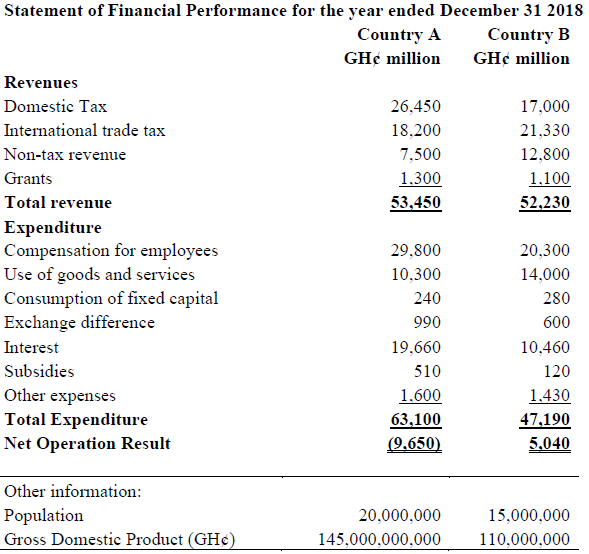

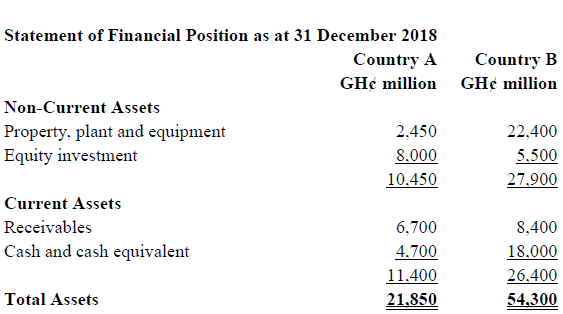

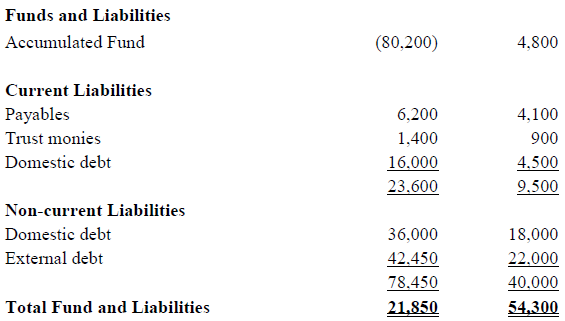

Country A and Country B are Sub-Saharan African Countries which attained independence around the same period. Presented below are the financial statements of the two countries.

Required:

a) From the information provided, compute for the two countries respectively:

i) Grant to Revenue ratio

ii) Wage Bill to Tax Revenue ratio

iii) Interest to Revenue ratio

iv) Capital Assets ratio

v) Debt to GDP ratio

vi) Capital expenditure per Capita (4 marks)

View Solution

. A B

i) Grants to total revenue ratio (%) 2.43 2.11

ii) Wage Bill to Tax Revenue ratio (%) 66.74 52.96

iii) Interest to revenue ratio (%) 36.78 20.03

iv) Debt to GDP ratio (%) 65.13 404.55

(8 ticks @ 0.5 marks = 4 marks)

b) Based on the result in question (a), write a report discussing and analyzing the financial performance and financial position of the two countries. Include in your report the limitations of the analysis of the two countries. (6 marks)

View Solution

Report on the Financial Performance and Position of Country A and Country B

Introduction

In this report, the financial performance and financial position of the two countries has been examined using some ratios. The aim of the report is to perform a comparative analysis of the two countries to direct the economic debates of the think tank of the Civil Society.

Discussions and Analysis

Both countries receive less than 3% of their revenue from grants, indicating that both countries may be winning themselves from aid as much as possible.

Country B manages its expenditure better than Country A. The wage bill to tax revenue is 53% for country B and 67% in Country A, indicating that B manages its wage bill better than country A. This is evident in the fact that country A generates more tax revenue than country B.

In addition 20% of the revenue of County B is spent on interest expenses whilst A applies 37%. This is an indication that in relative terms, country B spends less of its revenue on paying interest.

In relation to financial position, the Debt to GDP of country A is 65% whereas country B is as high as 405%, revealing that A manages its debt far better than B. For country B, its debt is over 4 times its GDP indicating a complete crisis situation.

Limitations

The analysis above should be appreciated in the face of these limitations:

- The basis of accounting used by the two countries may differ as this information is not given in the financial reports.

- The stage of development of the two countries may also be difference and this may affect their financial performance and conditions

- The type of governance system runs by the two countries may not be the same. The governance variables may affect the financial conduct of the countries.

Conclusion

The analysis reveals that country B is outperforming country A in all counts, country A required to examines its expenditure management policies and debt management policies as most of the problem comes from these ends.