Ashaiman and Nima are in partnership sharing profits and losses 2:1. They had originally invested GH¢50,000 and GH¢40,000, respectively. Their current account balances on 1 November 2016 were GH¢14,000 credit for Ashaiman and GH¢9,900 debit for Nima.

The partnership agreement specifies the following:

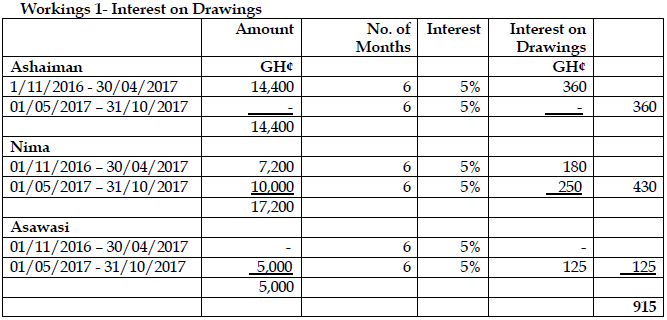

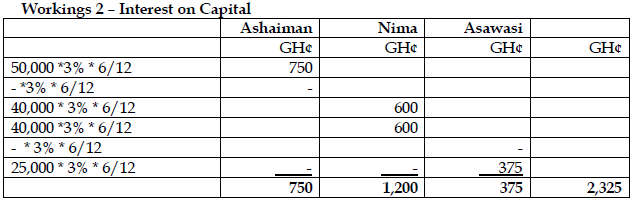

- The payment of interest on drawings and receipt of interest on capital at the rate of 5% per annum and 3% per annum, respectively.

- The partners take drawings in the same proportion as they share profits or losses. Ashaiman takes drawings of GH¢2,400 a month with Nima taking the amount of drawings as allowed by the partnership rules.

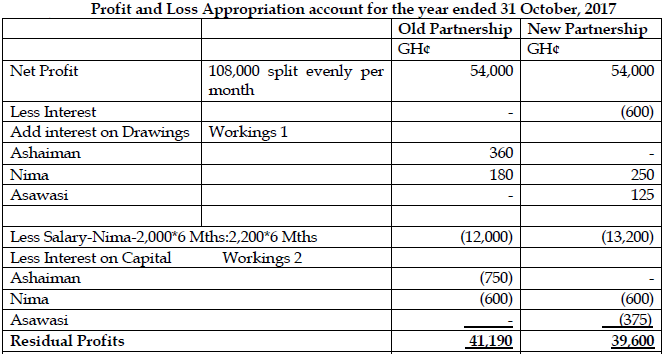

- Nima is entitled to take a salary of GH¢2,000 a month.

- The interest on drawings is calculated as if the drawings for the six month period had been taken in full on the first day of the period.

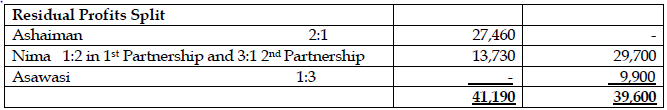

On 1 May 2017, Ashaiman decides to retire. Both partners agree to have the partnership valued and bring in the resultant goodwill into the partnership. Ashaiman agrees to leave GH¢30,000 of his capital as a loan to the business earning interest at the rate of 4% per annum and to withdraw the balance of what is owing to him. An independent expert values the goodwill on 1 May 2017 at GH¢90,000.

On 1 May 2017, Nima decides to enter into a new partnership with Asawasi where they share profits or losses 3:1. They decided to keep the same interest rates from the previous partnership agreement in relation to drawings and capital. Nima’s salary was changed to GH¢2,200 a month from this period to the year-end, Nima took drawings of GH¢10,000 and Asawasi took drawings of GH¢5,000. Asawasi introduced capital of GH¢25,000 on his admission to the partnership. The goodwill was cancelled in the same proportion as they share profits or losses.

The profits for the year amounted to GH¢108,000 and these profits accrued evenly throughout the year.

Required:

For the year ended 31 October 2017:

i) Prepare the Profit & loss Appropriation Accounts. (9 marks)

View Solution

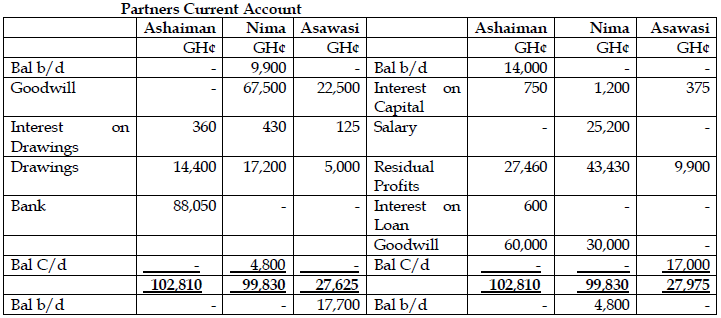

ii) Prepare the Current Account of all the individual partners. (6 marks)

View Solution

Workings for i & ii