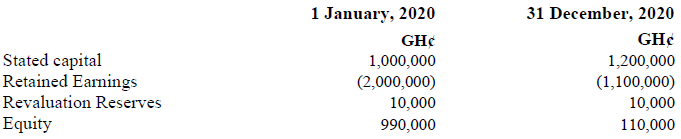

The following is an extract of Adidas Ltd for 2020 year of assessment with basis period January to December each year.

Additional information:

- Adidas Ltd, is owned 100% by IDAS

- The loan taken 5 years ago was GH¢12,000,000 from IDAS

- Loan balance as at 1 January, 2020 was GH¢2,400,000

- Loan balance as at 31 December, 2020 was GH¢1,200,000

- Interest payable for the 2020 year of assessment stood at GH¢150,000 to IDAS

- Foreign exchange loss from the loan repayment for 2020 was GH¢20,000

Required:

i) Explain the tax implications of the above arrangement. (6 marks)

View Solution

Equity: GH¢

Stated capital 1,000,000

Retained Earnings (2,000,000)

Equity (1,000,000)

Debt 2,400,000

Safe Harbour Rule : Debt Equity Ratio

. 3 : 1

. (3,000,000) : (1000,000)

From the above, and by implication, the entity is not required to borrow and if it must the interest is not allowable.

Interest on loan GH¢150,000

Foreign Exchange loss GH¢ 20,000

The interest on the loan is not an allowable deduction and therefore shall be added back to income for tax purposes. The equity being negative implies that for any loan from a related party, the interest shall not be an allowable negative. The foreign exchange loss shall not be allowable as the same reason adduced under the interest.

Given that the equity is negative, the interest shall be disallowed for tax purposes, so should the foreign exchange loss.

The interest should suffer a withholding tax at the rate of 8% that is (8% X GH¢150,000) = GH¢12,000

ii) Explain the tax implication of the movement in the stated capital as shown in the extracts above. (2 marks)

View Solution

It means that the company has issued shares, and consequently, a stamp duty of 0.5% shall be applied on the additional capital of GH¢200,000 introduced. (0.5% X GH¢200,000) = GH¢1,000. This is tax to be paid to GRA via Registrar General’s Department.