You are a manager in Amable & Co, a firm of Chartered Accountants, responsible for the audit of Kpandu Sika Limited for the year ended 31 December 2015. Kpandu Sika Limited is a company listed on the Ghana Stock Exchange (GSE) which has been a client of your firm in the past three years. The company manufactures consumer electronic appliances which are then sold to major retail organisations. You are aware that during the last year, Kpandu Sika Limited lost several customer contracts due to cheap imports. However, a new division has been created to sell its products directly to individual customers in Ghana and worldwide via a new website, which was launched on 1 December 2015.

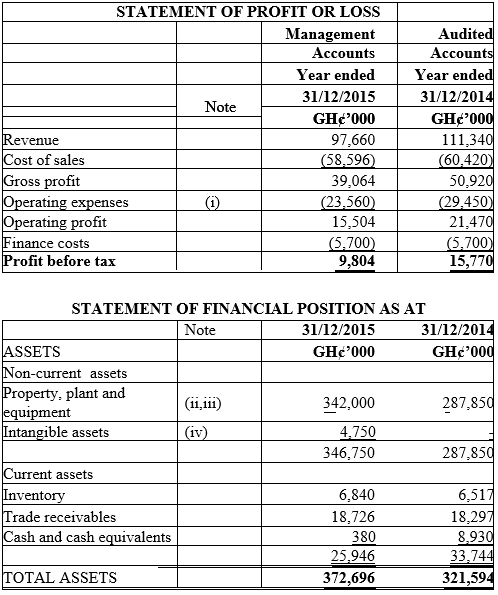

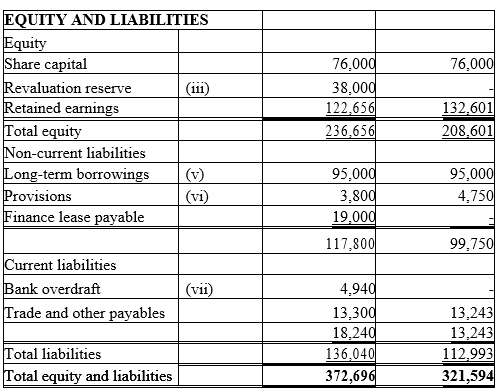

Financial information provided by the Finance Manager is shown below:

NOTES

i) Kpandu Sika Limited established an equity-settled share-based payment plan for its executives on 1 January 2015. 250 executives and senior managers have received 100 share options each, which vest on 31 December, 2015 if the executive remains in employment at that date, and if Kpandu Sika Limited’s share price increases by 10% per annum. No expense has been recognised this year as Kpandu Sika Limited’s share price has fallen by 5% in the last six months, and so it is felt that the condition relating to the share price will not be met this year end.

ii) On 1 July 2015, Kpandu Sika Limited entered into a lease which has been accounted for as a finance lease and capitalised at GH¢19 million. The leased property is used as the head office for Kpandu Sika Limited’s new website development and sales division. The lease term is for five years and the fair value of the property at the inception of the lease was GH¢76 million.

iii) On 30 June 2015 Kpandu Sika Limited’s properties were revalued by an independent expert.

iv) A significant amount has been invested in the new website, which is seen as a major strategic development for the company. The website has generated minimal sales since its launch last month, and advertising campaigns are currently being conducted to promote the site.

v) The long-term borrowings are due to be repaid in two equal instalments on 30 September 2016 and 2017. Kpandu Sika Limited is in the process of renegotiating the loan, to extend the repayment dates, and to increase the amount of the loan.

vi) The provision relates to product warranties offered by the company.

vii) The overdraft limit agreed with Kpandu Sika Limited’s bank is GH¢5.7 million

Required:

State the principal audit procedures which should be performed in respect of the provision for the product warranties offered by the company. (6 marks)

View Solution

PROVISION

The provision for warranties have reduced by 20%, which is not in proportion to the reduction in revenue of 12·3%. Possibly the company has changed its policy on providing warranties, or is selling fewer products with warranties attached. However, we should be alert to the risk of the warranty provision being understated, especially given the incentive for the accounts to be subject to management bias.

It is questionable whether the warranty provisions should be classified as non-current liabilities. It is likely that some, if not all, of the provision will lead to an outflow of economic benefits within the next 12 months and it should be recognised within current liabilities. This potential misclassification affects analysis of liquidity.

Auditors should adopt one or a combination of the following audit procedures in the audit of the Provision

- Review and test the process used by management to develop the Provision;

The steps ordinarily involved in reviewing and testing the process used by management are:

a) evaluation of the data and consideration of assumptions on which the estimate is based;

b) testing of the calculations involved in the estimate;

c) comparison, when possible, of estimates made for the purposes of the preparation of prior period financial statements with subsequent actual outcomes;

d) consideration of management’s approval procedures; and

e) Obtaining management representations. - Use an independent estimate for comparison with that prepared by management;

Auditors may make or obtain an independent estimate and compare it with the warranty provision prepared by management. When using an independent estimate auditors would ordinarily evaluate the data and consider the assumptions, and may test the calculation procedures used in its development. It may also be appropriate to compare warranty provisions made for prior periods with actual results of those periods. Or - Review subsequent events.

Transactions and events which occur after the period end, but prior to completion of the audit, may provide audit evidence regarding a warranty provision made by management. Auditors’ reviews of such transactions and events may reduce, or even remove, the need for the auditors to review and test the process used by management to develop the warranty provision or to use an independent estimate in assessing the reasonableness of the warranty provision. (3 points for 6 marks)