Bank of Ghana (BoG) earlier last year announced an increase in the minimum capital requirement for Micro Finance Institutions in the country from the current GH¢500,000 to GH¢2 million by June 2018. Capital Link, a Micro Finance Company has been affected by the increase in players in the Micro Finance Industry which has seen a reduction of its loan portfolio and an increase in loan default rate.

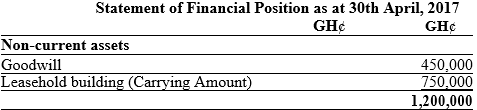

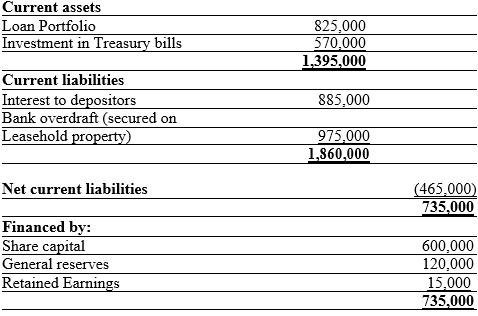

A statement of Financial Position recently prepared by Capital Link is as follows:

Additional information:

Depositors have the information that Capital Link is considering funding options to ensure the survival of the business. They are however not convinced that Management of Capital Link would be able to raise the required capital to meet the minimum requirement.

In a Stakeholders meeting, Management of Capital Link proposed two possible options for the company’s future.

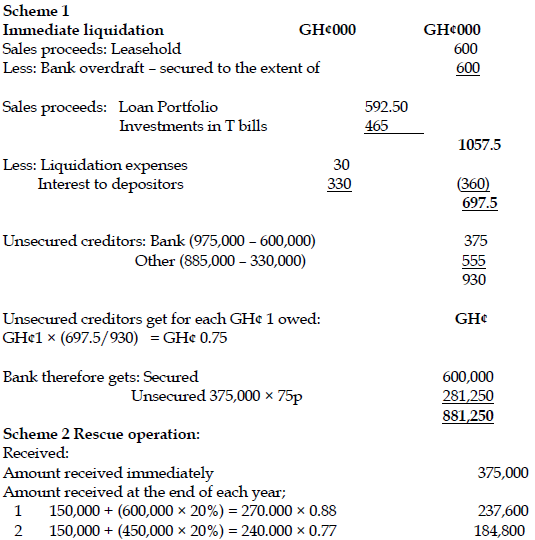

Scheme 1- Close Down Mission

Unity Capital Ltd has made a firm offer of GH¢600,000 for the company’s leasehold property. Total loan portfolio is conservatively valued at GH¢592,500 in a forced sale. Investments in Treasury bills amounts to GH¢465,000. Liquidation expenses are estimated at GH¢30,000 and interest to depositors is GH¢330,000.

Scheme 2- Rescue Mission

Management of Capital Link propose to implement a scheme which includes a cheap loan of GH¢600,000 from a distress fund set up by an NGO, Business Rescuers. The following terms have been arranged:

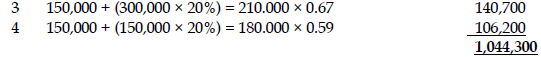

GH¢375,000 would be reserved to pay for the loan from the NGO when the first installment falls due. The NGO has been asked to accept 20% debenture in exchange for the balance remaining due. The debenture would be repayable in four annual installments of GH¢150,000, commencing 28 February 2017, with the interest due for the preceeding year, paid on the same date.

Assume that:

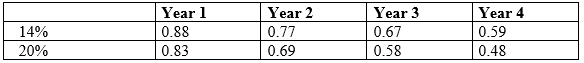

- The current rate of interest on all borrowing is 14%

- The calculations are being made on 30th April, 2017 and either scheme could be put onto effect immediately.

- The present value of GH¢1 recoverable at the end of each year is:

Required:

a) By means of numerical analysis of the two schemes, evaluate how much the bank would recover from each scheme. (12 marks)

View Solution

b) Discuss TWO advantages of each scheme. (3 marks)

View Solution

Scheme 1

i. The advantage of immediate liquidation is that the cash flows can be estimated with a reasonable amount of accuracy, particularly as a firm offer has been received for the leasehold buildings.

ii. On the face of it the valuations of the loan portfolio do not appear excessive, though the possibility of them realizing as much as forecast needs to be considered.

iii. The bank suffers a material loss on its investment, but nevertheless manages to recover 90% of the amount owing.

(Any 2 points for 1.5 marks)

Scheme 2

i. The advantage of this option is that the bank retains a customer, and avoids bad publicity possibly associated with the closure of a local firm.

ii. The computed financial advantage of this option is also a significant factor. However, there must be considerable doubt concerning the achievement of these estimates. Is there any evidence that the recent trading pattern has been reversed?

iii. The nature of the arrangement with the Cheap Finance Company Ltd also needs to be explored. If the bank is being offered 20% on its investment, the finance company is probably being offered something higher. Also, what is the order of priority on repayment between the planned loans from the finance company and the bank?

iv. Can the company really expect to generate the cash flows necessary to service and finance repayment of amounts due to both financial institutions?

v. Finally, what is the financial commitment of the directors in terms of further cash investment or offering assets as security?

(Any 2 points for 1.5 marks)