Proper Banking Limited (PBL) is required to comply with corporate governance principles in order to maintain its listed status and banking license due to the current banking crises in Ghana.

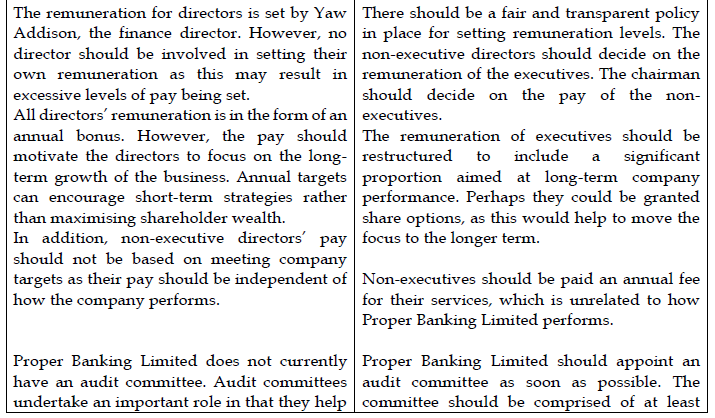

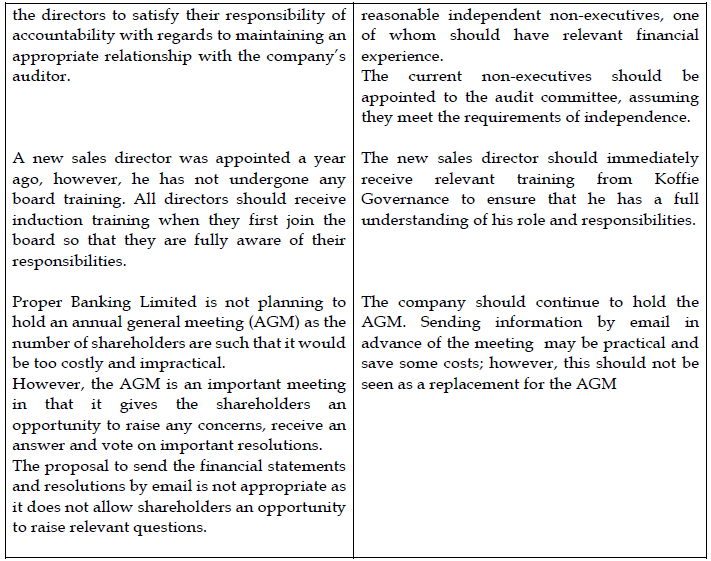

The Finance Director, decides on the amount of remuneration each director is paid. Currently all remuneration is in the form of an annual bonus based on profits. Yaw is considering setting up an audit committee, but has not undertaken this task yet as he is very busy. A new sales director was appointed a year ago. She is yet to undertake his board training as this is normally provided by the chief executive officer and this role is currently vacant.

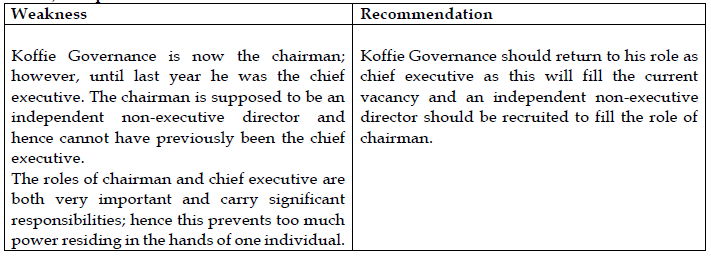

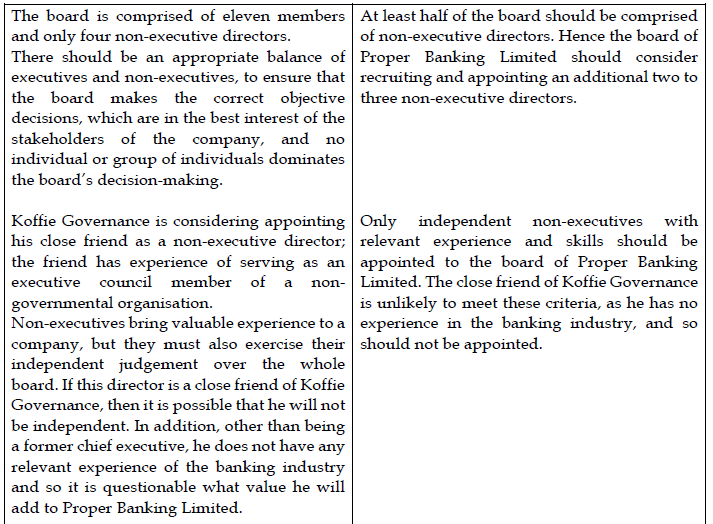

Koffie Quartey is the chairman of PBL. Until last year, he was the Chief Executive Officer. Koffie is unsure if PBL needs more non-executive directors as there are currently four non-executive directors out of the eleven board members. He is considering appointing one of his close friends, who is a retired executive council member of a Non-Governmental Organization (NGO), as a non-executive director.

The shareholders are many and due to their large numbers, the directors believe that it is impractical and too costly to hold an annual general meeting of shareholders. Instead, the board has suggested sending out the financial statements and any voting resolutions by email for shareholders to vote on the resolutions via email.

Required:

In respect of the corporate governance of Proper Banking Limited:

i) Identify and explain FIVE (5) corporate governance weaknesses; and (10 marks)

ii) Provide a recommendation to address each weakness. (5 marks)

View Solution