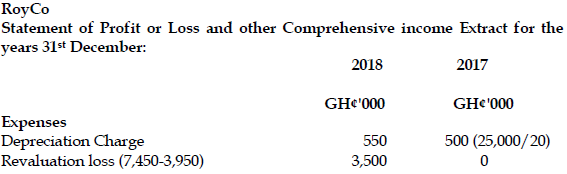

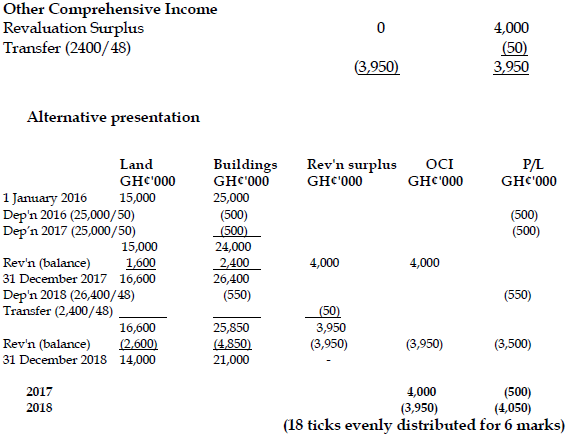

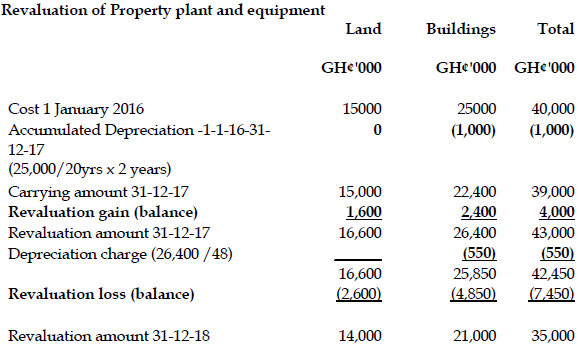

RoyCo acquired a brand new property (land and buildings) on 1 January 2016 for GH¢40 million (including GH¢15 million in respect of the land). The asset was revalued on 31 December 2017 to GH¢43 million (including GH¢16.6 million in respect of the land). The buildings element was depreciated over a 50-year useful life to a zero residual value. The useful life and residual value did not subsequently need revision. On 31 December 2018 the property was revalued downwards to GH¢35 million as a result of the recession (including GH¢14 million in respect of the land).

The company makes a transfer from revaluation surplus to retained earnings in respect of realised profit.

Required:

Calculate the amounts recognised in profit or loss and in other comprehensive income for the years ended 31 December 2017 and 31 December 2018. (6 marks)

View Solution

Transfer (excess depreciation) 24,000/48yrs =50