You are a manager in Amable & Co, a firm of Chartered Accountants, responsible for the audit of Kpandu Sika Limited for the year ended 31 December 2015. Kpandu Sika Limited is a company listed on the Ghana Stock Exchange (GSE) which has been a client of your firm in the past three years. The company manufactures consumer electronic appliances which are then sold to major retail organisations. You are aware that during the last year, Kpandu Sika Limited lost several customer contracts due to cheap imports. However, a new division has been created to sell its products directly to individual customers in Ghana and worldwide via a new website, which was launched on 1 December 2015.

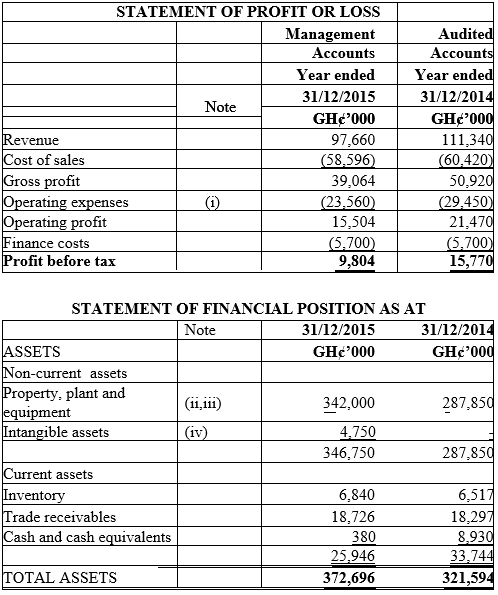

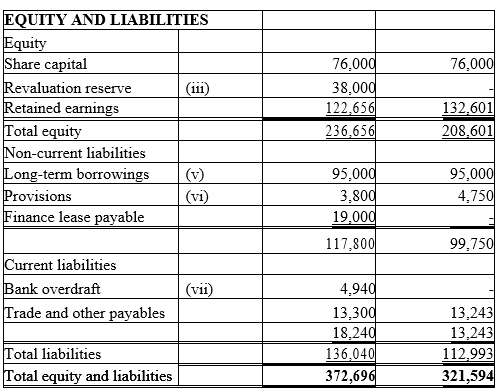

Financial information provided by the Finance Manager is shown below:

NOTES

i) Kpandu Sika Limited established an equity-settled share-based payment plan for its executives on 1 January 2015. 250 executives and senior managers have received 100 share options each, which vest on 31 December, 2015 if the executive remains in employment at that date, and if Kpandu Sika Limited’s share price increases by 10% per annum. No expense has been recognised this year as Kpandu Sika Limited’s share price has fallen by 5% in the last six months, and so it is felt that the condition relating to the share price will not be met this year end.

ii) On 1 July 2015, Kpandu Sika Limited entered into a lease which has been accounted for as a finance lease and capitalised at GH¢19 million. The leased property is used as the head office for Kpandu Sika Limited’s new website development and sales division. The lease term is for five years and the fair value of the property at the inception of the lease was GH¢76 million.

iii) On 30 June 2015 Kpandu Sika Limited’s properties were revalued by an independent expert.

iv) A significant amount has been invested in the new website, which is seen as a major strategic development for the company. The website has generated minimal sales since its launch last month, and advertising campaigns are currently being conducted to promote the site.

v) The long-term borrowings are due to be repaid in two equal instalments on 30 September 2016 and 2017. Kpandu Sika Limited is in the process of renegotiating the loan, to extend the repayment dates, and to increase the amount of the loan.

vi) The provision relates to product warranties offered by the company.

vii) The overdraft limit agreed with Kpandu Sika Limited’s bank is GH¢5.7 million

Required:

State the principal audit evidence which you would expect to find in respect of the classification of the new lease in terms of IAS 17 Leases (Do not consider the application of the new leasing standard IFRS 16 Leases) (4 marks)

View Solution

Leased Property

The lease taken out in July 2011 has been treated as a finance lease. However, there are indications that it is in fact an operating lease. Firstly, the lease is for only five years, which for a property lease is not likely to be for the major part of the economic life of the asset. According to IAS 17 Leases, an indicator of a finance lease is that the lease term is for the major part of the economic life of an asset.

Secondly, the amount capitalised of GH₵5 million represents only 25% of the fair value of the asset. Under IAS 17, for a lease to be classified as a finance lease, the present value of minimum lease payments (the amount capitalised) should amount to at least substantially all of the fair value of the asset. 25% is not substantially all of the fair value, indicating that this is actually an operating lease.

Therefore it appears that the accounting treatment is incorrect. The lease should have been treated as an operating lease. Currently, property, plant and equipment and non-current liabilities are overstated. The finance cost will be overstated if any interest accrued on the lease has been included. Operating expenses are understated as lease payments should have been included in this heading, and so profits are likely to be overstated. However, operating expenses will currently contain depreciation charges for the leased asset, which will need to be reversed. The overall impact on operating expenses could be minimal as the two adjustments will offset each other to an extent.