You are a manager in BS Cipax, a medium-sized firm which offers a range of services to audit and non-audit clients. You have been asked to consider a potential engagement to review and provide a report on the prospective financial information of Filtane Limited, a company which has been an audit client of BS Cipax for six years. The audit of the financial statements for the year ended 31 August 2015 has been completed and your firm issued an unmodified report.

Filtane Limited operates a chain of fashion stores across the country. Currently its merchandise are out of date and it sells clothing which do not reflect the latest and in mode fashion labels which are becoming more popular especially with the youth. Management is planning to revamp its image and stock the latest fashion in Africa and across the other continents. It also intends to invest in the latest technologies to include online real time trading on the internet in order to attract more customers, especially the up-and-coming youth, trendy middle-aged persons and even those far from its shops by attracting them to shop over the internet. The company has sufficient cash to fund half of the necessary capital expenditure, and has approached its bank, Boafo Bank Limited, with a loan application of GHS32 million for the remainder of the funds required. Most of the cash will be used to invest in acquiring inventory and the technology for ensuring secure and safe online trading. The remaining cash will be used for refurbishment of the shops.

Management had informed the Audit team, in the invitation to start the audit, of its intention to use the audited financial statements as the basis for preparing the prospective financial information to be used to seek for the loan from Boafo Bank Limited.

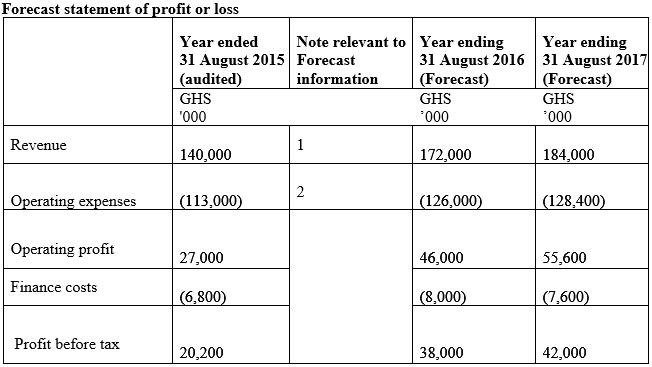

The draft forecast statements of profit or loss for the years ending 31 August 2016 and 2017 are shown below, along with the key assumptions which have been used in their preparation. The audited statement of profit or loss for the year ended 31 August 2015 is also shown below.

The forecast has been prepared for use by the bank in making its lending decision, and was to be accompanied by other prospective financial information including a forecast statement of cash flows.

Note 1: The forecast increase in revenue is based on the following assumptions:

(i) All shops will be stocked with new modern and in mode fashion to attract new customers to the shops and many persons who don’t live in the vicinity of the shops will also be attracted through on-line shopping by December, 2015.

(ii) Prices will increase by an average of 25% in December 2015.

Note 2: Operating expenses include mainly staff costs, depreciation of property and fittings, and repairs and maintenance to the shop fittings and equipment as well as ensuring continuous safe and secure on-line shopping.

Boafo Bank Limited gave the loan to the Filtane Limited on 15 October 2015 and a review of the first six months of operation in May 2016 of the new shops revealed that the company was not doing well and could not pay the first installment for the loan from Boafo Bank Limited. Further investigation revealed that the audited financial statements signed by BS Cipax which showed a profit of GHS20.2M should have been of a loss of GHS4.3M.

Boafo Bank Limited has indicated its intention to sue your firm for negligence on the basis that it placed reliance on the financial statements audited by your firm.

Required:

Comment on the matters that you should consider in deciding whether your firm will contest the matter in court or seek an out of court settlement with the bank. (7 marks)

View Solution

An injured party must prove ALL of the following three things in order to succeed in a claim for financial loss against an auditor for negligence:

– That the auditor owes a duty of care;

– That the duty of care has been breached;

– That financial loss has been suffered that was caused by the negligence. (2 marks)

i) Looking at the strict interpretation of the first requirement, the auditor owes a duty of care only to the shareholders as a body and not to Boafo Bank Limited as an outsider.

The courts, however have accepted that if the Auditor, at the time of signing the report knew that someone, other than the shareholders as a body will rely on the report, then the duty of care extends to the person. The facts of this case show that at the time the auditor signed the Audit Report, he was aware that it was Financial Statements going to form the basis for preparing the projected financial information to be used to seek for the bank facility from Boafo Bank Limited. Paragraph 3 of preamble to question).

This means it is probable that a court will rule that requirement 1 above has been proved. (2 marks)

ii) A breach of duty of care must be proved for a negligence claim against the audit firm to be successful. Duty of care generally means that the audit firm must perform the audit work to the required standard and that relevant legal and professional requirements and principles have been followed. For an audit firm, it is important to be able to demonstrate that ISAs have been adhered to. This is no evidence in the facts as given to enable us reach the conclusion that the duty of care has been breached or not. Looking at the fact that a loss of GHS4.3M was stated as a profit of GHS20.2M, a difference of GHS24.5M, if this error in the Income statement is confirmed, it is likely to be interpreted by a court to mean that the auditor did not perform the duties expected of him/her with all the skill, care and caution which a reasonably competent, careful and cautious auditor would use. What is reasonable skill, care and caution will depend on the particular circumstances of each case.

In this case, however, an error is material by all standards and will be proof that the auditor has acted negligently unless he can prove that the circumstance that caused this material error was beyond his/her control.

Requirement 2 appears to be likely to be proved. (2 marks)

iii) Requirement 3 is easy to prove since the loan was given on the basis of the projected financial information based on the audited financial statements, it is likely that a court will not need any serious persuasion to agree with the Bank that its financial loss was caused by the negligence of the auditor. From this discussion, the Auditors must seek an out of court settlement to avoid the bad publicity and likely litigation costs since it is probable that they would be found to be professionally liable to the Bank and the Bank is likely to the Bank for negligence. (1 mark)