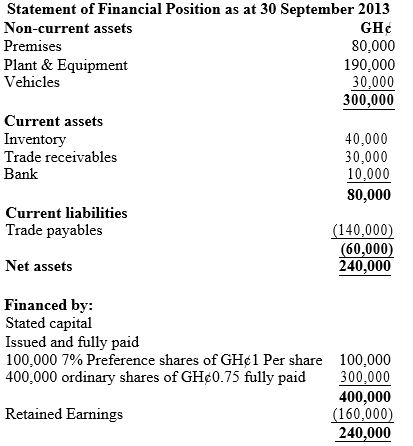

MM Ltd, producers of telecommunication equipment has been making losses in recent times. The directors have proposed a scheme of reorganization, to take effect on 1 October 2013. The statement of financial position of the company at 30 September 2013 is as follows:

Additional information.

i) The ordinary shares are to be written down to GH¢0.25 per share and then to be converted into new ordinary shares of GH¢1.0 per fully paid.

ii) The preference shareholders are to receive 40,000 ordinary shares of GH¢1 per share, fully paid in exchange for their preference shares.

iii) Dividends of 7% preference shares are two years in arrears. In consideration of waiving their rights to arrears of preference dividend, the Preference shareholders have agreed to accept 10,000 new ordinary shares of GH¢1.00 per share, fully paid in final settlement.

iv) The creditors have agreed to take 100,000 new ordinary shares of GH¢1 per share fully paid in part settlement of the amounts due them.

v) The balance on the retain earnings account is to be written off.

vi) Some assets of the company have been revalued and are to be incorporated into the accounts as follows:

. GH¢

* Freehold premises 100,000

* Plant and equipment 125,000

* Vehicles 25,000

* Inventories 36,000

vii) An allowance of GH¢3,500 is to be made for doubtful debts

viii) The ordinary shareholders have agreed to inject additional GH¢90,000 cash by acquiring 120,000 ordinary shares at 0.75 per share fully paid.

ix) Reorganization costs amounted to GH¢7, 500.

Required:

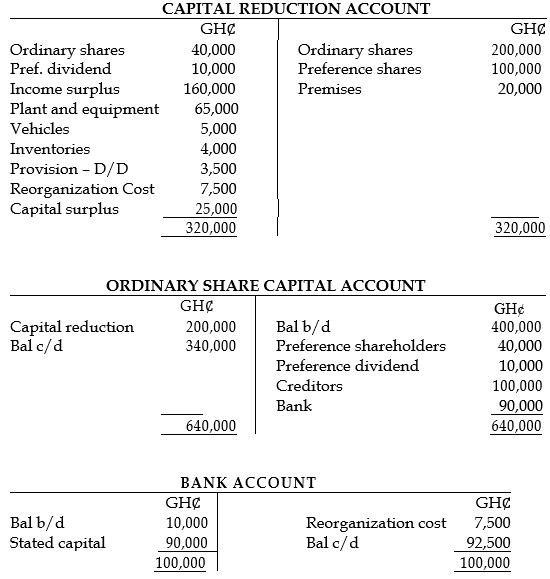

a) Prepare a capital reduction account, stated capital account and bank account. (9 marks)

View Solution

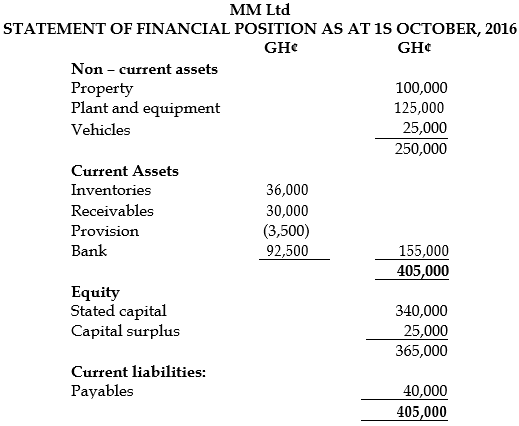

b) Prepare a statement of financial position of MM Ltd as at 1 October 2016, after the reorganization. (6 marks)

View Solution