Asawasi Ltd made a decision to sell a business unit on 15 June 2017, and the criteria to classify the unit as held for sale were met on 1 July 2017. Asawasi Ltd’s accounting year end is 31 December. At 1 July 2017, the carrying amount of the assets and liabilities of the business unit (before any 2017 depreciation or revaluation adjustments) was as follows:

. GH¢ million

Land and buildings 120

Equipment 50

Trade receivables 30

Inventories 20

Trade payables (26)

Additional Information:

i) The land and buildings are held under the revaluation model of IAS 16: Property, Plant and Equipment and were last revalued on 31 December 2016 to GH¢120 million. Their market valuation on 1 July 2017 was GH¢124 million and selling costs were estimated at GH¢2.5 million at that date. Residual value was, and continues to be, expected to be higher than cost.

ii) The equipment is held under the cost model of IAS 16. The equipment was purchased on 1 July 2015 for GH¢80 million and is being depreciated straight line over a four-year period to a zero residual value. Its sale value at 1 July 2017 was GH¢55 million. Selling costs are insignificant.

iii) The trade receivables are recorded at invoiced value, reduced by any allowances for credit losses recognised at 31 December 2016. No adjustment to these allowances was necessary at 1 July 2017. The receivables, if factored, would realise approximately GH¢26 million, net of transaction costs at 1 July 2017.

iv) The inventories are merchandise purchased for resale and are held at cost. Their market value at 1 July 2017 was GH¢28 million. Associated selling costs would amount to GH¢1.4 million.

v) It was anticipated at 1 July 2017 that the business unit will be sold for GH¢200 million, net of selling costs, to a rival company in a single transaction.

Required:

In respect of Asawasi Ltd’s year ended 31 December 2017, show, and briefly explain, the amount recognised as Non-Current Assets Held for Sale under IFRS 5 at 1 July 2017 and the impairment charge (if any) for the business unit. (5 marks)

View Solution

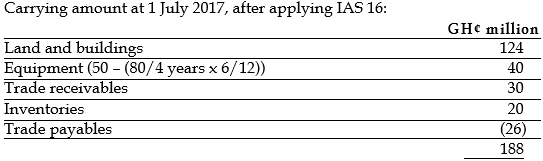

Any test for impairment will be based on the disposal group as a whole. As a disposal group, fair value less costs to sell (GH¢200 million) is higher than carrying amount (GH¢188 million) there is no impairment charge.

The amount recognised as non-current assets held for sale is therefore:

GH¢ million

Land and buildings 124

Equipment 40

. 164

Trade receivables and inventories are outside the scope of IFRS 5.