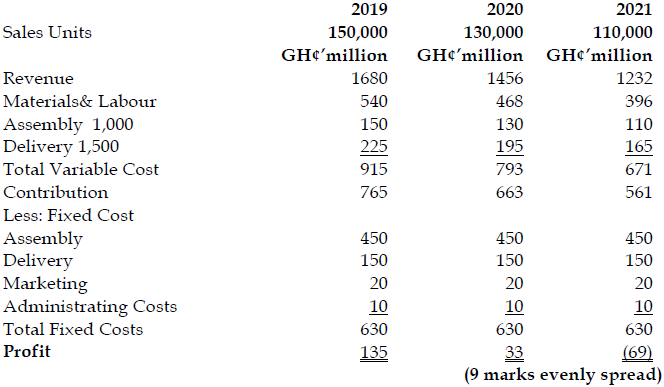

A motor car manufacturer has been specializing in the production and sale of Bedford model of cars. The model is somewhat outmoded and the current sales forecast indicates that the current (2018) sales level of 150,000 will be the same as 2019 but will decline to 130,000 cars in 2020, and 110,000 cars in 2021. The company supplies according to orders received and no stocks are held. Carbon monoxide emission regulations will prevent the model from being manufactured and sold after December 2021.

The company’s current estimates of the selling price and costs in 2019 are as follows:

. Per car

. GH¢

Selling Price 11,200

Production costs:

Material and Labour (vary with production volume) 3,600

Assembly 4,000

Delivery 2,500

75% and 40% of the assembly and delivery costs respectively are fixed and the remainder vary with production volume.

In addition, the company estimates that it will incur the following non-production costs:

- Marketing costs of GH¢60 million would be amortised on straight line basis over three years.

- The Administration costs of GH¢10 million are fixed per annum.

- The selling price, variable costs per car and total fixed costs are expected to remain constant throughout the period from 2019 to 2021.

The company’s Managing Director is unhappy with the current annual profit forecasts for 2019–2021 based on the information above and believes that the company has the potential to increase the profit to a desired level of GH¢245 million in each of the years 2019 to 2021. The Managing Director has undertaken a strategic review and developed the following strategies in order to eliminate the gap:

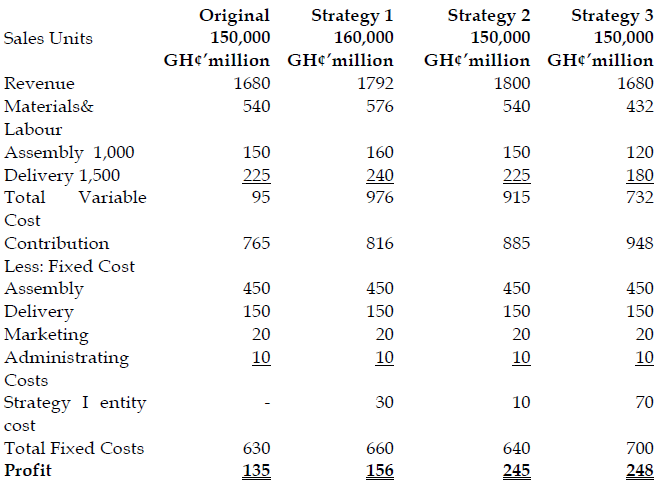

Strategy 1

A marketing proposal will enable the company to enter a new overseas market with the result that the total (including the overseas market) sales level will be stabilised at 160,000 cars per annum from 2019 to 2021. The market entry costs will be GH¢30 million for each of the three years.

Strategy 2

A re-design of the car will enhance its sales appeal and will permit the company to increase its selling price to GH¢12,000. The re-design costs are GH¢30 million and are to be amortised over three years on a straight line basis.

Strategy 3

A radical cost reduction programme will improve efficiency and lower all variable costs by 20%. This will add GH¢70 million to the annual fixed overheads each year from 2019 to 2021.

Required:

a) Prepare a financial analysis statement showing the current annual forecast of costs, revenues and profits for each of the years 2019 to 2021 and briefly comment on the figures. (Ignore time value of money) (9 marks)

View Solution

b) Calculate the profit gap for 2019, 2020 and 2021 (3 marks)

View Solution

Profit Gap – 2019: (110) 2020: (212) 2021: (314)

c) Estimate the profit in 2019 if:

i) Strategy 1 was implemented; (2 marks)

ii) Strategy 2 was implemented; (2 marks)

iii) Strategy 3 was implemented. (2 marks)

View Solution

d) Evaluate which strategy to implement. (2 marks)

View Solution

Strategy 3 should be selected as it is not only higher than the original profit, but also closes the profit gap.