a) Explain the accounting treatment for ‘deferred consideration’ and ‘contingent consideration’ in the context of the acquisition of a subsidiary by a parent entity. (4 marks)

View Solution

Accounting treatment of deferred consideration:

- Deferred consideration must be recognised by the purchaser at the acquisition date at its fair value.

- This is usually recognised as part of the cost of investment and a liability in the Consolidated Statement of Financial Position.

- This is normally the agreed cash amount discounted to the acquisition date at the purchaser’s cost of capital.

- The discount is unwound over time by the purchaser, by recognising it as a finance cost in the post-acquisition period as time passes.

- The liability at any reporting date will be the initial fair value plus the amount of the discount that has unwound to date. (4 points @0.5 marks each=2 marks)

Accounting treatment of contingent consideration:

- Any contingent consideration must also be recognised at acquisition at its fair value. This will normally include a discount to reflect the time delay before payment, plus a discount to reflect the probability that the amount will be paid in part or in full.

- Goodwill is calculated based on this estimate. At each reporting date after acquisition, the fair value is re-estimated, with any change being taken to profit or loss (of the purchaser) in the year of re-estimation.

- Any change due to the unwinding of the time value of money discount is recognised as a finance cost.

- The revised amount is carried as a liability until further re-estimated, or paid. (4 points @0.5 marks each=2 marks)

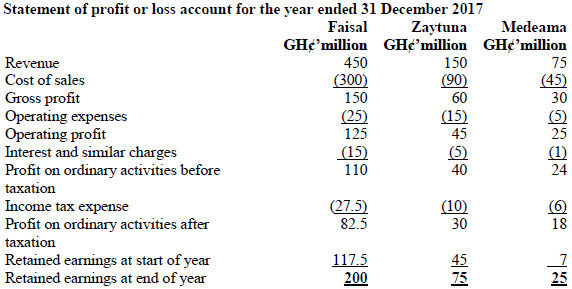

b) You are the Financial Accountant of Faisal Ltd (Faisal), a Ghanaian listed company, involved in food retailing. During 2017, Faisal acquired interests in Zaytuna Ltd (Zaytuna) and Medeama Ltd (Medeama).The Statement of profit or loss for Faisal, Zaytuna and Medeama for the year ended 31 December 2017 are as follows:

Additional information:

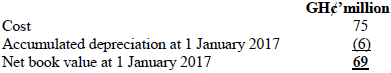

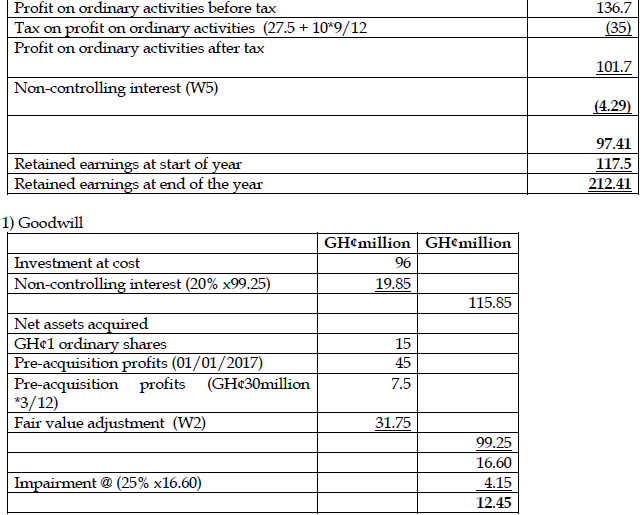

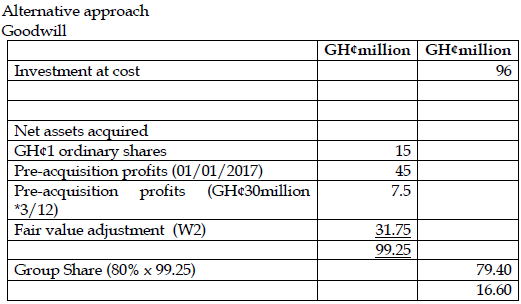

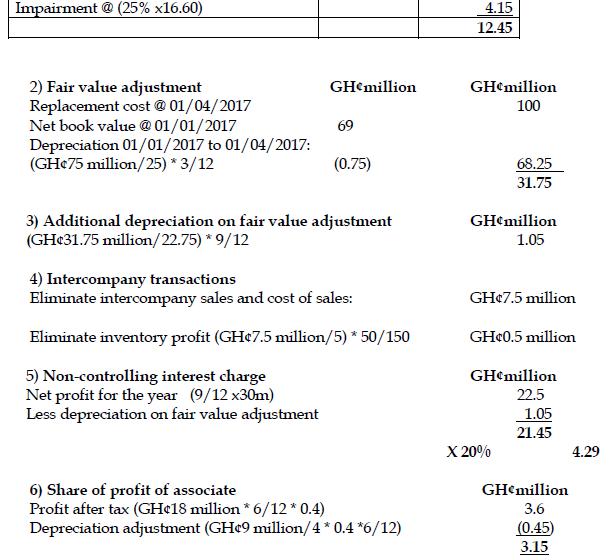

i) On 1 April 2017, Faisal purchased 12 million of the 15 million GH¢1 ordinary shares in Zaytuna at a cost of GH¢8 per ordinary share. At the date of acquisition the fair values of Zaytuna’s net assets were equal to their book value with the exception of property, the details of which are as follows:

The property, which had a useful economic life of 25 years on 1 January 2015, is in a prime commercial location and has increased dramatically in value since it was purchased by Zaytuna on 1 January 2015. The replacement cost of a similar building, with a similar remaining useful economic life at 1 April 2017, is GH¢100 million. The fair value at acquisition has not been reflected in the records of Zaytuna.

ii) On 1 July 2017, Faisal purchased 4 million of the 10 million GH¢1 ordinary shares in Medeama at a cost of GH¢6 per ordinary share. At the date of acquisition the fair values of Medeama’s net assets were equal to their book value with the exception of property that had a fair value of GH¢9 million in excess of its book value and a remaining useful life of four years.

iii) In August 2017, Faisal sold goods to Zaytuna for GH¢7.5 million and 20% of these goods remained unsold at 31 December 2017. Faisal prices its sales at cost plus 50%.

iv) On 23 January 2018, Faisal sold its former head office administrative building for GH¢1.25 million. At 31 December 2017, the building was for sale and unoccupied, with staff having moved to a new premises. The book value of the building in the statement of financial position of Faisal as at 31 December 2017 was GH¢2 million.

v) Each company charges depreciation on a time apportionment basis to operating expenses.

vi) The directors of Faisal believe that any goodwill arising on the acquisition of Zaytuna and Medeama has been impaired by 25% as at 31 December 2017. The directors have a policy of measuring non-controlling interests at the proportionate share of identifiable net assets.

(Note: All calculations may be taken to the nearest GH¢0.01 million and assume all expenses and gains accrue evenly throughout the year unless otherwise instructed.)

Required:

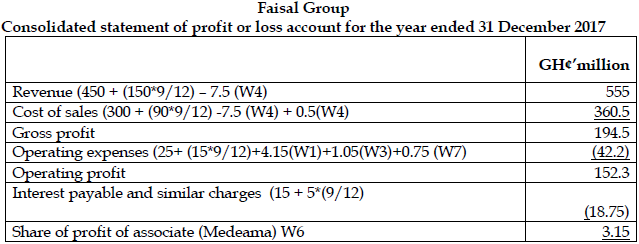

Prepare the consolidated statement of profit or loss account of Faisal Group for the year ended 31 December 2017 in accordance with International Financial Reporting Standards (IFRS). (16 marks)

View Solution

Faisal

7) Sale of former head office

IAS 10 Events after the Reporting Period states that sales of non-current assets are nonadjusting events and accounts would not normally be amended to reflect this (although it would be disclosed in the notes). However, in this case, it could be argued that the sale price is evidence of impairment at the year-end and unless it can be shown that the conditions causing the impairment arose after the year-end then the accounts should be adjusted. Given that the sale took place on 23 January 2018, it is likely that the conditions existed at the date of statement of financial position.

Therefore the impairment should be charged in the 2017 financial statements in accordance with IAS 36 Impairment of Assets.

Dr Income statement – operating expenses GH¢0.75 million

Cr Property GH¢0.75 million

The property would be classified as a ‘non-current asset held for sale’ in accordance with IFRS 5 Non-Current Assets Held for Sale and Discontinued Operations. (80 ticks @ 0.25 marks = 16 marks)