The Board of Directors of Continental Bank Ghana Ltd (CBGL) decided through a Board resolution to raise additional capital through rights issue to meet the new capital requirement by Bank of Ghana. CBGL plans to issue 1 new share for every 3 shares held by existing shareholders at 10% discount to its existing market price. CBGL currently has 6 million shares in issue at a book value of 2 cedis per share. CBGL maintains a dividend payout ratio of 50% and earnings per share currently is 1.6 cedis. Dividend growth is 5% per annum and this is expected into the foreseeable future. CBGL’s cost of equity is 15%. The issue cost is 600,000 cedis.

Required:

Calculate:

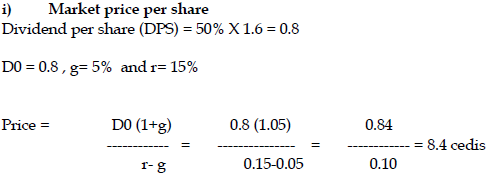

i) The market price per share (2 marks)

View Solution

ii) The capitalization of CBGL. (2 marks)

View Solution

Market capitalization = price per share x issued shares

= 8.4 x 6m shares

= 50.4m cedis

iii) The rights issue price (2 marks)

View Solution

Rights issue price @ 10% discount of the current market price = 90% x 8.4 = 7.56 cedis

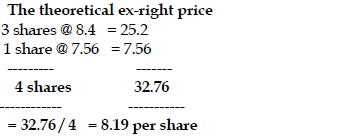

iv) The theoretical ex-right price (2 marks)

View Solution

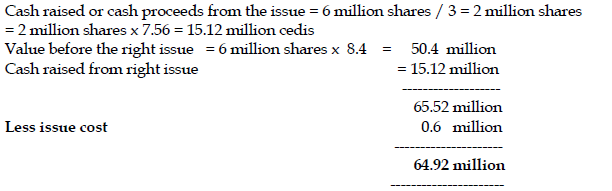

v) The market capitalization after the rights issue (2 marks)

View Solution