Afoko Ltd acquired a car taxi business on 1 January 2015 for GH¢230,000. The value of the assets of the business at that date based on net selling price were as follows:

. GH¢000

Vehicles 120

Intangible assets 30

Trade receivables 10

Cash 50

Trade payables (20)

. 190

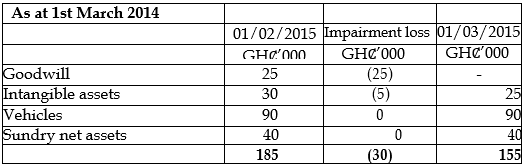

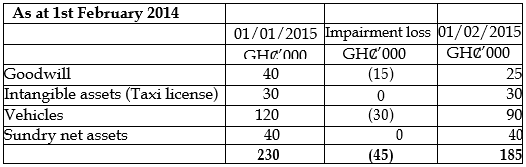

On 1 February 2015, the taxi business had three (3) of its vehicles stolen. The net selling values of these vehicles was GH¢30,000 and because of non-disclosure of certain risk to the insurance company, the business was uninsured. As a result of this event, Afoko Ltd wishes to recognise an impairment loss of GH¢45,000 inclusive of the loss of the stolen vehicles due to the decline in value of the stolen income generating unit, that is the taxi business. On 1 March 2015, a rival taxi company commenced business in the same area. It is anticipated that the business revenue of Afoko Ltd would be reduced by 25% leading to a decline in the present value in use of the business which is calculated at GH¢150,000. The net selling value of the taxi license has fallen to GH¢25,000 as a result of the rival taxi operator. The net selling values of the other assets have remained the same as at 1 January 2015.

Required:

Recommend how Afoko Ltd should account for the above transaction in its financial statements in accordance with IAS 36 Impairment of Assets. (6 marks)

View Solution

Afoko would recognise the impairment loss in the following way:

When impairment loss is identified, it should be recognised as an expense immediately in the income statement. Where impairment loss relates to a group of assets, usually, the impairment loss should be allocated in priority to those assets which have the most subjective valuations. Impairment identified in this way should usually be allocated to goodwill, thereafter to intangible assets to which there is no active market, thirdly to assets which net selling price is less than their carrying amount and finally to any tangible assets in the unit.

The impairment loss of GHȻ30,000 is recognised first for the stolen vehicles and the balance (GHȻ15,000) is attributed to goodwill.