed, extensive knowledge of Ghana and its tourist attractions, and an ability to communicate easily with their US customers. The company gained a strong reputation in parts of the US for efficient tour organisation, but also exhilarating and life-enhancing tours.

The company operated from a small office in Accra, from which tours were organised and coordinated. In the first year of operations, ending December 2012, they generated revenue of just under GH¢2 million, and although they made losses in the early years, they were pleased with the revenue growth they achieved. As the company grew, it recruited a small number of full-time tour guides, using contacts in US universities to identify and attract Ghanaians who were studying there and were attracted by the prospects of working in the tourist industry in Ghana, and for a company where the prospects of career development seemed strong. In recruiting new guides, the company looked for individuals with strong motivation, an interest in Ghana and its history, culture and resources, and an ability to communicate well with both foreigners and the local folks.

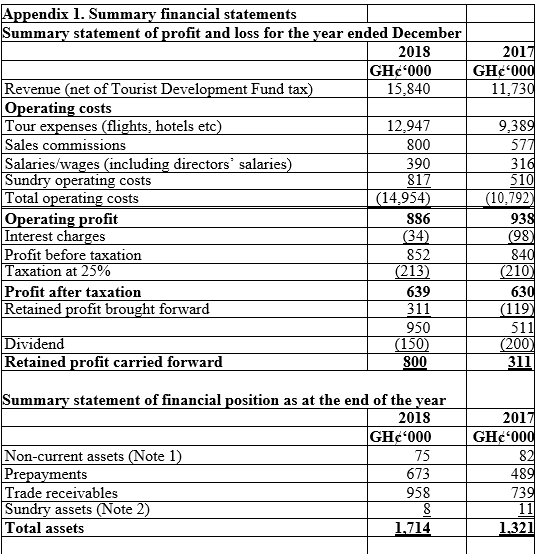

By 2018, the company was operating several tours each year for tour groups of about 16 people who were willing to pay premium prices for a top quality holiday experience, combining elements of Ghanaian culture, heritage, recreation and adventure. They also started to organise special themed tours each year to the PANAFEST festival in Elmina and Cape Coast. The company’s annual revenue in 2018 amounted to just short of GH¢16 million, and the net profit margin after tax was about 4% of revenue or GH¢639,000.

The tourism industry in Ghana

Tourism is now a major industry in Ghana. In 2018, the industry earned about US$3 billion for the national economy, attracting about 1.5 million international tourists from around the world and employing almost 700,000 people. However the industry is fragmented, with many small companies operating hotels, travel services, tours, catering for tourists, and so on. Visitors range from tourists looking for low-price holidays or short breaks to wealthier tourists taking longer holidays and visitors to business conferences.

The government is helping to support growth in tourism by funding infrastructure projects and other initiatives. However, Ghana’s tourist industry is still under-developed compared to other countries in Africa. Factors that appear to be holding back growth are a shortage of individuals with suitable skills, and insufficient branding and marketing of Ghana as an attractive tourist location to other countries. Tourists also often complain about the lack of comfort on tour buses that take them between their hotels and sightseeing locations.

Adofo and Coffie have discussed what Ghana needs to do to be a more attractive destination for foreign tourists.

Growth strategies

Adofo and Coffie believe that they need to think ahead and develop a strategy for taking the company forward and growing the business. There seem to be a number of different options for growth, and they want Ghanalux to be at the forefront of developments in the tourism industry. The strategic options they have discussed are set out briefly below:

Increase the number of tours each year. In 2018 the company ran twelve tours. It might be able to increase this number in future, although there is probably a limit to the number of tours that can be sold to customers in the north-east of the USA. There would be a need to recruit more tour guides.

Develop new bespoke high-end luxury tours, tailored to the specific requirements of individuals, couples or small families, where customers are accommodated in top quality hotels and have their own tour guides and private cars. These bespoke tours should sell for at least twice the price per person that the company charges for its existing tours.

Develop a range of themed tours. Currently, the company’s tours have an itinerary that combines different types of activity, such as visits to local festivals and events, visits to UNESCO heritage sites linked to the country’s history, adventure tours to rain forests and game parks, and recreational days at beach resorts. The company could develop tours that deal exclusively with just one type of activity.

Seek strategic tie-ups with other businesses in the tourism industry in Ghana, such as hotels and festival event organisers, so that they actively market each other’s services and products to their customers.

Merger. The company might consider a merger with one or more other tour companies. The directors of Ghanalux think that they would be unable to raise enough finance for an acquisition of suitable size, so any growth by way of business combination would have to be in the form of a merger, involving a share-for-share exchange.

A restriction on the company’s growth potential is that currently all its customers come from the north-eastern part of the USA. Ghanalux would be able to sell more tours if it could market its services successfully in other countries.

Company performance

The directors are pleased with the progress that the company has made since it was established. Annual revenues have grown, although profit has only been a relatively recent outcome, and there are encouraging future prospects. However, the company’s business is still at an early stage of development, and the directors understand that the company needs to sustain or improve the quality and efficiency of its operations and the skills of its employees. It cannot stand still and so needs to innovate, and it must find new ways of attracting customers so that its business continues to grow.

Until now, the directors have not made formal plans or budgets for the business, but they think that the company is reaching a stage where greater formality is required in the process of setting business targets and monitoring performance.

Shortage of talent

The company has so far been very careful in its selection of guides to lead its tour groups. Guides are well-educated, communicate well with other people and enjoy the tourism industry. However, many of them are also ambitious. If they think that Ghanalux is unable to offer them an attractive career, they are likely to move elsewhere in time, and possibly set up their own businesses. Already two experienced tour guides have left the company to seek a career elsewhere.

Adofo and Coffie think that if they are to retain as well as attract the top talent available, they will need to offer long-term incentives to their best guides. Incentives should encourage them not only to stay with the company, but also to contribute innovative ideas about how the company should develop.

At the moment guides are paid annual salaries of around GH¢60,000, plus a small annual bonus, but other forms of incentive might be needed.

Adofo thinks that if the company is unable to retain talent, it should ‘accept the inevitable’ and recruit guides locally on lower salaries, but give them intensive training before using them as tour leaders.

Ownership and organisation structure

Adofo and Coffie each own 40% of the shares in their company, and are the only directors of the company. The remaining 20% of shares are owned by members of their families. There are 50,000 equity shares in issue.

They recognise that unless and until the Ghana Stock Exchange grows substantially, there are no prospects for the company to obtain a stock market listing.

Now that the company has grown, neither Adofo nor Coffie act as tour guides themselves, and together they handle all the administrative and financial affairs of the company, with the help of an assistant, from their office in Accra.

Although there is no requirement for the company to appoint non-executive directors, Adofo thinks that more diversity of membership would benefit the board and the company’s leadership. He thinks that it might be a good idea to appoint a non-executive director to assist them with strategy formulation. Coffie disagrees, and thinks that if there is any benefit to be gained by increasing the size of the board, the new appointment should be an executive director, chosen from among the company’s tour guides. In this way, the owners would be demonstrating their commitment to promoting the careers of the individuals they recruit for their business.

Decision-making

The directors are reluctant to delegate authority to their employees. Each tour has a strict budget, and most spending is controlled from head office, for example spending on hotels, transport, entry to tourist sites and insurance. Tour guides are given a small budget for each tour for discretionary spending. Problems and concerns of customers during their tour are dealt with initially by the tour guide, but are referred to head office if they cannot be resolved easily.

Even so, the directors are keen to encourage their participation in decision-making, and to this end they hold six-monthly meetings with staff. These meetings are used to discuss issues that have arisen in the business, matters that concern staff, and ideas that the directors have for the future of the business. Adofo and Coffie think that these meetings are constructive and useful. The meetings help them to monitor feelings and concerns among employees, and give employees an opportunity to contribute their ideas about how the company should be run and what it should be doing.

Sustainability

During their period of study in the USA, Adofo and Coffie met and shared ideas with many individuals who were concerned about climate change, pollution of the earth and its atmosphere, and protection for wildlife. As a result of these influences, both directors have a strong sense of business ethics and sustainability. They believe that their company should demonstrate the attractions of Ghana to foreign visitors, but should operate their business without causing unnecessary environmental damage. They strongly support efforts by the government to protect rain forests and game parks, and for the protection of wildlife in game parks.

In spite of these views, they want to increase the numbers of international tourists visiting Ghana, even though they recognise that an expanding tourism industry might have adverse consequences for the country’s environment.

Personal security and customer protection

International visitors to Ghana sometimes express their concerns about personal security and the risk of being attacked and robbed. Tourists are often the target for criminals operating around tourist locations, with crimes such as muggings, bag snatching, petty theft and pickpocketing, particularly in markets and tourist sites, and on beaches.

Tour guides are instructed to warn the tourists in their group about the dangers, and to remain vigilant for possible problems. Customers are also advised to take out suitable insurance before starting their holiday.

It is generally recognised that Ghana is a safer country for tourists than some other countries in Africa, but there is also a view that tourist concerns about personal security might be holding back tourist numbers visiting Ghana.

Standards of customer service

The company has produced a code of conduct for its employees. As well as addressing the matter of personal security and crime, the code also deals with standards of service to the company’s customers. There have been occasional incidents in the past when standards of service have been poor; in particular, tour guides have sometimes left their group on their own, waiting for the local guide to turn up. There have also been complaints about tour guides ignoring customer requests for assistance, or forgetting to do something that they were supposed to do for their group.

There have been some indications recently that this problem is getting worse.

Financial issues

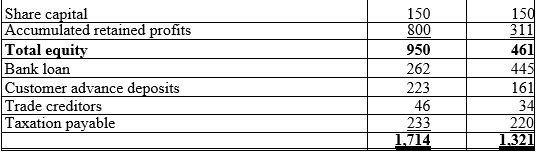

When the company was established, it was financed entirely by equity capital. As the business grew and made profits in some years, a proportion of the profits were retained in the business to finance further growth. However, there have been some years of loss, although the director’s still recommended and paid a dividend even in those loss-making years. As at 31 December 2016, there were retained losses, although this has since improved. The company rents its offices in Accra, and does not have many non-current assets. Some thought was given a few years ago to buying two tour buses for the company, but the buses would not be used sufficiently to justify their cost, and the cost of employing the drivers. Even so, it has not been possible for the company to rely entirely on equity finance to support the business operations.

The company needs a relatively large amount of working capital. This is because when a tour is organised, Ghanalux is required to make down-payments to airlines, hotels and other suppliers a long time in advance of the tour. Customers who book tours are required to pay a deposit, but the deposit money is insufficient to cover the company’s payments to other businesses. The company therefore borrows from its bank to finance working capital.

The company prices its tours in US dollars. Its expenses are mainly in US dollars (e.g. payments to airlines) and partly in cedis (for example, payments to hotels). Its short-term borrowings are in cedis.

Occasionally, tour groups visit parts of Ghana where most businesses do not accept credit card payments. Customers also sometimes want to buy cedis for personal expenditure, but have difficulty in finding a reliable foreign currency bureau or bank which can arrange currency transactions. The Ghanalux directors would like to make it more convenient for customers to make payments in cedis or buy cedis, but they are not sure what can be done.

Summary financial statements for the years ending December 2017 and December 2018 are shown in Appendix 1.

Note 1 : There were no non-current asset additions or disposals in the year.

Note 2 : Sundry assets comprise an inventory of brochures, and some small currency notes in a tin.

Prospects for the tourism industry in Ghana

Adofo wonders whether official estimates of future growth in the Ghana tourism industry over the next few years might be too optimistic. He is not convinced that West Africa, and Ghana in particular, is necessarily in a strong position to compete for tourists with other regions of the world, both in other parts of Africa and also in South America and parts of Asia. He thinks that prospects for growth in the tourism industry in Ghana, although reasonably good, are limited.

He has therefore suggested that it might make strategic sense for the company to look for ways to expand its business in other parts of the African continent. He has also suggested that since Ghanalux has positioned itself in the high price high quality segment of the tourist market, the company should consider moving into the conferencing business, for example by managing international business conferences in Accra.

Coffie has responded to these suggestions by saying that any strategic initiative by the company needs to be suitable, feasible and acceptable. He has an ethnocentric view of tourism in Africa and believes that Ghanalux must focus its growth strategies on tourism in Ghana.

Competitive advantage and performance management

The directors have discussed ways of making the company more competitive in the Ghana tourism industry. They recognise that Ghanalux charges high prices for its tours and to justify these it must be able to provide customers with a top quality experience during their holiday. Adofo and Coffie agree that they must focus on protecting and promoting their company’s competitive advantage, and they have been discussing ways of doing this.

The directors would like to increase the net profit margin from its current level of 4%, but they recognise that before they can think about raising prices, they must also consider a range of other aspects of performance, including control over costs. Adofo has suggested that a balanced scorecard approach to setting key performance indicators (KPIs) is needed, in order to strengthen the reputation of Ghanalux in the Ghanaian tourist industry.

Marketing and sales

The directors are not sure what to do about a further problem facing the company. At the moment, Ghanalux obtains customers through a travel booking company in the north east of the USA. The booking company charges a commission for the customers they obtain for Ghanalux. Commission costs are quite high, and the booking company does not operate outside its geographical region. Adofo and Coffie would like to reduce commission costs and extend their marketing coverage to a much wider area.

Strategic opportunities

Two strategic opportunities have arisen recently, which might enable the company to achieve more rapid growth.

Sunlit Hotels

Kwame Achebe, the managing director of Sunlit Hotels, a hotel chain company, has proposed that his hotel chain and Ghanalux should enter into a strategic alliance, and offer luxury package holidays in Ghana based on the tours currently operated by Ghanalux, with tour guests staying in hotels owned and operated by the hotel chain. In addition, each company would market the other’s services to their broader customer base. Sunlit Hotels operates five hotels in Ghana, each with between 100 – 200 guest rooms, with an average price of GH¢800 per room per night. Last year it made a profit after tax of GH¢3 million on sales turnover of GH¢110 million.

Kumasi sale

The directors have been informed privately that Jojo Okoye, the owner of a tour company based in Kumasi, is planning to retire soon, and would like to sell his company. The company operates luxury tours similar to those of Ghanalux, but from a different customer base; most of its customers come from France and Germany. The company has been operating for about the same length of time as Ghanalux, and in its previous financial year, it made a profit after tax of GH¢300,000 on sales revenue of GH¢8 million. Adofo and Coffie are not sure whether Ghanalux would be able to raise sufficient finance to buy this company, but they think there could be a strategic benefit from a merger of the two companies, subject to appropriate due diligence.

Required:

Discuss the issues that should be considered when responding to proposals for each of the following:

i) A strategic alliance between Ghanalux and Sunlit Hotels. (7 marks)

View Solution

Strategic alliance

It is questionable whether the proposed agreement between Ghanalux and Sunlit Hotels is a strategic alliance, or whether it is simply a trading arrangement between the two companies.

Measured by sales revenue and profits, Sunlit Hotels is a much bigger company than Ghanalux. Unlike Ghanalux, it also has extensive capital assets (its hotels). It is therefore possible that Sunlit Hotels would be the ‘dominant partner’ in any

trading arrangement between them. (1 mark)

We do not have figures for room occupancy in Sunlit’s hotels, but its proposal for an alliance is probably motivated by a wish to increase room occupancy in order to boost profits and return on capital, by arranging to accommodate Ghanalux customers during their tours. Assuming that the average number of rooms per hotel is 150, and that there are 360 trading days a year, the average revenue per hotel room in the Sunlit chain over the year is about GH₵407 per night (GH₵110 million/(5 hotels × 360 × 150)).

This is a low figure for a luxury standard hotel where the average room price is GH₵800 per night, suggesting that occupancy rates are very low at 51% (407/800 = 51%). (2 marks)

From the viewpoint of Ghanalux, it is not clear how much extra business it might win from its alliance with Sunlit Hotels. Ghanalux might be able to sell short oneday excursions to Sunlit’s customers, but the company does not currently operate one-day excursions. It is also unlikely that visitors to Sunlit Hotels would be persuaded to book lengthy tours with Ghanalux.

Since the average length of a tour is four weeks and presumably covers much of the country, it is also unlikely that Sunlit’s five hotels could offer all the accommodation that Ghanalux requires.

There may be a cost benefit for Ghanalux, if Sunlit Hotels offer a price per room that is lower than the price Ghanalux is currently paying for hotels for its customers. However, cost savings would need to be substantial to justify any trading agreement in which Ghanalux ties itself to using the hotels of a trading partner. (2 marks)

In summary, a strategic alliance between the companies seems an unrealistic proposition. However a trading agreement might be beneficial, in which Ghanalux undertakes to use Sunlit’s Hotels where possible, in return for attractive room rates. This would help Ghanalux to control its costs, but is unlikely to help it to grow its business to any great extent. (1 mark)

ALTERNATIVE SOLUTION:

A strategic alliance is an agreement between two or more parties to pursue a set of agreed upon objectives needed while remaining independent organisations. This main objective of such partnership is to enable each of the parties to leverage on the strength of each partner to foster a long-term win-win situation for all the parties involved.

Below are some of the qualitative issues that directors of Ghanalux should consider in responding to proposals for a possible strategic alliance.

• Shared risk: It is important for Ghanalux to determin the extent to which the partnership with Sunlit Hotels would enable it to offset its market exposure. Strategic alliances probably work best if the companies’ portfolio complement each other, but do not directly compete. In this instance, the business of Ghanalux is complementary to the business of Sunlit so it is expected that the proposed alliance would enable Ghanalux to offset its market exposure. Thus, they stand to be able to obtain new business by arranging tours for customers of Sunlit Hotels who may demand tour services. This would be in addition to those who visit the country for tourism purposes through its US marketing agency.

• Shared knowledge: Sharing skills (distribution, marketing, management), brands, market knowledge, technical know-how and assets leads to synergestic effects, which results in pool of resources which is more valuable than the separated single resources in the particular company. It is important for directors of Ghanalux to assess the skills set that Sunlit Hotels would bring into the alliance and determine whether they could leverage on these skills to achieve more competitiveness within its markets. Additionally, it is important for them to also ensure that Ghanalux do have the skill set which can be of beneficial to Sunlit Hotels, otherwise a win-win situation cannot be fostered.

Notwithstanding, it is crucial for the directors of Ghanalux to assure themselves that there will not be the divulgement of business secrets through the sharing of knowledge, which will be detrimental to Ghanalux, should the alliance be brought to an end someday. Even though agreements can protect these secrets, the directors of Ghanalux cannot guarantee that Sunlit Hotels would stick to such agreements. If the directors of Ghanalux decide to go ahead with the strategic alliance with Sunlit Hotels, they would have to put in place measures that will significantly reduce the risk of losing control over proprietary information, especially regarding complex transactions which require extensive coordination and intensive information sharing.

• Creating a competitor: The strategic partner, in this case Sunlit Hotels, might become a competitor one day, if it profits enough from the alliance and grow enough to end the partnership and then is able to operate on its own in the same market segment. This should especially be of great concern for the directors of Ghanalux considering the fact that Sunlit Hotels is already well positioned within the industry and have the financial resources or could easily obtain the financial resources to enter into the tour business successfully. This would be injurious to Ghanalux business.

• Uneven alliances: Ghanalux stand the risk of becoming a weak partner in a strategic alliance with Sunlit Hotels. As it stands now, Sunlit Hotels seems to have much more resources compared with Ghanalux. It is important for the directors of Ghanalux to critically assess their relative position in terms of the alliance so as to avoid a situation where it becomes a weaker partner in the alliance and thus be forced to act according to the will of Sunlit Hotels, which could be a more powerful partner, especially when it is not actually willing to do so.

Other risks which should also be critically considered and discussed by the directors of Ghanalux with regards to a possible alliance with Sunlit hotels include:

• Failures which might be attributable to unrealistic expectations of the partner. It is important for the directors to exercise prudence and be measured in their expectation of the benefits and opportunities that would crystallise should they enter into a strategic partnership with Sunlit Hotels. They may have to engage the services of a strategic consultant to be able to have an objective view about the possible benefits of the strategic partnership.

• They should also gauge the commitment level of the partner vis-à-vis their own commitment towards the strategic alliance. A lack of commitment from either both sides or even one side can seriously and negatively affect the expected outcome of the alliance. The directors should satisfy themselves with their own commitment level and that of Sunlit Hotel management before accepting any proposal for a strategic alliance. If they cannot commit to a high degree or their potential partner cannot commit to a high degree, they should not go ahead with the agreement. Otherwise, they would waste time which comes with some opportunity cost.

• The directors of Ghanalux should also consider the cultural differences, strategic goal divergence and matters bothering on sufficient trust before accepting a proposal of Strategic Alliance with Sunlit Hotel. If there are significant differences with the culture of the partners, coupled with extreme strategic goal differences an insufficient trust, then the directors of Ghanalux should refrain from entering into the alliance since this will be detrimental to the success of the company.

(2 marks each for any 3 points)

ii) A business combination with the tour company in Kumasi (7 marks)

View Solution

If there is to be a business combination between the two companies, it would need to be an all-equity transaction, or a transaction financed mostly by equity. Ghanalux is unlikely to raise sufficient finance to pay for an acquisition in cash. It is not clear whether the owner of the Kumasi-based tour company would be willing to accept Ghanalux shares as consideration for selling his company. (1 mark)

Assuming that the owner would be willing to discuss an all-equity merger or acquisition, there will be a problem in agreeing the valuation of each company, since both are private companies. The two companies began operations at about the same time, which means that Ghanalux has grown faster in terms of revenues (about GH₵16 million compared to GH₵8 million) and profits (GH₵639,000 compared to GH₵300,000), so that Ghanalux is twice the size of the Kumasi-based company, and growing at a much faster rate. The profit/sales margins of the two companies are roughly the same, but slightly higher for Ghanalux. The Kumasibased company, since it operates a similar business to Ghanalux, is likely to own relatively few long-term assets. (2 marks)

Since Ghanalux might be seen as being twice the size of the other company, it seems possible that in order to obtain the agreement of Jojo Okoye to a merger or takeover, Ghanalux might need to increase its shares in issue by up to 50%, so that Jojo Okoye would own up to about one-third of the combined business. The current shareholders of Ghanalux would need to consider whether they are willing to accept a dilution in their equity share of the company in order to grow the company.

The directors of Ghanalux also need to consider whether a combination with the Kumasi-based company makes strategic sense.

Ghanalux would gain access to the customer base of the Kumasi company, but this is mostly in France and Germany. A business combination would therefore almost certainly lead to management and administrative difficulties due to language differences and probably also big differences in corporate culture. Some restructuring of the management organisation of the combined entity would also be necessary.

A business combination might result in some savings in labour costs (since Jojo Okoye is retiring and might not need replacing as executive head of his business), but it is not clear whether any other synergies are achievable. Since they operate from different locations (Accra and Kumasi) and deal with different customer languages, it might be difficult to reduce other operating costs. (3 marks)

In summary, Ghanalux might reasonably consider a strategy of growth through merger or acquisition, but given its current size and position in the market, dealing with US customers, it would be advisable for the directors to look for business combinations where the potential benefits are greater. (1 mark)