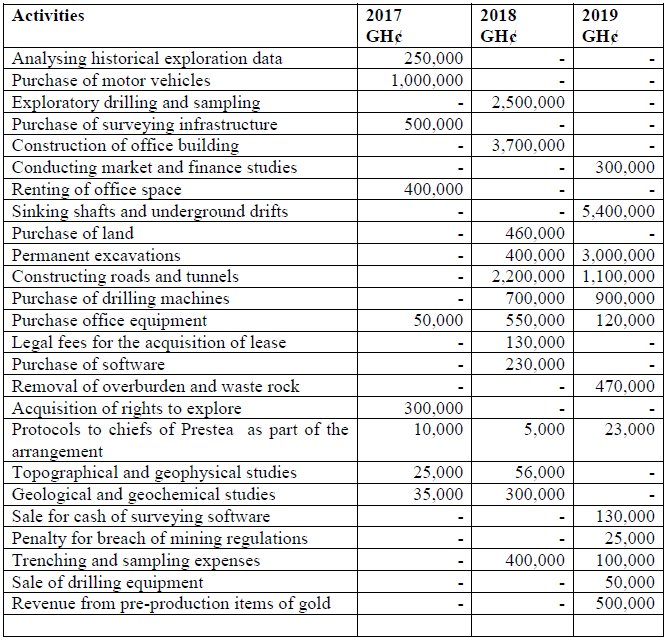

Kanawu Mine Resources Limited was incorporated on 1 January 2017 to mine gold and diamonds at Prestea in the Western region of Ghana. Various reconnaissance and prospecting activities took place from 2017 to 2019. Actual production started on 1 January, 2020.

The following were the cost and revenue relative to reconnaissance and prospecting activities and cost from 2017 to 2019.

The following transactions took place from 1 January, 2020 to 31 December, 2020:

i) The company received a compensation of GH¢3,500,000 from their insurers for destruction of some gold mined.

ii) Mining and processing cost, including wages and salaries, incurred during the year was GH¢120,345,000.

iii) Sales of gold and diamonds GH¢378,532,900.

iv) Ground rent paid to the Administrator of Stool Lands GH¢321,500.

v) The company undertook further research and development studies at the cost of GH¢374,300.

vi) Royalties amounting to GH¢11,355,987 was paid to the government.

vii) The company acquired a new Mineral Right at a cost of GH¢5,000,000. Bonus payment made in respect of grant of the new mineral right was GH¢300,000. The legal and other professional fees paid with respect of the acquisition of the new right was GH¢121,800.

viii) Stope preparation and development cost paid was GH¢884,300. The total cost of the stope preparation and development incurred was GH¢1,021,700.

ix) The total cost of business operating permits was GH¢5,563,200. This amount includes GH¢400,000 provision for 2021.

x) Other general and administrative expense totaled GH¢190,467,100. This includes construction of a huge iron gate at the entrance of the mine at a cost of GH¢421,600.

xi) Selling and distribution cost paid was GH¢172,554,700.

xii) Finance charge of operations, including interest on loans and bank charges, incurred was GH¢211,500,000.

Required:

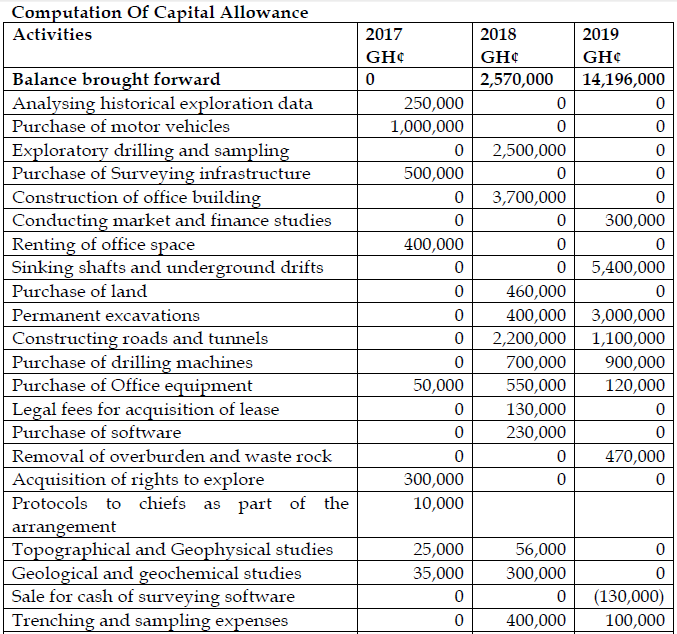

a) Compute capital allowance claimable in 2020. (6 marks)

View Solution

Kanawu Mine Resources Limited

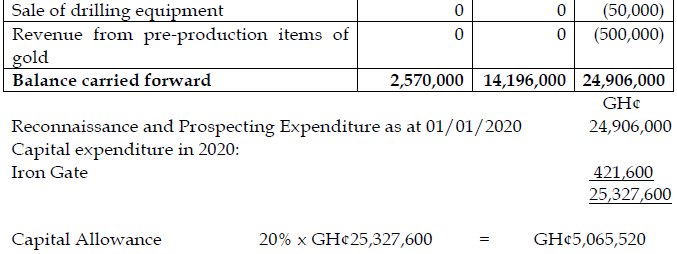

b) Compute the chargeable income of the company and the tax payable for the year 2020. (10 marks)

View Solution

Kanawu Mine Resources Limited

There will be no tax payable for the assessment year 2020 because of the assessed loss.

c) Comment on the tax treatment of Royalty Payment and acquisition of new mineral rights. (4 marks)

View Solution

Royalty is a levy on production and therefore an allowable deduction for tax purpose. New mineral right acquired is an asset and therefore should be capitalized and capital allowance granted. Being related to a new acquisition, it becomes a separate mineral operation