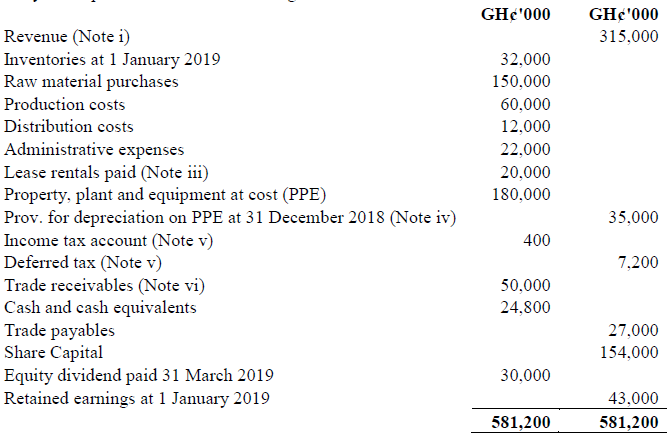

Makoo Ltd’s financial statements for the year ended 31 December 2019 are being prepared and you are provided with the following trial balance at that date:

Additional Information:

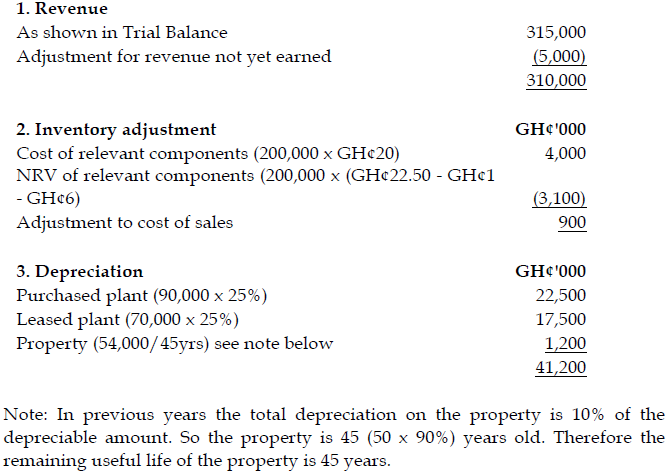

i) On 20 December 2019, Makoo Ltd signed a contract to supply a customer with goods in February 2020. The customer paid a deposit of GH¢5 million when the contract was signed and Makoo Ltd credited this amount to revenue. Makoo Ltd did not make any adjustment to inventory on 20 December 2019 as a result of receiving the deposit.

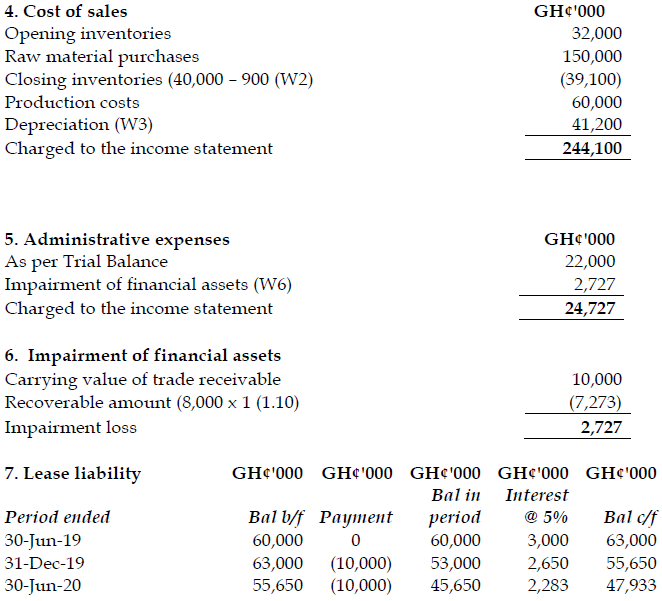

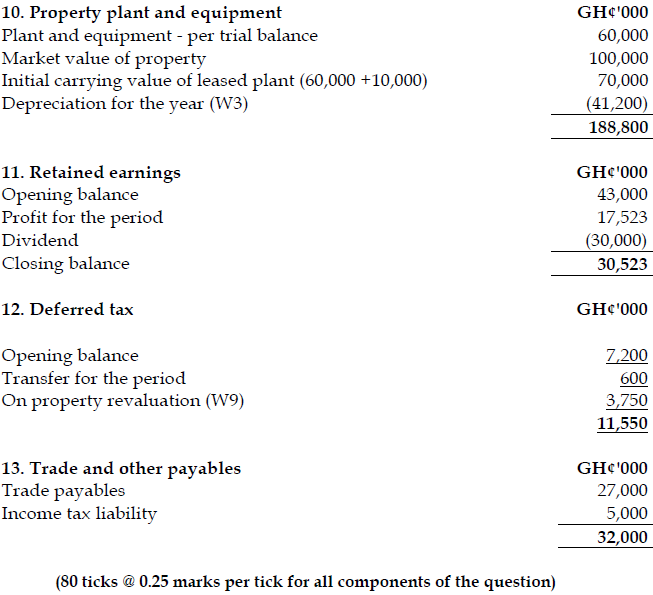

ii) On 31 December 2019, the value of the inventories at cost at Makoo Ltd’s premises was GH¢40 million. This included 200,000 units of partly completed inventory that had cost GH¢20 per unit to manufacture. The estimated cost to complete this inventory is GH¢6 per unit and the selling cost is estimated at GH¢1 per unit. Until recently the selling price of this product was GH¢30 per unit. However, a competitor has developed a new product which has affected the ability of Makoo Ltd to sell the product at the normal price and it is estimated that they will need to reduce the price to GH¢22.50 per unit (selling costs unaffected) in order to be able to sell these items.

iii) On 1 January 2019 Makoo Ltd entered into an agreement to lease a number of machines. The lease was for a four-year period, which was the estimated useful economic life of the machines. Makoo Ltd is required to repair and insure the plant, which has no estimated residual value at the end of the lease. The lease rentals were set at GH¢10 million every six months, payable in advance. The lease rentals figure included GH¢20 million in respect of this lease. The rate of interest implicit in this lease was 5% per six-monthly period and the present value of the future lease payments was estimated at GH¢60 million at 1 January 2019.

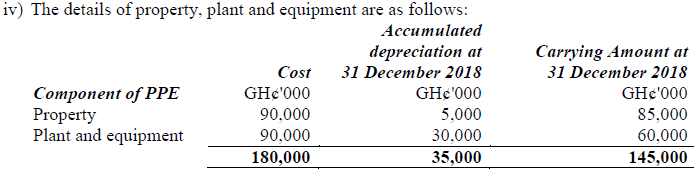

- Depreciation of all property, plant and equipment should be charged to cost of sales. Depreciation has not yet been charged for the year ended 31 December 2019.

- The plant and equipment is being depreciated on a straight-line basis at 25% per annum. No disposals of property, plant and equipment occurred in the period.

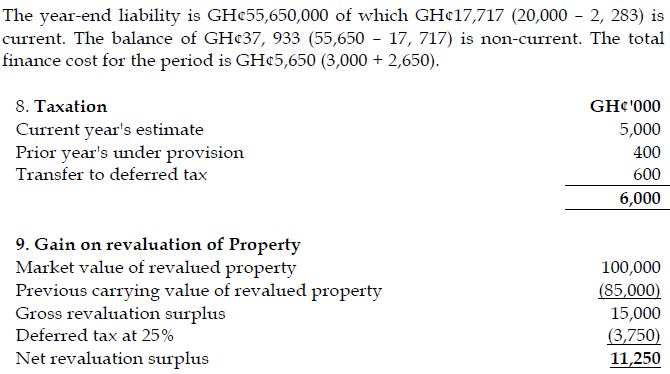

- The depreciable element of the property has an allocated carrying value of GH¢50 million and is being depreciated on a straight-line basis over 50 years from the date of original purchase. On 1 January 2019 the directors of Makoo Ltd revalued this property for the first time. The property had an estimated market value at 1 January 2019 of GH¢100 million. It is further estimated that GH¢54 million of this value relates to the depreciable element. The original estimate of the useful economic life is still considered valid.

- The directors have decided not to make an annual transfer of excess depreciation on revalued assets to retained earnings.

v) On 31 March 2019 Makoo Ltd made full and final payment to discharge the income tax liability for the year ended 31 December 2018. The balance on the income tax account in the trial balance is the residue after making that payment. The estimated income tax liability for the year ended 31 December 2019 is GH¢5 million. A transfer of GH¢600,000 needs to be made to the deferred tax account for the period. This includes the impact of all the adjustments necessary to prepare the financial statements apart from the initial revaluation of the property (Note iv). The rate of income tax is 25%.

vi) The closing trade receivables include an amount of GH¢10 million owed by a customer who experienced cash flow problems prior to the year end. Makoo Ltd agreed to accept a payment of GH¢8 million in full and final settlement of the debt and to defer the payment until 31 December 2020. Makoo Ltd would expect a return of 10% on sums invested for one year.

Required:

Prepare for Makoo Ltd;

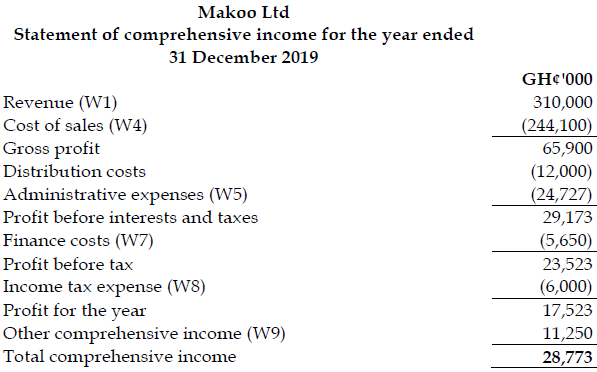

a) The Statement of Profit or Loss and Other Comprehensive Income for the year ended 31 December 2019. (10 marks)

View Solution

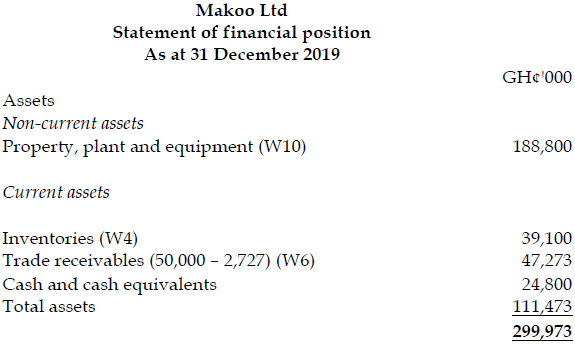

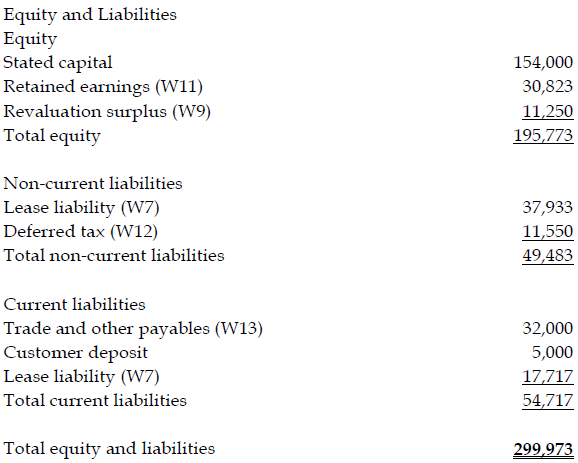

b) The Statement of Financial Position as at 31 December 2019. (10 marks)

View Solution

View All Workings