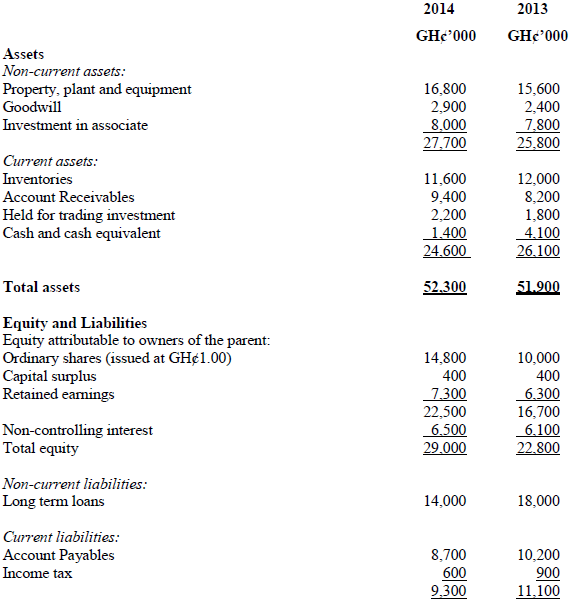

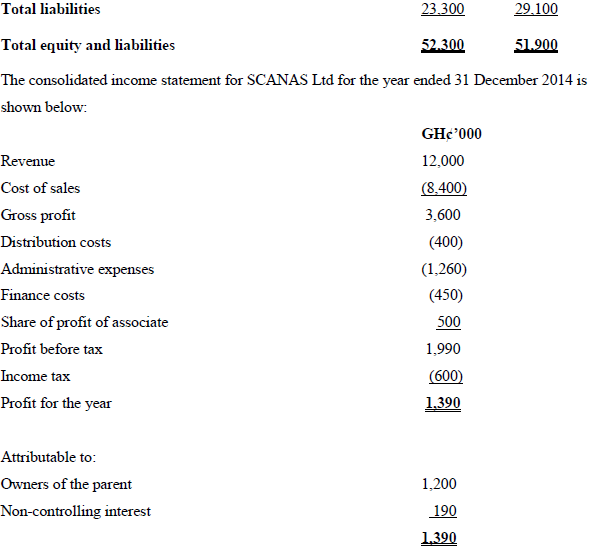

The consolidated statement of financial position of SCANAS Ltd Group as at 31 December 2014 and the comparative for 2013 are shown below:

Additional information:

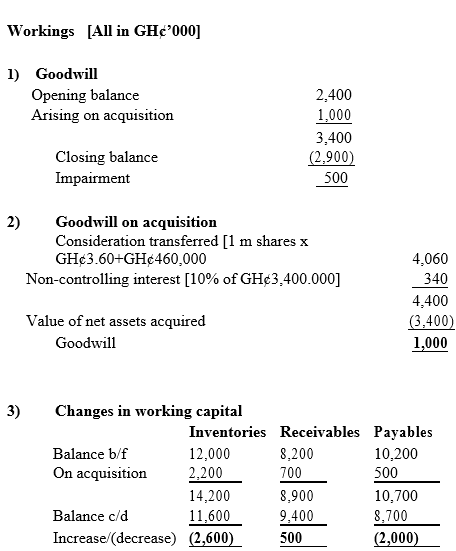

(i) There were no disposals of property, plant and equipment in the year. Depreciation

charged in arriving at profits totaled GH¢1,800,000.

(ii) SCANAS Ltd acquired 90% of the ordinary shares of AT Ltd on 1 September 2014 for a cash consideration of GH¢460,000 plus the issue of 1 million ordinary share of SCANAS which had a deemed value of GH¢3.60 per share at the date of acquisition. The fair values of the net assets acquired were as follows:

. GH¢’000

Property, plant and equipment 800

Inventories 2,200

Receivables 700

Cash and cash equivalents 200

Payables (500)

. 3,400

SCANAS Ltd made no other purchases or sales of investments in the year. The group policy is to value the net assets.

(iii) Finance costs include interest on loans and any gains on held for trading investments. All interest due was paid in the year.

Required:

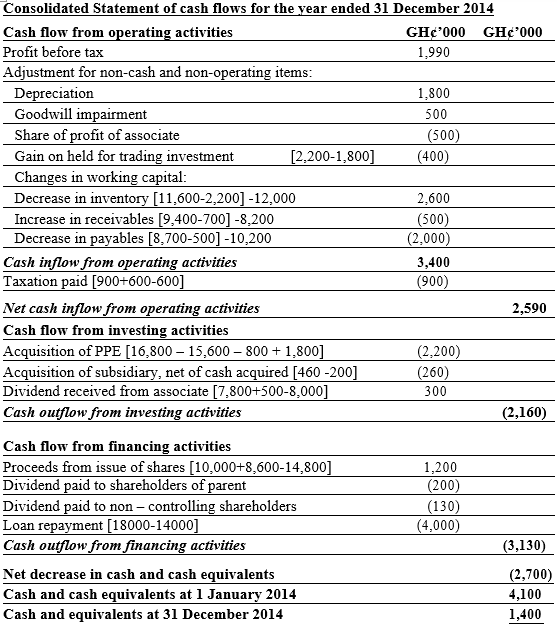

Prepare the consolidated statement of cash flows for SCANAS Ltd for the year ended 31 December 2014. (20 marks)

View Solution