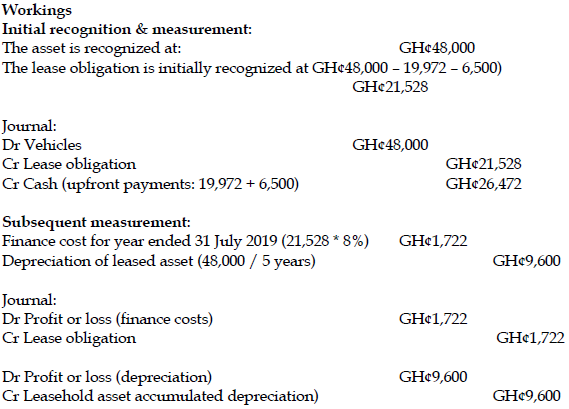

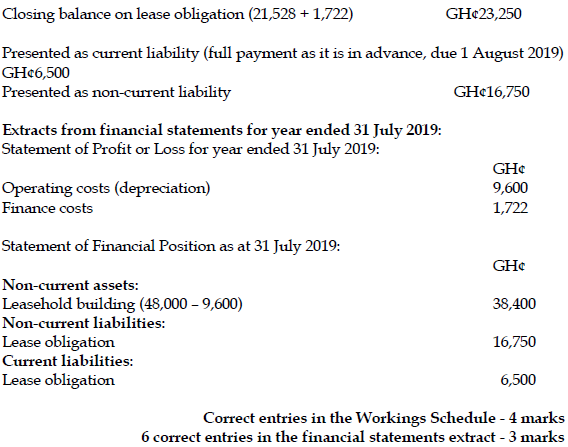

On 1 August 2018, Asawase Ltd entered into an agreement to acquire a motor vehicle. The terms of the agreement were that the vehicle would be leased for 5 years from the date of inception, subject to a deposit of GH¢19,972 and 5 annual payments of GH¢6,500 in advance, commencing on 1 August 2018. The fair value of the vehicle and the present value of the lease payments were GH¢48,000 at inception. The interest rate implicit in the lease is 8%.

Required:

In accordance with IFRS 16: Leases, show with appropriate calculations, the accounting entries required to record the transaction above in the financial statements for the year ended 31 July 2019. (7 marks)

View Solution