Dodowa Ltd is a large textile manufacturing company. Wherever possible, it structures its operations to take advantage of any financial assistance available from national and regional authorities.

During the year, a heavy duty equipment was purchased for Dodowa Ltd’s main manufacturing operation for GH¢12 million on 1 April 2015. The equipment was expected to be used for 10 years, with a zero residual value. Dodowa Ltd pre-applied for a government grant on 1 January 2015, meeting all necessary criteria for awarding of the grant. On 1 February 2015, the grant was awarded for 40% of the equipment’s cost and the cash was received on 1 July 2015. Conditions relating to maintaining employment are attached to the grant and if they are not satisfied, then the grant becomes repayable, or partly repayable.

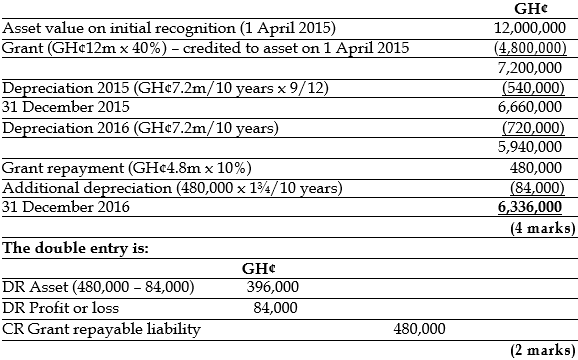

Dodowa Ltd expected to meet these conditions when the grant was applied for. However, due to worsening economic conditions, redundancies for some staff on 31 December 2016 resulted in a repayment of 10% of the original grant becoming due. The repayment was made on 1 February 2017. Dodowa Ltd accounted for the grant as a reduction in the carrying amount of the asset.

Required:

Explain, with suitable calculations, the financial reporting treatment of the above in the financial statements of Dodowa Ltd for the year ended 31 December 2016 in accordance with IAS 20: Accounting for Government Grants and Disclosure of Government Assistance. (6 marks)

View Solution

The grant was recognised in the financial statements on 1 February 2015 as deferred income on that date. It is credited to the asset’s value on 1 April 2015, the date of the asset’s initial recognition.

The carrying amount of the asset is calculated as follows: