Kantanka Ltd adopts the revaluation model of IAS 16 Property, Plant & Equipment and the fair value model of IAS 40 Investment Property. Kantanka Ltd chooses to recognise any fair value gains or losses arising on its equity investments in ‘other comprehensive income’ as permitted by IFRS 9 Financial Instruments. The following transactions relate to Kantanka Ltd for the year ended 31 March 2017.

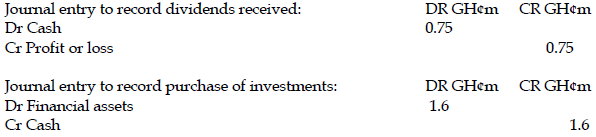

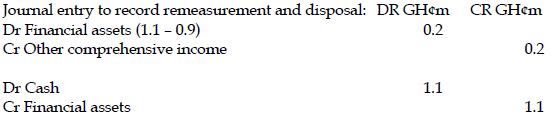

ii) Kantanka Ltd holds a portfolio of equity investments the value of which was correctly recorded at GH¢12 million on 1 April 2016. During the year ended 31 March 2017, the company received dividends of GH¢0.75 million. Further equity investments were purchased at a cost of GH¢1.6 million. Shares were disposed of during the year for proceeds of GH¢1.1 million. These shares had cost GH¢0.4 million a number of years earlier but had been valued at GH¢0.9 million on 1 April 2016. The fair value of the financial assets held on 31 March 2017 was GH¢14 million.

Required:

Advise Kantanka Ltd on how to account for the above transaction in accordance with relevant accounting standards. (5 marks)

View Solution

Dividends received are recognised as income regardless of the treatment of the financial assets.

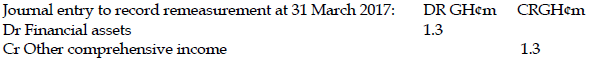

Remeasurements are treated in accordance with the policy of the entity. We must assume that the irrevocable election required by IFRS 9 was made as this is the policy of Kantanka Ltd.

The assets held at the period end must be remeasured to GH¢14 million. These are already carried at GH¢12.7 million (12.0 – 0.9 + 1.6). The original carrying value included GH¢0.9 relating to the investments sold, so these are no longer there. In addition, new assets costing GH¢1.6 million were purchased.

The fair value of these remaining assets on 31 March 2017 was 14 million, hence a gain of GH¢1.3 million (14 – 12.7) must be recognised.