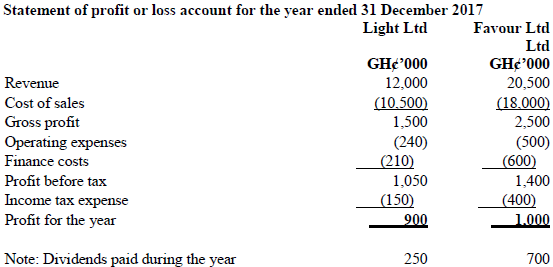

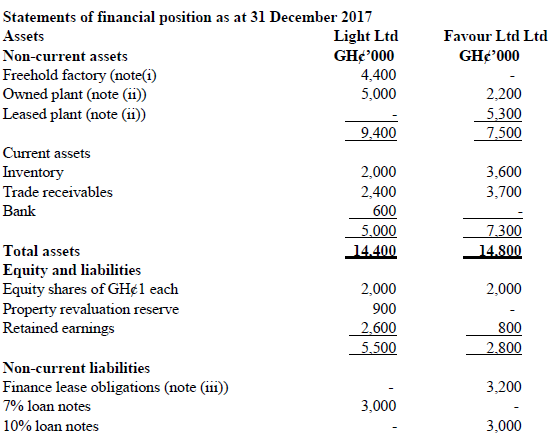

Salt Ltd is a Government Business Entity that would like to acquire (100% of) a viable private company. It has obtained the following draft financial statements for two companies, Light Ltd and Favour Ltd. They operate in the same industry and their managements have indicated that they would be receptive to a takeover.

Notes:

i) Both companies operate from same premises.

ii) Additional details of the two companies’ plant are:

Light Ltd Favour Ltd

GH¢’000 GH¢’000

Owned plant – Historical cost 8,000 10,000

Leased plant – original fair value – 7,500

There were no disposals of plant during the year by either company.

iii) The interest rate implicit within Favour Ltd’s finance leases is 7.5% per annum. For the purpose of calculating ROCE and gearing, all finance lease obligations are treated as long-term interest bearing borrowings.

Required:

Assess the relative financial performance and financial position of Light Ltd and Favour Ltd for the year ended 31 December 2017 to inform the directors of Salt Ltd in their acquisition decision. Your analysis should focus on profitability, liquidity and gearing. (15 marks)

View Solution

Assessment of the relative performance and financial position of Light Ltd and Favour Ltd Favour Ltd for the year ended 31 December 2017.

Introduction

This report is based on the draft financial statements supplied and the ratios shown in the appendix above. Although covering many aspects of performance and financial position, the report has been approached from the point of view of a prospective acquisition of the entire equity of one of the two companies. (1 mark)

Profitability

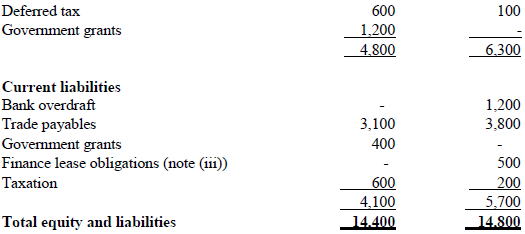

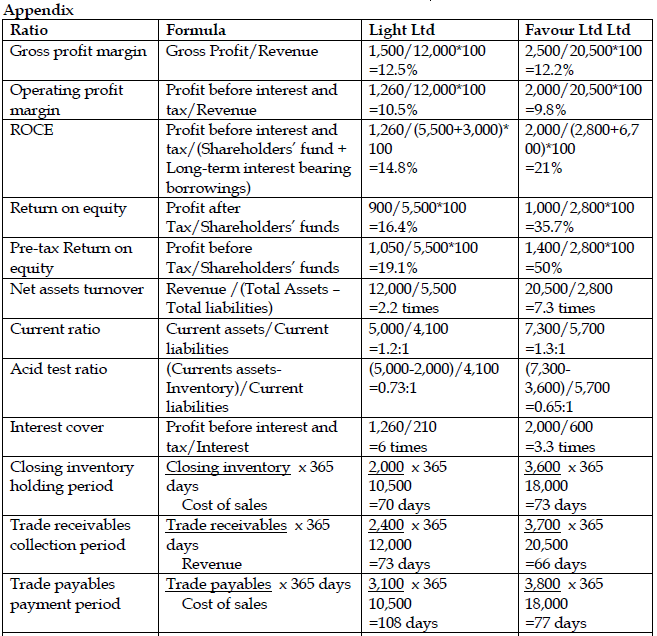

The ROCE of 20·9% of Favour Ltd is far superior to the 14·8% return achieved by Light Ltd. ROCE is traditionally seen as a measure of management’s overall efficiency in the use of the finance/assets at its disposal. More detailed analysis reveals that Favour Ltd’s superior performance is due to its efficiency in the use of its net assets; it achieved a net asset turnover of 2·3 times compared to only 1·2 times for Light Ltd. Put another way, Favour Ltd makes sales of GH¢2·30 per GH¢1 invested in net assets compared to sales of only GH¢1·20 per GH¢1 invested for Light Ltd.

The other element contributing to the ROCE is profit margins. In this area Favour Ltd’s overall performance is slightly inferior to that of Light Ltd, gross profit margins are almost identical, but Light Ltd’s operating profit margin is 10·5% compared to Favour Ltd’s 9·8%. In this situation, where one company’s ROCE is superior to another’s it is useful to look behind the figures and consider possible reasons for the superiority other than the obvious one of greater efficiency on Favour Ltd’s part. A major component of the ROCE is normally the carrying amount of the non-current assets. Consideration of these in this case reveals some interesting issues. Favour Ltd does not own its premises whereas Light Ltd does. Such a situation would not necessarily give a ROCE advantage to either company as the increase in capital employed of a company owning its factory would be compensated by a higher return due to not having a rental expense (and vice versa). If Favour Ltd’s rental cost, as a percentage of the value of the related factory, was less than its overall ROCE, then it would be contributing to its higher ROCE.

There is insufficient information to determine this. Another relevant point may be that Favour Ltd’s owned plant is nearing the end of its useful life (carrying amount is only 22% of its cost) and the company seems to be replacing owned plant with leased plant. Again this does not necessarily give Favour Ltd an advantage, but the finance cost of the leased assets at only 7·5% is much lower than the overall ROCE (of either company) and therefore this does help to improve Favour Ltd’s ROCE. The other important issue within the composition of the ROCE is the valuation basis of the companies’ non-current assets.

From the question, it appears that Light Ltd’s factory is at current value (there is a property revaluation reserve) and note (ii) of the question indicates the use of historical cost for plant. The use of current value for the factory (as opposed to historical cost) will be adversely impacting on Light Ltd’s ROCE. Favour Ltd does not suffer this deterioration as it does not own its factory.

The ROCE measures the overall efficiency of management; however, as Salt is considering buying the equity of one of the two companies, it would be useful to consider the return on equity (ROE) – as this is what Salt is buying. The ratios calculated are based on pre-tax profits; this takes into account finance costs, but does not cause taxation issues to distort the comparison. Clearly Favour Ltd’s ROE at 50% is far superior to Light Ltd’s 19·1%. Again the issue of the revaluation of Light Ltd’s factory is making this ratio appear comparatively worse (than it would be if there had not been a revaluation). In these circumstances it would be more meaningful if the ROE was calculated based on the asking price of each company (which has not been disclosed) as this would effectively be the carrying amount of the relevant equity for Salt Ltd. (4 marks)

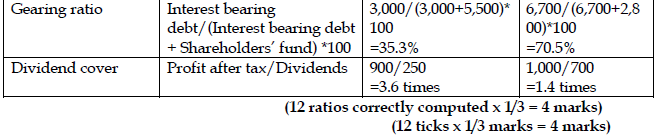

Gearing

From the gearing ratio it can be seen that 71% of Favour Ltd’s assets are financed by borrowings (39% is attributable to Favour Ltd’s policy of leasing its plant). This is very high in absolute terms and double Light Ltd’s level of gearing. The effect of gearing means that all of the profit after finance costs is attributable to the equity even though (in Favour Ltd’s case) the equity represents only 29% of the financing of the net assets. Whilst this may seem advantageous to the equity shareholders of Favour Ltd, it does not come without risk. The interest cover of Favour Ltd is only 3·3 times whereas that of Light Ltd is 6 times. Favour Ltd’s low interest cover is a direct consequence of its high gearing and it makes profits vulnerable to relatively small changes in operating activity. For example, small reductions in sales, profit margins or small increases in operating expenses could result in losses and mean that interest charges would not be covered.

Another observation is that Light Ltd has been able to take advantage of the receipt of government grants; Favour Ltd has not. This may be due to Light Ltd purchasing its plant (which may then be eligible for grants) whereas Favour Ltd leases its plant. It may be that the lessor has received any grants available on the purchase of the plant and passed some of this benefit on to Favour Ltd via lower lease finance costs (at 7·5% per annum, this is considerably lower than Favour Ltd has to pay on its 10% loan notes).

Liquidity

Both companies have relatively low liquid ratios of 1·2 and 1·3 for Light Ltd and Favour Ltd respectively, although at least Light Ltd has GH¢600,000 in the bank whereas Favour Ltd has a GH¢1·2 million overdraft. In this respect Favour Ltd’s policy of high dividend payouts (leading to a low dividend cover and low retained earnings) is very questionable. Looking in more depth, both companies have similar inventory days; Favour Ltd collects its receivables one week earlier than Light Ltd (perhaps its credit control procedures are more active due to its large overdraft), and of notable difference is that Light Ltd receives

(or takes) a lot longer credit period from its suppliers (108 days compared to 77 days). This may be a reflection of Light Ltd being able to negotiate better credit terms because it has a higher credit rating. (4 marks)

Summary

Although both companies may operate in a similar industry and have similar profits after tax, they would represent very different purchases. Favour Ltd’s sales revenues are over 70% more than those of Light Ltd, it is financed by high levels of debt, it rents rather than owns property and it chooses to lease rather than buy its replacement plant. Also its remaining owned plant is nearing the end of its life. Its replacement will either require a cash injection if it is to be purchased (Favour Ltd’s overdraft of GH¢1·2 million already requires serious attention) or create even higher levels of gearing if it continues its policy of leasing. In short although Favour Ltd’s overall return seems more attractive than that of Light Ltd, it would represent a much more risky investment. Ultimately the investment decision may be determined by Salt’s attitude to risk, possible synergies with its existing business activities, and not least, by the asking price for each investment (which has not been disclosed to us). (2 marks)