The management of Kelkadadi Ltd, a company resident in Ghana since the year of assessment 2007, is a wholly owned subsidiary of Danlerigu Ltd, a company resident in Nigeria. The Finance Manager of Kelkabadi has invited you as a final level three candidate of ICAG and also a Tax Intern with Danlerigu to analyze the transaction below and provide tax implication thereon.

Kelkadadi Ltd contracted a loan of $10 million from Danlerigu Ltd to help it meet its operational activities.

The balance standing on the loan account at the beginning of 2018 stood at $5 million and $4.1 million at the end of 2018 year of assessment. The exchange rates are as follows:

Year Start (2018) $1 = GH¢5.20

Year End (2018) $1 = GH¢5.21

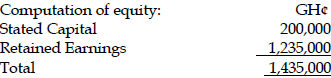

The extract of the financial statement at the beginning of the year 2018 was as follows:

. GH¢

Stated Capital 200,000

Retained Earnings 1,235,000

Capital Surplus 40,000

Share Deals 30,000

Interest on the debt paid during the year amounted to GH¢90,124 and foreign exchange loss on the loan repayment stood at GH¢147,000.

Required:

Write a memo on the possible tax implication(s) on this arrangement to the Finance Manager. (12 marks)

View Solution

WORKINGS:

W1:

Debt Outstanding @ 1/1/2018 = $5,000,000

Translation of loan into Cedis = ($1 x $5,000,000)/GH¢5.20

. = GH¢26,000,000

Threshold Ratio = Debt : Equity

. = 3 : 1

3 times equity = 3 x 1,435,000

. = 4,305,000

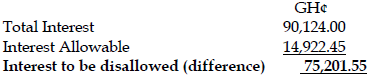

Computation of allowable Interest:

If 26,000,000 = 90,124

Therefore 4,305,000 = ?

=(4,305,000 x90,124)/26,000,000

=GH¢14,922.45

W2:

W3:

Foreign Exchange Loss:

Total foreign Exchange = 147,000

If 26,000,000 = 147,000

Therefore 4,305,000 = ?

Allowable Foreign Exchange = 4,305,000 x (147,000/26,000,000)

. =24,339.81

. GH¢

Total Foreign Exchange 147,000.00

Foreign Exchange Allowable 24,339.81

Foreign Exchange unallowable 122,660.19 (7 marks evenly spread using ticks)

MEMO

TO: Tax Manager

FROM: Tax Intern

DATE: 7th July 2019

SUBJECT: Tax Implication on Thin Capitalization Rules

INTRODUCTION

Following your request for me to provide the tax implication on the thin capitalization, I furnish as follows:

ISSUES

Kelkadadi ltd is a subsidiary of Danlerigu and any loan that is granted shall be subject to Thin capitalization rule which rules say that the debt secured should not be more than 3 times the equity of the entity.

In this particular situation, the debt exceeds the three times. Consequently, the interest paid or payable that exceeds the 3: 1 ratio shall be added to income and taxed and also the foreign exchange loss paid or payable.

Additionally, the total interest paid or payable attracts a withholding tax at the rate of 8%.

From W2 as attached, total interest of GH¢ 90,124.00 shall attract interest at 8% which is (90,124.00 * 8%) = GH¢7,209.92

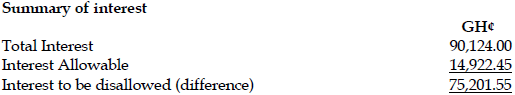

Interest of GH¢75,201.55 shall be disallowed, meaning it should not be an allowable deduction out of GH¢90,124 with GH¢14,922.45 allowable. (2 marks)

Summary of Foreign Exchange Loss

From W3 as per the schedule attached, the total foreign exchange loss of GH¢147,000 only GH¢24,339.81 shall be allowable with GH¢122,660.19 not allowable for tax purpose. (2 marks)

CONCLUSION

In conclusion, the attached schedule will aid your comprehension of the issues as stated above.

Thank you

Yours faithfully, (1 mark for structure of Memo)