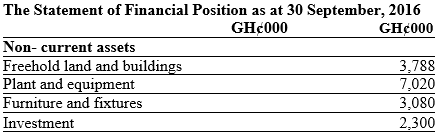

Abusua Ltd. has been trading profitably for several years but for the past four years its operations have resulted in losses. The board of directors has decided to restructure the company.

You have been provided with the following additional information.

ii) No dividend was declared on the Preference shares for the year ended 30 September, 2016.

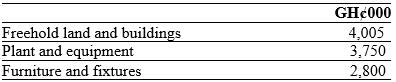

iii) The following assets have net realizable values as indicated below:

iv) The investment in Abusua Ltd. is 55% holding in Obi Ltd. An offer of GH¢ 1,350,000 has been made for it and it has been accepted by the directors.

v) Following further feasibility study carried out on the project which gave rise to the deferred development expenditure, the directors have decided to discontinue the project. The project is not patented.

vi) The directors have decided to sell the patent rights for a net realizable value of GH¢ 1,800,000.

vii) Inventories were written down by GH¢ 2,232,000.

viii) The 22% debentures are secured on the freehold land and buildings.

ix) The bank has a fixed and floating charge over the assets in respect of the loan.

x) It is considered that a proposed reconstruction of the company should result in net profit after tax of GH¢1,500,000 in the year ending 30 September, 2017 and GH¢1,800,000 or more in each of the years thereafter.

xi) The company will require a ratio of accounts receivable and cash to current liabilities of 0.80:1 in future to trade satisfactory.

Required:

As a Director of Finance of Abusua Ltd, recommend a scheme of reconstruction for consideration by the board of directors of the company and prepare a summarized statement of a financial position. (15 marks)

View Solution

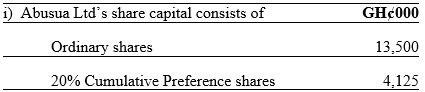

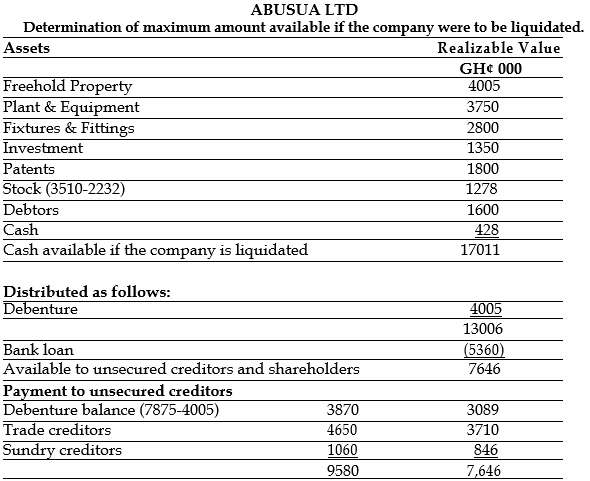

Since the amount available is GH¢7,646,000 as against creditors of GH¢9,580,000. Each ordinary creditor would receive for every GH¢1 as capital.

GH¢ 0.798=GH¢0.80 PER

The shareholders would receive nothing if their company liquidates.

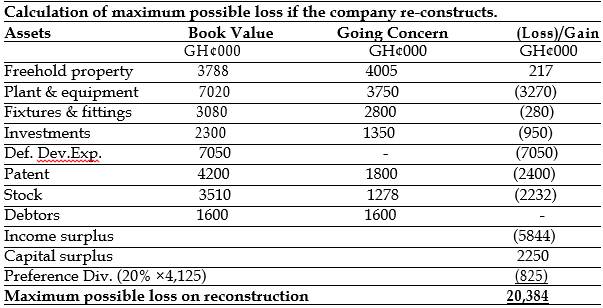

The loss should be shared as follows:

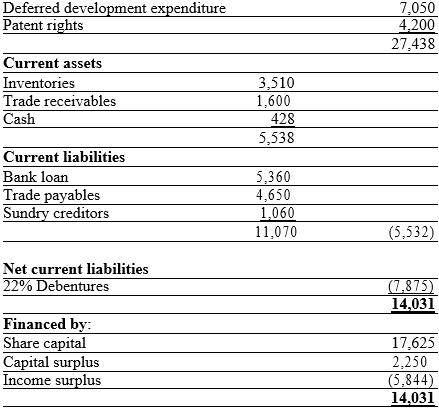

Ordinary shares:

They would suffer most because they are the owners and if the company liquidates they will receive nothing. They should sacrifice GH¢13, 400,000 of their capital and leave GH¢100, 000 as capital.

Preference shareholders:

They will also suffer the same fate as ordinary shareholders under liquidation. They should therefore suffer a loss of GH¢4,000,000 leaving a capital of GH¢125,000.

Debenture holders:

They would suffer 20 per cedi of the remaining balance after they have been paid GH¢4,005,000. I recommend that they should suffer GH¢1,005,000 leaving debentures of GH¢6,870,000.

Creditors:

The trade creditors and sundry creditors should be made to suffer the maximum loss they would have lost under liquidation, which is GH¢940,000 and GH¢214,000 respectively.

Preference dividends in arrears:

The preference dividend in arrears of GH¢825,000 is to be waived.

Note: alternative recommendations are acceptable provided they are logical reasonable and in accordance with best practice.

Working capital requirements:

Ratio of debtors to current liabilities is 0.80:1

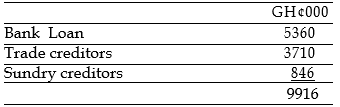

After the capital reduction, current liabilities are:

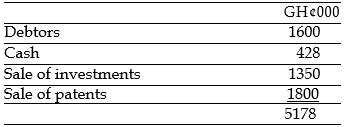

Debtors and cash should be 0.8 of the new current liabilities. This is GH¢ 7,933,000. But existing debtors and cash is made up as follows:

Additional cash of the difference of GH¢7,933,000 and GH¢5,178,000 is required to maintain the desired ratio. This amounts to GH¢ 2,755,000 and should be raised by the old shareholders as ordinary share capital.

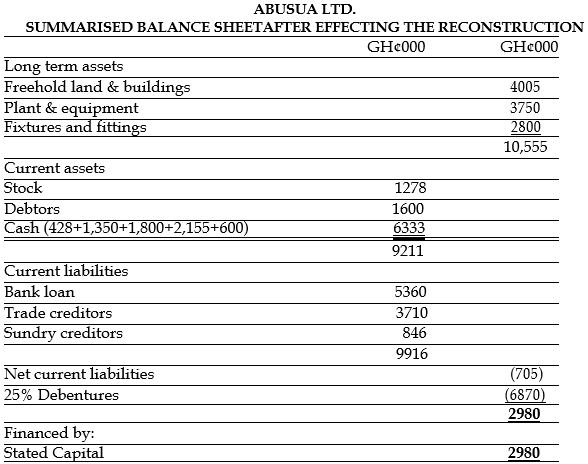

PROPOSED SCHEME

Ordinary share:

Reduce the ordinary share capital by GH¢13,400,000 and convert the balance to new ordinary share capital.

Eliminate the negative income surplus and capital surplus balances

Preference shares:

Reduce the preference share capital by GH¢4,000,000 and convert the balance to new ordinary share capital.

Preference dividend:

Write off the preference dividend of GH¢ 825,000 in arrears.

22% Debentures:

I recommend that they should suffer GH¢ 1,005,000 and be compensated by raising their interest rate to 25%.

Creditors:

Creditors should be made to suffer 20% of the amounts owed to them by the company.

The investments and patents to be realized to GH¢1, 350,000 and GH¢ 1,800,000 respectively.

In order to have a ratio of debtors and cash to current liabilities of 0.80:1 additional cash of GH¢ 2,755,000 will have to be sourced (see workings). The existing ordinary shareholders and existing preference shareholders will be required to introduce cash of GH¢2, 155,000 and GH¢600, 000 respectively for the purchase of new ordinary shares.